Personal loans are available to help finance large purchases, consolidate debt, and pay unexpected bills. There are many benefits to obtaining a personal loan with no income verification. This article will answer the following questions: What are the benefits of obtaining a personal loan?

These are the Key Takeaways

- A personal loan is money given to a borrower by a lender (a bank, credit union, or state-licensed lender). The borrower must repay the loan and pay any interest and other fees within a given time.

- Personal loans offer many benefits, including debt consolidation loans, predictable payments, and building a credit history.

- Assess your financial situation to determine the best lender. All documentation is required to complete your application.

Personal loans offer many benefits. These topics will be addressed:

- Dealing with unexpected expenses by utilizing personal loan funds

- The importance of understanding repayment terms when opting for a personal loan

- Knowing your options for personal loan rates

- What is a personal loan?

- What are the benefits of a personal loan?

- How do you obtain a personal loan?

What Is a Personal Loan?

A personal loan is a money a lender gives you (a bank, credit union, or state-licensed personal loan lender). The borrower repays the loan, including any interest and fees, within a specified loan term.

The annual percentage rate (APR) is the cost of credit per year. APR includes fees and interest. The interest rate is the annual amount of money you borrow. This is the amount a borrower will pay in interest and other fees.

APR can include application fees, processing fees, and origination fees. It will vary according to the lender and local laws. Lenders may charge different fees. You can also add products like credit insurance.

Personal loans can also be used for various purposes like debt consolidation, home improvements, or emergencies and can help establish or improve your credit score. Some people also use personal loans as alternative lines of credit when they need funds quickly and want to use something other than a credit card.

There are two types of personal loans.

Secured personal loans

You will need collateral to guarantee the repayment of your loan. As collateral, you could use your car or home. Secured personal loans let you default on your payments. The lender can also take collateral to make partial payments. Keeping an eye on your income ratio helps you understand how much loan you can afford.

Unsecured Personal Loan

Unsecured personal loans don’t require collateral. Lenders love this type of loan because it has higher interest rates. If you cannot pay your monthly payment, lenders have fewer options. Evaluating your major expenses can help you avoid defaulting while achieving your financial goals.

What are the benefits of a personal loan?

These are the five benefits of a personal mortgage.

1. Personal loans can be used for many reasons

You can use a personal loan for many reasons, like paying off your credit card balance or dealing with an online lender. These are just a few of the many reasons that you could use a personal loan.

- Pay unexpected costs: Large expenses are often unpredictable due to the unpredictable nature of our lives. A personal loan is a good option if you have an emergency expense and must pay quickly.

- Personal loans can be used to finance major purchases. You can use the single loan to finance home repairs or vehicle repairs.

- Consolidate debt. To consolidate multiple unsecured personal loans into one loan, you can combine them. These loans are low-interest, and they can be paid monthly.

2. It is easier to pay one personal loan than several credit card accounts.

Keeping track of your finances can be hard when multiple credit cards offer different payment options. Sometimes it takes work to pay your interest and manage credit card debt.

Personal loans require one-time repayment. Only one payment is required. It will be easier to track your finances if all the money is in one location.

3. Personal loans are available with predictable repayments

Before you can repay a loan, it is crucial to understand its terms fully.

- The total amount you will need to repay

- How much should each month cost?

- The amount of time that you will be making payments

- Understanding equity loan and student loans options

- Recognizing borrowing limits and credit qualifications

Making a well-informed financial decision when choosing the right loan is essential. The lender will provide all the information required to apply for personal loans. This will enable you to see how much you owe and when.

4. Consolidating your debts can be done with personal loans

Do you have multiple loans or credit cards? To help you pay high-interest debts, a personal loan might be an option. Consolidating debt into one payment can result in lower monthly payments.

5 Personal loans can improve your credit score

A loan can be a way to build credit. GreenDay Online monitors your payment history and reports it to national credit bureaus. Your lender must inform GreenDay Online of your payments to build credit. Late payments will be notified directly to the national credit bureaus.

How To Obtain a Personal Loan?

How do you get a personal loan? Let’s take an in-depth look at the process.

1. Review your financial situation

Once you’ve calculated how much money you require for purposes like medical bills or improvement projects, you can begin to plan how to pay it back. Calculate the monthly cost of your loan payments, including any time payments if available.

2. Find the right lender

Be realistic about your financial situation. It is important to receive fair terms and the correct amount from your lender, especially when dealing with medical expenses. Before you apply, GreenDay Online will review your credit history within one business day. This is especially helpful for those with low credit scores. Lenders may offer secured and unsecured loans if you need good credit. It’s easier to be approved for secured loans.

