How to Get an Online Title Loan With No Income Verification

A car title loan with no income verification allows borrowers to use their car as collateral. The car secures the loan without the need for income verification. Individuals with difficulty getting approved for traditional loans seek out these loans. Many financial institutions offer them, including online title loan providers. Borrowers typically need proof of car ownership and title ownership to apply for a car title loan without income verification. The lender then appraises the car and determines the loan amount based on its value.

The borrower must then sign over their car title as collateral and complete the title loan application. Car title loans without income verification allow borrowers to easily get the funding they need. They still qualify even if they have bad credit or cannot verify proof of income. However, it is important to note that car title loans, especially online title loans, are quite expensive and are a better option for some. Borrowers must consider their financial situation and the loan terms before applying.

They can be approved for a Car Title Loan Online even if borrowers are jobless and have no income. The lender uses the automobile title to guarantee that borrowers repay the loans on time and as proof of their creditworthiness. In certain circumstances, income verification is optional. Borrowers do not need a credit check. The title loan process is quite simple and suitable for those with poor credit.

In Illinois, you can use your car to get a title loan if you can’t get a traditional loan. No income verification is necessary with an Illinois title loan. You must own your vehicle and possess its clear title as collateral. The title loan process here is designed to be accessible even for borrowers with bad credit.

Can I qualify for loans with bad credit?

Yes, bad credit holders are more likely to get approved for title loans. Lenders see better credit scores as safer investments by lenders. Lenders view borrowers with poor credit scores as “risky.” Lenders need collateral from borrowers with bad credit to get loans. Title loans are risky. The use of cars is essential to daily life. They are necessary for almost everything, including getting people to work, the food shop, and other places. Most people’s lives become more challenging and unpleasant if they don’t use a vehicle. Thus, it is better to repay title loans on time.

Before approving title loans, some lenders might require a vehicle inspection to determine the car’s condition and value. A vehicle inspection ensures that the vehicle is in good shape and reduces the risk for the lender.

Is income required to get a car loan?

Yes, lenders need evidence that borrowers have the means and desire to pay their debts. They sometimes provide a loan without a job or even loans without proof. It makes no difference when the borrower has a job that earns money. Other than employment, there are other alternative sources to earn money. The strategies involve government perks and profits on investments. Lenders still grant the loan request regardless of where the money comes from. Some lenders don’t care where the money comes from. A few hundred to tens of thousands of dollars are the values of these loans if the borrower doesn’t default on the loan. They take their car.

Is there a limit on how much I can borrow from a vehicle title loan?

When taking out a vehicle title loan, lenders usually have a limit on the amount that people can obtain. The car’s value determines the limit and terms of the title loan agreement. Make sure to carefully review the details of your agreement before committing to a loan.

Yes, lenders have limits depending on the vehicle’s value. The lender takes the car when borrowers don’t make your loan payments. Lenders prefer vehicles between $2,000 and $4,000 in value. The borrower’s credit score and financial situation play a role in determining the loan amount. Borrowing more than needed leads to higher interest rates and longer repayment terms. Different loan options are available, and the borrower should consider their vehicle identification before choosing one of the loan options.

How do I get a vehicle loan without income verification?

Below are the step-by-step guides on getting a loan without income verification.

- Proof of income. Have a reliable income source, such as a worker’s salary. Be a freelancer or gig worker who only receives periodic payment. The jobs above lead to the denial of your loan application even if you are unemployed. In a financial emergency, having a stable income source is crucial for loan approval.

- Credit history. Borrowers’ credit report to the lender reveals how quickly they pay bills. Lenders are impressed by excellent credit score histories. It explains how to make loan payments on time. Borrowers provide documentation supporting their credibility when requesting a car loan. The approval process relies heavily on the borrower’s credit history.

- Statements from bank accounts. The borrower’s history, including cash withdrawals or deposits, is in the bank statement. It is a great resource for lenders to learn more about the borrower’s bank account. Their lender authorizes the loan if their bank account is in excellent standing and they spend little money. An online loan application may require you to submit your bank statements digitally.

- Rent and utility payments. The lender acknowledges the history of utility and rent payments. It shows that they are reliable when it comes to paying debts. A long history of timely and complete monthly payments is what most lenders look for during the approval process.

- Paystubs. Lenders still give borrowers a loan even if they don’t have a job. Pay Stubs are necessary to demonstrate that the borrowers have stable sources of income. These records show the lender that borrowers are eligible for loan repayment. Remember to include your paystubs when submitting an online loan application.

Can I get a car loan without income verification if I have bad credit?

Yes, people with bad credit frequently use auto title loans. They will use their automobile as collateral, and lenders are more willing to lend to those with bad credit. Approving a loan for vehicles with bad credit is possible but not guaranteed. Borrowers must have a minimum credit score to qualify for credit. Some lenders won’t provide a car loan when the credit score falls below a particular point. Lenders consider income when determining whether to provide the loan or not. Typically, a monthly salary of at least $750 is sufficient. In case of any doubt, contact the lender when applying for an income-verification vehicle loan.

Here are some statistics on title loans with no income verification:

| Statistic | Value |

|---|---|

| Number of title loans with no income verification outstanding in the United States | 2 million |

| Percentage of title loans that do not require income verification | 33% |

| Average interest rate on a title loan with no income verification | 300% |

| Average term of a title loan with no income verification | 30 days |

| Percentage of title loans with no income verification that end in repossession | 20% |

Why is income verification important?

