Payday loans look like a quick solution for immediate cash, but they hurt the credit scores of certain payday loan borrowers. They are short-term loans with very high-interest rates targeted at people with bad credit or no credit history. Payday loans seem helpful in the short term, but they get very expensive and difficult to repay on time in certain cases. Making repayments on time is crucial for maintaining a good credit score. The following blog post talks about how payday loans affect a borrower’s credit score distribution and overall credit rating.

Summary

- Payday loans are short-term loans with high-interest rates targeted at people with poor or no credit history.

- Payday loans seem helpful in the short term, but they get very expensive and difficult to repay on time in certain cases.

- Payday loans hurt the borrower’s credit score due to difficulty managing payments, missed payments and late fees, high-interest rates, potential risks for defaulting on the loan, and long-term impact on credit score.

- Missed payments are reported to credit bureaus which negatively affect one’s credit score, making it harder to obtain future credit approvals and facing higher interest rates.

- Payday loans provide temporary relief but come at a significant cost regarding long-term financial stability.

- Defaulting on a payday loan lead to legal action, including wage garnishment and asset seizure.

- Defaulting on a payday loan starts a debt cycle for borrowers, which becomes difficult to break.

Difficult To Manage Payments

The debt cycle can be hard to break as the borrower has to manage multiple loans, causing difficulty in managing payments. This vicious debt cycle leads to missed payments, resulting in late fees and higher interest rates, further worsening the borrower’s credit score. Therefore, payday loans should be approached cautiously and only as a last resort for urgent financial needs.

Accessing access to payday loans from payday lenders hurts the borrower’s credit score due to difficulty managing payments on time. Payday loans have high-interest rates and short repayment terms, which make it challenging for borrowers to keep up with their payments. It leads to missed or late payments, which are reported to credit bureaus and lower the borrower’s credit score. Getting multiple payday loans complicates payment management and increases the likelihood of bad credit events being reported on the credit reports.

Missed Payments And Late Fees

Accessing credit from payday lenders has a detrimental effect on a credit score if the borrower is unable to make a consistent payment history of on-time payments, resulting in missed payments and late fees. Listed below are the fees and penalties for missing payday loan payments.

- Late payment fee – Lenders charge a fee if they fail to pay on time. This can be particularly troublesome during financial emergencies when borrowers need to prioritize paying their essential bills on time.

- Default fee – Borrowers must pay a fee if they fail to repay the loan in full. Defaulting on loans can lead to bad credit scores which may affect their ability to obtain future loans or other financial services.

- Collection fees – Borrowers are responsible for paying the fees charged by a collection agency if they default on a payday loan. Defaults, like late payments, can also negatively affect credit scoring models used to evaluate creditworthiness.

- Increased interest rates – Lenders increase the interest rate on a payday loan if a borrower misses a payment or defaults on a loan. The increased rates make it harder for the borrower to repay the loan, resulting in more fees and penalties. In times of financial emergencies, increased interest rates can compound the financial burden for the borrower.

Missed Payment Consequences

Missed Payment Consequences significantly negatively impact an individual’s credit score. Borrowers who get a payday loan agree to repay the amount borrowed with interest and fees at their next payday. Failing to make the payment in full or on time results in late fees and penalties that further increase the overall cost of borrowing. It’s important to consider the potential impact on one’s credit score, especially concerning bad credit scores and the resulting challenges in obtaining financial assistance in the future.

Missed payments are reported to credit bureaus, negatively affecting one’s actual credit score. Lenders view individuals who miss payments as high-risk borrowers more likely to default on future loans. People with poor credit scores face higher interest rates and difficulty obtaining future credit approvals due to lower credit limits.

