There is a common myth among the public that individuals who have already taken out a payday loan are not eligible for another one. The misconception has been perpetuated by financial institutions and lenders alike, leading many to believe that they are unable to receive additional payday loans if they have an existing balance. But the theory is simply not true. Obtaining a new payday loan is viable even if payday loan borrowers have one outstanding. There are numerous sources available where borrowers are able to access online payday loans despite their previous borrowing history. The following blog post discusses getting numerous payday loans from various payday lenders.

Summary

- There is a common myth that borrowers with existing payday loans are not allowed to obtain another one, but this is not true.

- Payday loans are short-term, high-interest loans used by consumers who need quick access to cash, but they have significant risks and drawbacks.

- The risks associated with payday loans include debt cycles, high fees and penalties, access to bank accounts, and negative impacts on credit scores.

- Borrowers who need another payday loan must research potential lenders thoroughly, compare terms and conditions, look for transparency and licensing, and avoid lenders who pressure borrowers.

- Alternatives to payday loans include credit cards, pawnshops, and personal loans, but borrowers must use them responsibly and read loan agreements carefully.

Understanding The Risks Of Payday Loans

Payday loans are a type of short-term, high-interest loan used by consumers who need quick access to cash. They are helpful in emergencies, such as unexpected car repairs or medical bills, but they have significant risks and drawbacks. In particular, they cater to short-term financial needs but often create long-lasting financial problems.

The most obvious risk is the high-interest rate associated with payday loans. It means that borrowers pay back significantly more than they originally borrowed in certain cases. Many payday lenders require borrowers to provide post-dated checks or electronic access to their bank accounts as collateral for their short-term financial needs.

It puts borrowers at risk of overdraft fees if they don’t have enough money in their account when the lender attempts to withdraw funds. Payday loans seem like a convenient solution for people in financial distress, but it’s necessary to understand the potential risks before taking one out. Listed below are the common risks associated with payday loans.

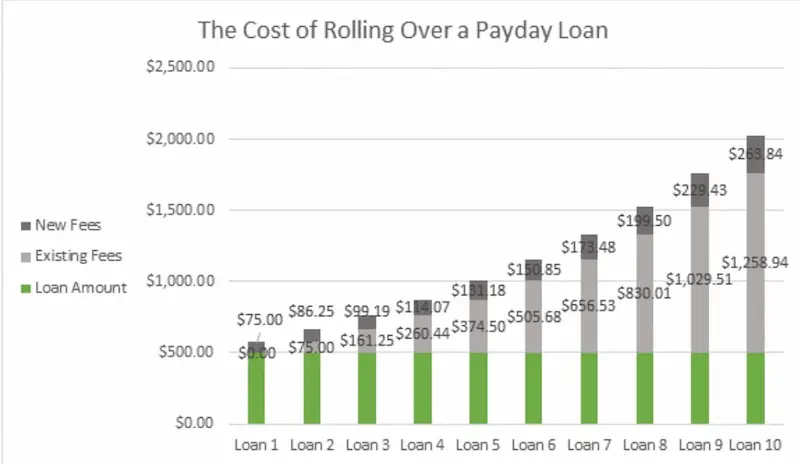

- Debt cycle – Payday debt can arise when payday loans require repayment within a short period. Certain borrowers struggle to repay the loan and are forced to get another payday loan to cover the costs. It leads to a cycle of debt, where borrowers continually get new loans to cover the costs of previous loans.

- Fees and charges – Payday lenders charge high fees and penalties for late payments, which add to the overall cost of the loan. When considering online loans, it’s important to factor in these fees, as they quickly add up, making it difficult for borrowers to repay the loan on time.

- Access to bank accounts – Certain payday lenders require borrowers to provide access to their bank accounts, which puts their personal information at risk. Lenders have access to the borrower’s bank account and withdraw funds without their consent if they are unable to repay the loan. Carefully reviewing the loan terms can help borrowers avoid this risk.

- Loan application and impact on credit score – Payday loans are only reported to credit bureaus if they go into default. Borrowers who are unable to repay the loan after the loan application get negative items on their credit report, which significantly impacts their credit score. Having negative items on the credit report makes it difficult for them to obtain credit in the future.

Here are some statistics on people who have more than one payday loan:

| Statistic | Value |

|---|---|

| Percentage of payday loan borrowers who have multiple loans | 60% |

| Average number of payday loans per borrower | 4 |

| Average amount of money borrowed per payday loan | $500 |

| Average interest rate on payday loans | 400% |

| Average APR on payday loans | 521% |

| Percentage of payday loan borrowers who default on their loans | 10% |

Finding A Reputable Lender

Many online lenders and payday loan services are available online and in person, but not all lenders operate ethically or within legal boundaries. It is best to thoroughly research potential online lenders and payday loan services. Borrowers with a payday loan must find a reputable lender if they need another one.

