Payday loans are a short-term borrowing option for people who need immediate cash for their short-term financial needs. They have high-interest rates and fees, making it hard to repay on time. Payday loan borrowers who are unable to pay on the due date face extra charges and penalties.

Payday loan extension is an attractive option for many borrowers. It delays repayment by only paying the finance fee or interest on the original amount borrowed, giving the borrower more time to gather funds and avoid late payment charges. But extending the payday loan has risks. It increases overall debt obligations and accumulates higher interest over time. Knowing how to extend a payday loan appropriately is necessary to manage finances effectively and avoid long-term financial problems.

Summary

- Payday loans are short-term loans with high-interest rates and fees provided by a payday loan lender.

- Extending the loan by paying only the finance fee or interest is an option, but it increases overall debt obligations and accumulates higher interest over time.

- Borrowers must understand the loan terms and contact the lender to request an extension or extended payment plan.

- Costs associated with extending the loan include extension fees, higher interest rates, and late payment fees.

- Payment options for extended payday loans include lump-sum payday loan payments, installment payments, and rollover loans.

- Alternatives to extending a payday loan include negotiating a payment plan with the lender, seeking assistance from nonprofit credit counseling agencies, and borrowing from friends or family members.

- Borrowers must examine their financial situation before extending a payday loan.

Understanding The Terms Of A Payday Loan

Payday loans serve as a short-term solution to bridge the gap until their next paycheck arrives. Payday loans have short repayment periods and high loan interest rates, meaning borrowers must repay the borrowed amount quickly, along with added interest. But lenders charge fees for late payments or if the payday loan customer is unable to repay the loan on time. But it’s best for payday loan customers to fully comprehend the loan terms before entering into any agreement.

Understanding the terms allows borrowers to decide if extending a payday loan is the right choice for their circumstances. It helps minimize potential negative consequences and assures borrowers stay in control of their finances.

Contacting Lender To Request An Extension

Borrowers struggling to repay their payday loans must contact their lenders. Most payday lenders offer extensions or payment plans that help borrowers avoid default and extra fees. Requesting an extension from the lender is the best way to manage the loan repayment.

But borrowers must gather all necessary information, such as their loan agreement, current balance, and payment history, before reaching out. Prepare to explain why they need the extension and propose a feasible timeline for repayment. Doing so streamlines the entire extension request.

It’s best to note that certain lenders charge added interest or fees for extensions, so borrowers must clarify the terms beforehand. Being proactive and maintaining open communication with their lender allow borrowers to increase their chances of successfully extending their payday loan without negatively impacting their credit score or finances.

As a leading provider of financial solutions, our company is dedicated to assisting individuals and families in pursuing financial stability. We understand that unexpected expenses can arise; sometimes, a short-term payday loan extension can provide relief. We are proud to offer our services in various states across the United States, reaching out to those needing reliable financial assistance. The following table highlights the American states where our company is actively operating, ensuring that we support our customers when they need us the most.

| Alabama – AL | Alaska – AK | Arizona – AZ | Arkansas – AR |

| California – CA | Colorado – CO | Connecticut – CT | Delaware – DE |

| District Of Columbia – DC | Florida – FL | Georgia – GA | Hawaii – HI |

| Idaho – ID | Illinois – IL | Indiana – IN | Iowa – IA |

| Kansas – KS | Kentucky – KY | Louisiana – LA | Maine – ME |

| Maryland – MD | Massachusetts – MA | Michigan – MI | Minnesota – MN |

| Mississippi – MS | Missouri – MO | Montana – MT | Nebraska – NE |

| Nevada – NV | New Hampshire – NH | New Jersey – NJ | New Mexico – NM |

| New York – NY | North Carolina – NC | North Dakota – ND | Ohio – OH |

| Oklahoma – OK | Oregon – OR | Pennsylvania – PA | Rhode Island – RI |

| South Carolina – SC | South Dakota – SD | Tennessee – TN | Texas – TX |

| Utah – UT | Vermont – VT | Virginia – VA | Washington – WA |

| West Virginia – WV | Wisconsin – WI | Wyoming – WY |

Costs Associated With Extending The Loan

When considering a loan extension, borrowers should be aware of the additional cost involved. This could include higher interest charges, late fees, or other additional cost terms associated with the extension. Be sure to inquire with the lender about any additional cost incurred before agreeing to the extension. This will help borrowers avoid any unforeseen expenses and better manage their finances.

Many payday loan providers require fees for extending a loan. It means that certain borrowers pay more interest or fees on top of the original loan amount even if the lender grants an extension. Borrowers should review and understand the terms of any loan contract and extension agreement before agreeing to it to avoid any surprises or unexpected fees in the long run.

Many lenders require borrowers to pay extension fees or higher interest when extending their payday loans. The average payday loan interest and fees vary depending on the lender and the loan terms, and they significantly increase the overall cost of borrowing. Listed below are the costs involved with extending the loan.

- Extension fees – Many lenders require borrowers to pay a fee for extending their loan. The fee varies but is a percentage of the total loan amount.