Here are some statistics about missed payment consequences:

| Statistic | Value |

|---|---|

| Percentage of borrowers who miss a payment | 25% |

| Percentage of borrowers who miss two or more payments | 10% |

| Percentage of borrowers who default on their loans | 5% |

| Average impact of a missed payment on credit score | 100 points |

| Average impact of two or more missed payments on credit score | 200 points |

| Average impact of defaulting on a loan on credit score | 300 points |

| Percentage of lenders who will deny a loan application if there is a missed payment on a borrower’s credit report | 50% |

| Percentage of lenders who will increase the interest rate on a loan if there is a missed payment on a borrower’s credit report | 25% |

High-Interest Rates

It’s ironic that accessing credit from payday lenders, marketed as a quick solution to financial problems, actually leads to long-term negative consequences. The major reason for it is the high-interest rates charged by payday lenders, which range up to 400% APR, according to Incharge.org. These high-interest rates, combined with reports sent to major credit bureaus when borrowers miss payments, further decrease their chances of securing better credit limits in the future, as lenders align with credit reporting agencies in estimating the risk level of potential borrowers when processing credit applications.

Payday loans provide temporary relief and come at a significant cost regarding long-term financial stability. The exorbitant interest rate makes it difficult for borrowers to repay their loans on time and results in a cycle of debt. Late or missed payments are reported to credit bureaus, negatively impacting one’s credit score.

| Scenario | Interest Rate | Loan Amount | Duration (days) | Total Repayment |

|---|---|---|---|---|

| Payday Lender A | 300% | $500 | 14 | $650 |

| Payday Lender B | 400% | $200 | 7 | $280 |

| Payday Lender C | 200% | $1000 | 30 | $1,400 |

The table shows the different scenarios of borrowing from payday lenders, highlighting the high-interest rates charged by them. Borrowers getting loans from payday lenders face much higher interest rates, and the repayment period is much shorter. Payday loans are a quick solution for emergency cash needs, but the high-interest rates and short repayment periods lead to a cycle of debt.

Potential Risks For Defaulting On The Loan

80% of payday loans are rolled over or renewed within two weeks, according to a report by the Consumer Financial Protection Bureau. It means that borrowers are unable to repay the loan in full and must get another loan, creating a cycle of debt that becomes difficult to break.

The potential for defaulting on payday loans is high, which hurts one’s credit score. Defaulting occurs when a borrower fails to make payments as agreed upon in the loan agreement, resulting in late fees and collection efforts from the lender. The missed payments and collections are reported to credit reporting agencies, causing a drop in credit scores.

High credit utilization can have negative effects on a borrower’s credit standing. Borrowers who are unable to pay back the loan face legal action, further damaging their credit standing. Accessing credit from payday lenders must be done cautiously and only after examining all other available options.

Long-Term Impact On Credit Score

Accessing credit from payday lenders has a long-term negative impact on a borrower’s credit score. Payday loans have high-interest rates and fees, making them expensive and difficult to repay on time. Borrowers who miss a payment or default on a loan are reported to credit bureaus, significantly lowering their credit score. Additionally, borrowers’ position in the credit score deciles can be affected by their loan repayment habits, which influences their ability to obtain credit in the future.

A low credit score makes it harder for borrowers to access credit in the future, and they incur higher interest rates and fees for loans and other financial products. This can affect their loan application and limit their financial capability. It leads to a cycle of debt and financial distress, which is difficult to break out of. Developing good credit habits and being responsible with credit can help improve one’s credit score and avoid any difficulties in the future.

Legal Action

Borrowers who default on a payday loan face legal action to collect the debt. It involves filing a lawsuit against the borrower, seeking a judgment for the amount owed. Lenders who successfully obtain a judgment can garnish the borrower’s wages or seize their assets, such as bank accounts or property, to satisfy the debt. The involvement of a credit reporting agency can also impact the borrower’s credit score leading to further complications.

Legal action has serious consequences for borrowers, so it’s best to make every effort to repay a payday loan on time and avoid defaulting. Wage garnishment involves the lender obtaining a court order to take a portion of the borrower’s wages directly from their employer. In contrast, asset seizure involves the lender taking possession of the borrower’s assets to sell and collect the proceeds.

Cycle Of Debt

Defaulting on a payday loan starts a cycle of debt for borrowers. Lenders charge extra fees and penalties when a borrower defaults, which makes it even harder to repay the loan. Borrowers are forced to get new loans, even with higher fees and interest rates, to cover the costs.