Finding a reputable lender is the difference between getting trapped in debt and achieving financial stability. Borrowers must look for online lenders with positive reviews from previous customers, clear terms and conditions, and transparent fees and interest rates. Listed below are the steps to find the best payday loan services for another payday loan.

- Research potential lenders. Find a direct lender that offers the loan type you’re interested in. Look for lenders that operate legally and have positive reviews from previous customers. Borrowers are free to check online reviews and ratings from sources such as the Better Business Bureau or state regulatory agencies.

- Compare terms and conditions. Borrowers must choose a lender with transparent terms and conditions that suit their needs. Review the lender’s terms and conditions, including the loan amount, repayment period, fees, and interest rates. Be sure to consider loan limits and the application process when comparing different lenders.

- Check for transparency. Reputable lenders are transparent about their fees and interest rates. Avoid lenders who are vague or unclear about their terms and conditions or who use aggressive sales tactics. A trustworthy lender will be upfront about their loan type and loan limits.

- Look for licensed lenders. Borrowers must check if the lender is licensed to operate in their state. Unlicensed lenders operate illegally or charge excessive fees and interest rates. Choose a licensed direct lender with a straightforward application process.

- Avoid lenders who pressure borrowers. Responsible lenders do not pressure borrowers to get more than they need or accept unfavorable terms. It is a red flag if a lender is pushy or aggressive. It’s best to look for a different lender that respects your needs and helps you navigate the application process smoothly.

Regarding financial needs and unexpected expenses, payday loans can be a helpful resource for many individuals. If you find yourself in a situation where you already have a payday loan and require additional assistance, it’s essential to understand where you can access such services. Our company is proud to offer payday loans in various states nationwide, providing timely financial solutions to those in need. Below is a comprehensive table outlining the American states where our company actively provides payday loan services, ensuring that individuals can find the assistance they require conveniently and efficiently.

| Alabama | Alaska | Arizona | Arkansas |

| California | Colorado | Connecticut | Delaware |

| District Of Columbia | Florida | Georgia | Hawaii |

| Idaho | Illinois | Indiana | Iowa |

| Kansas | Kentucky | Louisiana | Maine |

| Maryland | Massachusetts | Michigan | Minnesota |

| Mississippi | Missouri | Montana | Nebraska |

| Nevada | New Hampshire | New Jersey | New Mexico |

| New York | North Carolina | North Dakota | Ohio |

| Oklahoma | Oregon | Pennsylvania | Rhode Island |

| South Carolina | South Dakota | Tennessee | Texas |

| Utah | Vermont | Virginia | Washington |

| West Virginia | Wisconsin | Wyoming |

Alternatives To Payday Loans

Not all lenders offer borrowers the option to get another payday loan. Payday lenders must follow state laws and regulations that limit the number of loans a borrower is allowed to have at any given time. The laws are in place to protect borrowers from getting trapped in a cycle of debt. But there are payday loan alternatives, such as payday alternative loans, credit cards, pawnshops, and personal loans.

Credit Cards

Credit cards are a viable option for people with one outstanding loan. Credit cards offer lower interest rates than payday loans and have rewards programs that allow users to earn points or cash back on purchases. Certain credit card companies offer balance transfer options that allow individuals to consolidate their debt from multiple sources onto one card with a lower interest rate. Credit cards can also provide access to money even for those with a less-than-perfect credit history. But it is best to use credit cards responsibly and avoid accumulating high balances that lead to financial trouble.

Pawnshops

Pawnshops offer emergency cash loans to people in need by allowing them to pawn their personal belongings in exchange for a short-term loan. The pawned item is held by the pawnshop as collateral, and the loan amount is based on the item’s value. Borrowers must repay the loan and interest within a specified timeframe to reclaim their possession. Though pawnshop loans tend to have higher interest rates than other alternatives, they can be a useful option for those without access to traditional forms of credit or those who need quick access to cash in a pinch.

Pawnshops provide short-term loans in exchange for collateral, such as jewelry, electronics, or other valuable items. It can be a viable option for those with a bad credit score or those who lack a stable source of income. The loan amount depends on the value of the item being pawned and ranges from a few hundred to several thousand dollars. There is no credit check required since the collateral secures the loan. But it’s necessary to note that borrowers must repay the loan within an agreed-upon time frame to avoid losing their collateral permanently.

Personal Loans

Personal loans are unsecured loans used for various purposes, such as debt consolidation, home improvements, or unexpected expenses. The amount borrowers obtain and the interest rate depend on their credit score and income. Personal loans have fixed terms ranging from one to five years with fixed monthly payments. To obtain these financial products, lenders might require proof of income to ensure borrowers can repay the loan.

