Can I Receive More Than One Title Loan Maximum?

If you are in financial hardship, you may require an enormous loan to cover expensive costs. Personal loans and auto loans are some types of loans that could help improve your financial situation. If you are eligible for an auto title loan in loan max and get the maximum amount, can you apply for more than the entire title loan? How does your credit score affect the loan process?

How Many Title Loans Can I Get?: Loan Max

It is possible to get several title car loans near me. However, you’ll require more than one vehicle. There is only one lien allowed per asset. Therefore, getting more than one maximum title loan proceeds for a car is impossible. Credit scores are essential in determining your eligibility for loans. A credit check is usually necessary, and a bad credit score could affect your chances.

Suppose you own more than one vehicle, and both have enough equity. In that case, it’s possible to get more than one maximum amount of title loans. An online lender may provide competitive loan terms. But what is the equity in your car? Before finalizing a loan agreement, check for factors like a high-interest rate and the availability of loan funds.

Loan Max Title Loans is a well-known direct lender that offers various financial services, including New Mexico title loans. With Loan Max Title Loans, customers in New Mexico can use the equity in their vehicle to secure a short-term loan, allowing them to access the funds they need quickly and easily. Whether you need to cover unexpected expenses, pay off debt, or make a large purchase, a New Mexico title loan from Loan Max Title Loans could be the solution you’re looking for.

These title loans, sometimes known as equity loans, are an alternative option to traditional loans as they don’t require a thorough credit history check, making them suitable for borrowers with a bad credit history or no credit records. They can also serve as a quick cash advance when you need funds for a short period with Flexible Repayment Terms and manageable monthly installments. It’s important to note that while these loans typically have higher interest rates than loans from a conventional financial institution, they can offer favorable repayment terms for borrowers.

Is the equity in My Car enough to cover more than one title loan?

The equity of your vehicle is a significant factor in determining your loan status and whether you qualify for the maximum loans.

The term equity refers to the calculation used to determine financed asset ownership. For instance, the difference between the value of the resale assets and the loan’s principal is the equity amount.

An asset may have equity that is either positive or negative. Suppose the market value of your car is higher than what the lender is offering as the principal amount. In that case, your vehicle has positive equity.

However, If your loan’s principal value is greater than the current resale price of the car, it is in negative equity.

If you want to know the amount of equity in your vehicle and whether you are eligible for a maximum title loan, make use of the easy online title loan calculator.

After entering a few specifics regarding your car, you will be able to receive a title loan estimation and a pre-approval within only a few minutes! Moreover, some lenders offer same-day funding and instant decision for a quick and easy experience. 1, 3

To begin, you must be able to provide the following information:

- Your Car Year

- Model and Make

- Car Style

- Current Mileage

This information is utilized to calculate the value of your vehicle and determine if you’re eligible for a maximum title loan.

In addition to title loans, you may also consider personal installment loans, which could be a suitable alternative for people with poor credit history. These bad credit loans often don’t require a traditional credit check and can provide affordable loans with a manageable repayment schedule. Ensure you have a regular income to make timely payments and improve your credit score.

Some lenders may charge an origination fee to process your installment loan online application. Remember to factor this fee into your budget when considering a loan on time.

Is there a Max I can get with the Title Loan?

In Tennessee, the maximum loan amount is $6,500, providing the customer qualifies for and accepts both the pledge limit of $2,500 and the secured loan limit of $4,000. Mississippi and Tennessee Pledge goods do not qualify for refinancing. South Carolina title-secured loans have a minimum loan amount of $601.

If you’re thinking of getting Online installment loans to pay emergency expenses, you might be wondering if you could get more than one car title loan. Instead of seeking two title loans max and putting liens on both your cars, take out just one! It is essential to choose reputable lenders and avoid payday lenders that may charge high-interest rates.

It is entirely possible for anyone eligible to secure a title loan that covers their entire hospital or repair cost to their home. Suppose your vehicle is worth enough, and you’re eligible. In that case, you can obtain a substantial loan not to pay two expenses per month. To be eligible, you may need to show proof of income and have a consistent source of income. Providing your Repayment history and making payments on time will improve your chances of approval. You may also have to provide bank statements and information about your credit card debt.

You can secure a title loan while maintaining a healthy credit score by staying diligent with your lines of credit and ensuring accurate reporting to major credit bureaus.

The maximum amount from the title loan is contingent upon the business day, credit card, and the loan company you do business with. Each title loan lender has various terms and amounts of loans, including installment loan lenders.

If you require a particular amount of financial assistance, ask an agent to determine the maximum amount for a title loan you can get and if it’s an approved loan or just a loan request.