The cycle continues, with the borrower getting more loans to cover the previous ones, leading to a situation where they owe more than they realistically repay. It is a serious problem for borrowers, leading to financial instability and long-term financial struggles. Listed below are the steps on how to avoid a cycle of debt.

- Only borrow an affordable amount. Borrowers must assess their financial situation and only borrow what they realistically afford to repay before getting a payday loan consolidation. It’s best to examine their income, expenses, and other debts, including any additional debt they may have.

- Create a repayment plan. Borrowers must create a repayment plan that works for their budget. In order to improve their financial habitsinvolves cutting back on other expenses or finding ways to increase their income to free up funds for loan repayment and reducing the outstanding balance.

- Avoid getting more loans. Resist the temptation to apply for new loans, or any other form of credit, to cover the original loan and fees. It only increases the debt and makes it harder to repay.

- Communicate with the lender. Borrowers must communicate with the lender if they need help repaying a payday loan. The lender may be able to offer a repayment plan or other options to help avoid defaulting.

- Seek financial counseling. Seeking the advice of a financial counselor or advisor who is able to help develop a budget and repayment plan and provide tips for improving the financial situation overall.

Conclusion

Accessing credit from payday lenders seems like a quick solution for immediate cash, but it hurts a borrower’s credit score stage in the long term. High-interest rates, short repayment periods, and difficulty managing timely payments make it challenging for borrowers to repay their loans on time, resulting in missed payments, late fees, and penalties. Payday loans are a temporary relief, but they significantly cost a borrower’s long-term financial stability. The potential for defaulting on payday loans is high, leading to legal action and wage garnishment. For the average consumer, exploring other types of loans that offer more favorable terms and better access to funds is a wiser choice.

Frequently Asked Questions

How does borrowing from payday lenders affect your credit score differently than traditional lenders?

Payday loans are rarely reported to credit bureaus, so they don’t impact your score directly. But if you default they may send accounts to collections which damages credit significantly.

What are the key factors that contribute to a negative impact on your credit score when using payday loans?

The main factors are repeated rollovers or extensions generating multiple overdue payments and eventually default, and aggressive collections practices if you fail to repay as agreed.

Can a payday loan default lead to collections and seriously damage your credit score?

Yes, defaulting on a payday loan can result in the debt being sent to collections which can significantly hurt your credit score by up to 100 points or more.

Are there any alternatives to payday loans that won’t harm your credit rating?

Better options that avoid credit damage include borrowing from family or friends, credit union loans, credit card cash advances, 401k loans, income-based repayment plans, payroll advances, or debt management plans.

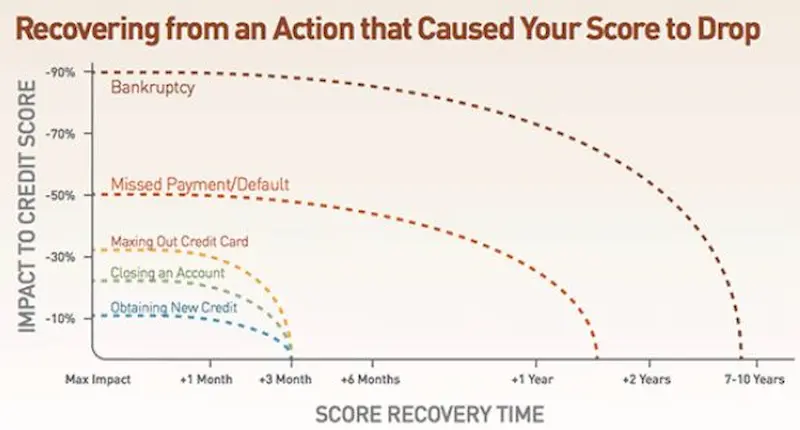

How long does it typically take to recover your credit score after using payday loans, and what steps can you take to rebuild it?

It can take 6 months to a year or more to rebuild credit after payday loan defaults. Establishing new positive credit history responsibly and disputing inaccurate information help improve scores.