- Higher interest rate – Lenders charge higher interest on the loan for each day or week it is extended. The interest quickly adds up and increases the total cost of the loan.

- Late payment fees – Borrowers who are unable to repay the loan even with the extension face late payment fees or penalties.

Payment Options

Borrowers have different payment options depending on the lender and the terms of the loan extension after extending a payday loan online. It is important to understand the definition of payday loan to ensure borrowers are aware of how the extension process impacts them. The definition of payday loan also highlights the risks of extending these short-term loans. Here are common payment options for extended payday loans.

- Lump sum payment – Many lenders require borrowers to make a lump sum payment at the end of the loan extension period to repay the loan fully. It is challenging for borrowers who are still struggling financially.

- Installment payments – Other lenders allow borrowers to make installments over a period. It is a more manageable option for borrowers who need more time to repay the loan and helps achieve a long-term financial solution.

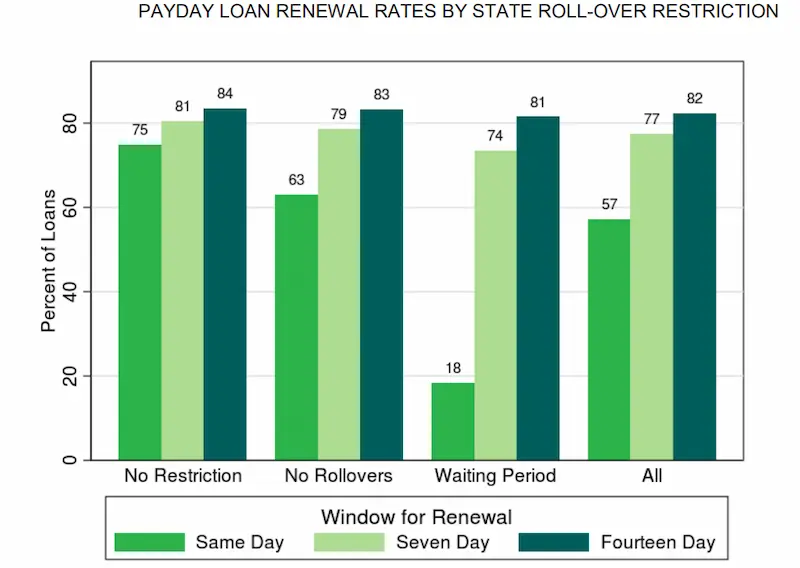

- Rollover – Lenders offer to roll over the loan into a new loan with a longer repayment period, also known as payday loan rollover. The option gives borrowers even more time to repay the loan, but it results in higher interest charges. It is crucial to consider payment amounts before opting for this.

It’s best for borrowers to carefully examine their payment options and choose the one that best suits their financial situation. Borrowers must communicate with their lender if they are unable to make a payment or need assistance managing their loan repayment.

Alternatives To Extending A Payday Loan

It is necessary to know that there is a guide to payday loan alternative options available when having a problem repaying. Exploring the options allows borrowers to avoid the extra costs and risks of extending a payday loan and work toward long-term financial stability. Negotiating a new payment plan with the lender, seeking assistance from nonprofit credit counseling agencies, and borrowing from friends or family members are just a few alternatives to extending a payday loan. One such option is exploring a Payday Alternative Loan, which can be more affordable and help borrowers develop better financial habits, such as making payments on time.

- Negotiating a payment plan with the lender – Borrowers must contact their lender and negotiate a payment plan that fits within their budget rather than extending the payday loan. It includes spreading the payments over a longer period or reducing the amount of each payment. Many lenders are open to working with borrowers and offer flexible repayment options. Choosing a reputable lender to ensure a fair negotiation and secure the best possible type of loan arrangement is essential.

- Seeking assistance from nonprofit credit counseling agencies – Nonprofit credit counseling agencies provide financial education and help create a debt management plan. They work with borrowers to create a budget and negotiate with lenders to reduce or waive fees and interest rates. They can also help borrowers navigate any outstanding payday loans and guide them toward better financial decisions. The agencies assist in finding other forms of financial aid, such as government assistance programs or local resources.

- Borrowing from friends or family members – Borrowing from friends or family members is an option if the borrower has a trustworthy support system. This option can be a good alternative to other types of loans when dealing with financial hardships. But it is best to note that you must promptly repay any borrowed money to maintain healthy relationships. It is helpful to put the agreement in writing and have a clear repayment plan.

What To Consider Before Extending A Payday Loan

Borrowers must consider their overall financial situation, including their income and expenses, before extending a payday loan. It is best to assess if the extension provides sufficient relief and allows for timely repayment or if it only adds to the existing financial strain. Customers with credit difficulties should also be cautious before extending a payday loan.