3. Collect all documents

Personal loans have different requirements depending on the lender. Depending on your loan type, you will need the correct documentation, such as for medical bills or improvement projects. Lenders most commonly request these documents. GreenDay Online doesn’t require a credit history or a Social Security Number to apply.

Secured personal loan (secured to your car)

- Vehicle title

- The state must register the original and copied vehicle registrations

- International driver’s license (U.S.A.

- By providing bank statements or payslips, you can prove your income.

- Address proof

- Photos of your vehicle (front, back, passenger side, driver side, VIN) and the odometer.

- Routing number and bank accounts

Personal loan with no security

- Valid photo ID (driver’s license, passport, consular ID card, or not-U.S. identification cards)

- Income proof

- Address proof

- Up to four references can be provided by family and friends

4. Request a loan

A personal loan application is simple. Sometimes, it takes less than 10 minutes. The lender will verify that all documentation is received after reviewing your application. Lenders will reimburse you within two hours, ensuring quick funding times. Most lenders approve auto loans within 24 hours, offering shorter-term options.

5. Use the loan

It’s important to comparison shop, as the average rate for personal loans can vary greatly. Take advantage of the various financial products available to find the best option suited to your needs.

You can spend the money on your expenses once you have received the funds. Consider your credit mix and any equity lines you have before making decisions.

6. Start making payments

Once you have received your money, you must repay the loan regularly. Aim for a single, fixed-rate monthly payment to make budgeting easier. Set up automatic payments on your smartphone or a reminder to ensure you pay on time. This will ensure you never miss a payment and can handle unexpected life events more efficiently.

Below are statistics on personal loans:

| Statistic | Value |

|---|---|

| Total personal loan debt | $222 billion |

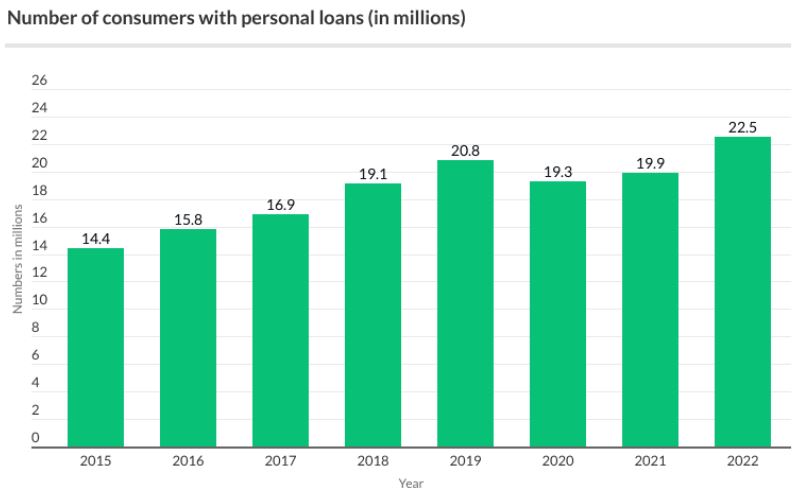

| Number of personal loan borrowers | 22.5 million |

| Average personal loan amount | $8,018 |

| Average personal loan interest rate | 11.05% |

| Delinquency rate (60 days or more past due) | 4.14% |

Frequently Asked Questions

How can a personal loan help me consolidate my debt and improve my financial situation?

Personal loans allow you to bundle multiple high-interest debts into one lower fixed-rate loan, reducing monthly payments, simplifying repayment, saving on interest, and improving credit.

What are the key advantages of using a personal loan for home improvement projects?

Personal loans offer predictable fixed rates, flexible terms, ability to borrow precise amounts needed, and potential approval even with lower credit scores compared to home equity loans.

How does obtaining a personal loan for education expenses compare to other financing options like student loans?

Personal loans provide flexible use of funds and predictable repayment, but student loans have lower rates and more options like income-driven repayment and loan forgiveness programs.

What are the potential benefits of using a personal loan for unexpected medical expenses or emergencies?

Personal loans allow consolidation of medical debts at lower interest rates with fixed monthly payments and credit building potential compared to credit cards or payday loans.

Can you explain how a personal loan can be used to cover major life events like weddings or vacations and its advantages over credit cards?

Personal loans have lower fixed rates, require regular monthly payments, and help avoid ballooning credit card debt. However, credit cards provide rewards and purchase protections.