Income verification is important because it helps lenders determine a borrower’s ability to repay the loan. The lender uses the borrower’s income information to calculate their debt-to-income ratio. It measures how much of the borrower’s income will pay off debts. It indicates they are at a higher risk of defaulting on the loan if a borrower has a high debt-to-income ratio. Additionally, income verification helps lenders ensure that the borrower is not over-extending themselves financially and that the loan amount is affordable. It is important for compliance with laws and regulations for lending.

Pros and cons of vehicle title loans without income verification

Below are the pros and cons of vehicle title loans without income verification.

Pros for potential borrowers

- It is optional to provide proof of income. Some lenders can provide a loan without proof of income to get a vehicle loan

- Get the money fast: Borrowers get financing from various lenders quickly. Most receive their cash within one business day once approved, making it perfect for those who need quick cash.

- It is a fantastic way to pay for unplanned or unexpected expenses: Many lenders, like a title lender, give out money on the same day if you have the car’s title.

Cons

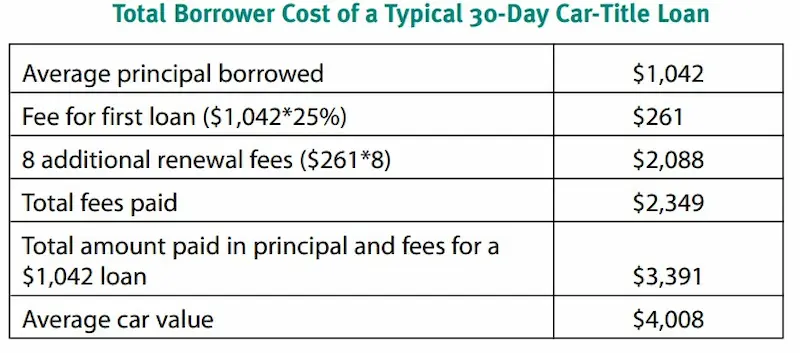

- Expensive: The cost of a car loan is typically higher than that of other loans, especially from auto title lenders. Only those applicants with high credit ratings are eligible for these loans.

- The loans feature extremely high-interest rates for borrowers with bad credit scores: Other fees apply in addition to the interest rate. The overall vehicle cost significantly increased due to these added expenses. The cost of the car increases when you borrow money. It is especially true during the process for title loans.

- It is hazardous: It is challenging to repay it: Borrowers must repay these loans quickly because they are expensive and often categorized as emergency financial support. The car is unsafe when borrowers don’t pay on time for auto loan payments. The complexity of the process makes these loans risky.

- It is possible to lose the vehicle: The lender seizes the car if borrowers fail to repay the loans.

Best reasons to choose GreenDayOnline

Listed below are a few of the reasons why it is best to choose GreenDayOnline.

- It needs to meet a few requirements. These include a valid email address, phone number, and bank account.

- Green Day Online offers a loan with no job needed. People who receive other financial help, such as retirement and social security benefits, qualify. Get a title loan funding with no employment.

- Connects to a car title loan lender who is in the best position to approve a qualified borrower loan request.

- Gives the loan in a lump sum to the borrowers.

- The online application process is simple.

- Borrowers are free to use the loan proceeds if they need them.

At GreenDayOnline, we take pride in our extensive presence and commitment to serving customers nationwide. As a leading provider of car title loans with no income verification, we understand the financial challenges individuals may face during times of unforeseen expenses or emergencies. With our dedication to accessibility and convenience, we have expanded our operations across several American states, ensuring that our services are readily available to those in need. Below is a comprehensive list of the states where our company is active, reflecting our commitment to empowering individuals with quick and reliable financial solutions.

| AL – Alabama | AK – Alaska | AZ – Arizona | AR – Arkansas |

| CA – California | CO – Colorado | CT – Connecticut | DE – Delaware |

| DC – District Of Columbia | FL – Florida | GA – Georgia | HI – Hawaii |

| ID – Idaho | IL – Illinois | IN – Indiana | IA – Iowa |

| KS – Kansas | KY – Kentucky | LA – Louisiana | ME – Maine |

| MD – Maryland | MA – Massachusetts | MI – Michigan | MN – Minnesota |

| MS – Mississippi | MO – Missouri | MT – Montana | NE – Nebraska |

| NV – Nevada | NH – New Hampshire | NJ – New Jersey | NM – New Mexico |

| NY – New York | NC – North Carolina | ND – North Dakota | OH – Ohio |

| OK – Oklahoma | OR – Oregon | PA – Pennsylvania | RI – Rhode Island |

| SC – South Carolina | SD – South Dakota | TN – Tennessee | TX – Texas |

| UT – Utah | VT – Vermont | VA – Virginia | WA – Washington |

| WV – West Virginia | WI – Wisconsin | WY – Wyoming |

Frequently Asked Questions

Can I qualify for a car title loan without providing proof of income?

Some lenders may approve title loans without formal income documentation by verifying personal details and the vehicle’s equity. However, you still need to demonstrate repayment ability.

What are the alternative methods for income verification when applying for a car title loan?

Alternatives to paystubs or tax returns include bank statements showing regular deposits, authorization for electronic bank access, prepaid card account information, and having a co-signer.

What are the eligibility criteria for obtaining a car title loan without income verification?

Typical requirements are owning your vehicle outright, being at least 18 years old, having government ID, holding a valid driver’s license and showing auto insurance coverage.

What documents and information will I need to provide when applying for a car title loan with no income verification?

You’ll need your car title, keys, government ID, proof of insurance, registration, odometer reading, personal references, and bank account information in most cases.