Checking The New Loan Cost

Extending the loan leads to more fees, such as interest and origination fees, which increase the overall cost of the loan. Borrowers must look at the Annual Percentage Rate (APR), which includes both the interest rate and fees associated with the loan, to determine the cost of the loan. The average annual percentage rate (APR) of payday loans is around 391%, according to the Federal Reserve Bank of St. Louis. Online loans and online lenders might present different fees and APRs than those listed here, so borrowers should always compare different offers.

| Scenario | Loan Amount | Interest Rate | Origination Fee | APR | Total Cost |

|---|---|---|---|---|---|

| A | $100 | 20% | $10 | 36% | $126.67 |

| B | $250 | 25% | $25 | 49% | $372.92 |

| C | $500 | 30% | $50 | 64% | $797.67 |

- Scenario A – A borrower takes out a loan of $100 with an interest rate of 20% and an origination fee of $10. The APR for this loan is 36%. The total cost of the loan is $126.67.

- Scenario B – A borrower takes out a loan of $250 with an interest rate of 25% and an origination fee of $25. The APR for this loan is 49%. The total cost of the loan is $372.92.

- Scenario C – A borrower takes out a loan of $500 with an interest rate of 30% and an origination fee of $50. The APR for this loan is 64%. The total cost of the loan is $797.67.

The table above shows three different loan scenarios with a maximum loan amount of $500. The borrower incurs an origination fee and interest rate, which increases the overall cost of the loan in each scenario. The APR, which includes both the interest rate and fees associated with the loan, is used to determine the cost of the loan. The scenarios illustrate how extending the loan leads to higher fees and overall costs.

Repayment Terms

Repayment terms for payday loans vary depending on the lender and the borrower’s state. Payday loans are due on the borrower’s next payday, anywhere from two to four weeks after receiving the loan. But other lenders offer longer repayment terms, such as 30 or 60 days.

It is best to understand the repayment terms of the payday loan and have a plan to guarantee timely repayment. Failure to repay on time results in more fees and interest, which quickly accumulate and lead to a cycle of debt. Here are the steps to properly repay a payday loan. Additionally, it is important to check your credit report within a few business days after repaying the loan to ensure that the lender has updated your account and reported the repayment to the credit report agencies.

- Create a repayment plan. Borrowers must assess their finances and determine how much they can repay each month. Create a repayment plan that fits their budget and timeline.

- Prioritize the loan repayment. Make the payday loan a priority and allocate the necessary funds toward repayment before other expenses.

- Set up automatic payments. Set up automatic payments with the lender to guarantee a timely and consistent repayment.

- Communicate with the lender. Borrowers experiencing financial difficulties must communicate with their lender to discuss alternative repayment options or extensions.

Here are some statistics about payday loan extensions:

| Statistic | Value |

|---|---|

| Percentage of payday loan borrowers who roll over their loans | 80% |

| Average number of times a payday loan borrower rolls over their loan | 3 |

| Average fee charged for a payday loan extension | 15% |

| Average APR for a payday loan | 400% |

| Percentage of payday loan borrowers who default on their loans | 10% |

Conclusion

Extending a payday loan is an attractive option for borrowers struggling to make timely payments. But it is necessary to fully understand the loan terms and the costs associated with extending it. Communication with the lender is needed, and borrowers must explore alternative options before extending their payday loan.

Borrowers must carefully evaluate their financial situation and seek necessary assistance before making any decisions. Being proactive and informed helps borrowers effectively manage their finances and avoid long-term financial problems.

Frequently Asked Questions

What are the steps to extend a payday loan?

The typical steps to extend a payday loan are 1) Contact your lender before the due date to request an extension 2) Agree to pay the interest owed on the principal amount for the extra time required 3) Provide updated personal and employment details for extension approval 4) Make a partial payment if required and sign a contract for the new extended due date 5) Arrange payments to avoid further extensions and pay off the loan.

Is it possible to get an extension on a payday loan, and if so, how?

Yes, it is possible to get an extension on a payday loan. You will need to contact your lender before the repayment due date and request an extension. If approved, you will sign a contract and make a payment of accrued interest and sometimes a portion of the principal loan amount. Extensions allow you to pay over a longer period but also increase your costs. Extensions enable you to avoid default but should be avoided when possible.

What fees or charges are associated with extending a payday loan?

The fees to extend a payday loan often include an extension fee around $50, an additional finance charge or interest fee based on the principal loan amount, and late fees if you extend after the due date. There may also be insufficient funds fees if automatic payments are denied due to extending. Rollover fees and additional interest charges accrue each time you extend the loan. All these costs significantly increase the total loan repayment amount.

Are there any eligibility requirements to qualify for a payday loan extension?

Common eligibility requirements for extending a payday loan include: having made timely payments previously, providing proof of income, showing the ability to repay the full balance within the extension period, paying any fees or interest owed, submitting bank statements, and meeting the lender’s minimum credit score requirements. You may have to demonstrate reasonable cause for the extension request as well.

What are the alternatives to extending a payday loan if I can’t repay it on time?

Alternatives to extending a payday loan include: borrowing from family/friends, credit counseling to negotiate payment plans, debt consolidation loans to lower payments, credit card cash advances, 401k loans, selling assets, payment extensions from other creditors, and assistance from charities and hardship programs. These allow you to avoid rollovers and additional payday loan charges.