It’s best to shop for the best rates and read the loan agreement before committing to a loan. Credit applicants should be aware that the approval process may vary depending on the individual lender. Late or missed payments result in penalties and damage the borrower’s credit score. Gaining access to credit can be influenced by these factors. Personal loan rates currently range from around 4% to 36%, according to Nerdwallet.

| Credit Score | Personal Loan Rates (Range) |

|---|---|

| 700+ | 4% – 18% |

| 600 – 699 | 10% – 25% |

| 500 – 599 | 15% – 36% |

Explanation

- Borrowers with excellent credit scores of 700 or higher are seen as less risky by lenders and qualify for personal loan rates ranging from 4% to 18%. These borrowers may also benefit from active checking and instant approval.

- Borrowers with good credit scores of 600 to 699 are still deemed low-risk by lenders and are offered personal loan rates ranging from 10% to 25%. They might also apply for features like same-day funding to address their emergency expenses.

- Borrowers with poor credit scores of 500 to 599 are usually seen as higher risk by lenders and are offered personal loan rates ranging from 15% to 36% to compensate for the higher risk. They may still qualify for loan options with instant approval but could face higher interest rates.

Strategies For Paying Off Loans Quickly

Having multiple payday loans is overwhelming, as certain borrowers find it challenging to keep up with multiple repayment schedules and high-interest rates. But there are ways to pay off the debt early and avoid falling further into debt. Borrowers must maximize payoff strategies and create a budget.

Maximizing Payoff Strategies

Maximizing payoff strategies is a necessary step. It involves identifying the loan with the highest interest rate and focusing on paying it off first while making minimum payments on other loans. Customers with credit difficulties should consider this strategy to save on the overall interest paid. Another strategy is to make biweekly instead of monthly payments, as it reduces the overall interest paid over time and helps accumulate extra cash.

Consolidating multiple loans into one is an effective approach if done correctly. Increasing the borrower’s income or cutting expenses provide extra money to pay off debts faster. Utilizing the strategies allows individuals to achieve financial freedom sooner rather than later and enjoy the peace of mind that comes with being debt-free.

Budgeting For Loan Payments

Budgeting loan payments is another step in achieving financial freedom. It involves prioritizing loan payments over discretionary spending and finding ways to cut expenses wherever feasible. Creating a strict budget and allocating funds toward paying off loans help individuals to assure that they are on track to becoming debt-free. Proper budgeting can also assist in handling amounts of money effectively while managing debt payments.

Setting up automatic payments or reminders helps you stay on top of payment deadlines and avoid late fees. Incorporating budgeting into their overall repayment strategy allows individuals to gain greater control over their finances and make progress toward achieving their long-term financial goals.

Conclusion

The misconception that borrowers with an outstanding average payday loan are not allowed to receive another one is entirely untrue. Many sources are available where borrowers are free to access average payday loans despite their previous borrowing history.

It is necessary to understand the potential risks associated with payday loans, such as debt cycles, fees, access to bank accounts, and their impact on credit scores. Borrowers must find a reputable lender if they need another payday loan and should look for options with instant funding and same-day approval.

They must look for licensed lenders with transparent terms and conditions, positive reviews from previous customers, and transparent fees and interest rates. Borrowers must check alternatives to payday loans, such as credit cards, pawnshops, and personal loans, before getting another payday loan.

Frequently Asked Questions

Can I apply for a second payday loan if I already have one outstanding?

Most payday lenders do not approve a second loan if you already have one outstanding due to debt-to-income ratio concerns. There are some online lenders who may approve an additional loan, but this puts you at high risk of falling into a debt cycle and accruing unmanageable fees. It is not advisable to take out another payday loan.

Are there any lenders that offer payday loans to individuals with existing payday loans?

While most avoid it, some online and tribal lenders will approve payday loans even if you have an existing one. Lenders like Big Picture Loans, Plain Green, and LendUp are known to sometimes approve borrowers rolling over or stacking loans. However, this practice is extremely risky and leads to loan dependency and unaffordable repayment costs over time.

What options do I have for obtaining additional funds if I have an existing payday loan?

If you already have a payday loan, alternatives for getting additional funds include requesting an advance from your employer, borrowing from family/friends, using a credit card cash advance, selling assets, or reaching out to non-profits and charities for assistance. You should avoid payday loan rollovers or additional payday loans which will increase debt.

Is it possible to consolidate multiple payday loans into one, more manageable loan?

Yes, it is sometimes possible to consolidate multiple payday loans into one new loan with extended terms through direct negotiation with the lenders or by using a debt consolidation company. This can potentially lower monthly payments but will increase the overall repayment costs. It requires paying off the old loans in full. Consolidation works best for reducing payments on multiple loans.

How can I avoid the cycle of debt when I already have a payday loan?

Strategies to avoid the payday loan debt cycle when you already have one include: paying off the loan in full on your next pay date, contacting the lender to establish an extended repayment plan, finding a credit counseling agency to help manage payments, borrowing from friends/family or selling assets to cover the balance, or consolidating debt through a personal loan from a credit union. Avoiding rollovers is key.