Here are some statistics on title loans:

| Statistic | Value |

|---|---|

| Loan amount | $500 to $5,000 |

| APR | Average of 300% |

| Loan term | 1 to 12 months |

| Repayment | Monthly installments |

| Fees | Origination fees, late payment fees, and prepayment penalties |

| Target audience | Borrowers with fair to bad credit |

| Pros | Quick and easy way to get cash when you need it. Don’t require a credit check and can be repaid in monthly installments. |

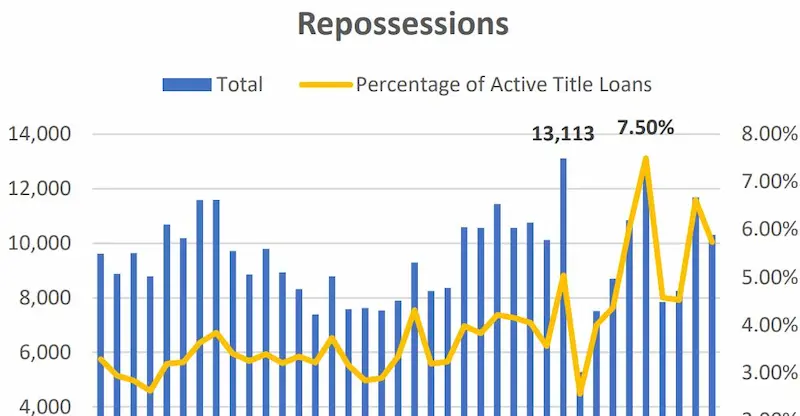

| Cons | High interest rates and fees. If you default on the loan, the lender can repossess your vehicle. |

What questions should I ask an agent for a title loan?

In addition to asking about the maximum loan amount in a loan title, what else could a prospective borrower ask an agent for a title loan? In the event of obtaining any loan, it’s crucial to take into consideration the following factors:

Interest Rate

The amount of interest is the amount you spend to obtain funding. Rates may vary; therefore, it is recommended to inquire with the title loan representative regarding the competitive interest rate and an affordable interest rate or an annual percentage rate (APR).

Monthly Payment Amount

Ask about the monthly payment amount and how it is calculated. Also, inquire about the impact of your payment history and financial history on the total loan amount you can receive.

Lending Institutions

As you shop around for the best title loan, consider asking the agent about the various lending institutions they cooperate with and their unique features.

Access to Cash

Lastly, you might want to know how quickly you can gain access to cash after your loan is approved – typically, this should be within the next business day. Also, clarify if there are any restrictions on the usage of the cash, such as putting it on your credit card.

The number of monthly payments will significantly impact an eligible borrower’s budget and lifestyle. Before making a financial decision, consult a title loan agency agent to estimate how much you can expect to pay each month. Student loans can also be an installment loans for eligible individuals.

Repayment Length

Contact a title loan broker regarding the length of time you can repay. The repayment duration will affect the amount you pay each month in that shorter repayment terms can result in higher monthly payments. Flexible terms and reasonable interest rates may be available with some personal loan lenders.

Extra Fees

It’s crucial to consult a loan representative about additional fees before signing up for the title loan. Ask about hidden charges and whether there are any penalties for paying the maximum title loan early. It’s essential to consider debt consolidation loans if you have multiple loans simultaneously and need extra cash.

Can I get a Maximum Title Loan?

If you need an extra title loan, you might wonder if you can obtain more than one maximum title loan. However, if you select the right loan, it is unlikely that several loans will be needed. Be cautious with online payday loans and traditional lender offerings, and ensure you’re clear on the minimum credit score required for credit check loans. Sometimes, lenders may offer a soft credit check option, which would not affect your credit score.

Suppose you receive a perfect loan title offered through Green Day Online, like Long-term loans or quick loans. In that case, you can expect rapid emergency cash, reasonable payment options at competitive rates, no hidden charges, and no prepayment penalties! Before getting the perfect solution for your loan needs, you must provide some crucial documents such as your Social Security Number, Proof of residence, and details about your monthly income.

Green Day Online verifies your income ratio and conducts income verification to ensure you can comfortably repay the loan. They offer credit check installment loans, which adjust from time to time to suit your financial situation. Moreover, Green Day Online takes pride in providing Excellent customer service that helps guide you through the loan process and even when you need extra money for emergencies.

Frequently Asked Questions

How do Loan Max Title Loans work?

Loan Max offers title loans using your car as collateral, lending up to 50% of the car’s value for 30 days to a few months and requiring repayment or car forfeiture.

What are the eligibility requirements for getting a title loan from Loan Max?

You’ll need to own your vehicle fully, meet income requirements, have a valid driver’s license, insurance, and clear car title to get a Loan Max title loan.

What is the maximum loan amount I can get from Loan Max Title Loans?

Loan Max offers maximum title loan amounts up to $2,500 in most states, with specific limits determined by your car’s assessed value.

What are the interest rates and fees associated with Loan Max Title Loans?

Loan Max has interest rates starting around 30% APR but averaging 100-175% APR, plus origination fees and late fees if you miss payments.

What happens if I can’t repay my title loan to Loan Max on time?

If you default on repayment, Loan Max can repossess your car, charge fees, sell the vehicle to cover the loan, and pursue you for any remaining balance.