Money worries can overwhelm you, but we have the perfect solution. GreendayOnline provides fast, easy loans of up to $1,000 – even if you have bad credit. Say goodbye to financial stress and actionable peace of mind with our quick, secure payday loans today.

What Is a $1,000 Loan?

A payday loan can be your saving grace for unexpected financial needs. It provides fast and easy access to funds and eases the financial hurdle of an emergency bill. It’s the perfect solution when you need a quick financial boost without waiting for long approval times or extended repayment periods. Please get the help you need right away, and let a 1000-dollar payday loan work its magic!

With payday lending, there are no long wait times or complicated credit check processes, gifting you the loaning power in your hands. Put your financial worries behind you with our hassle-free loan approval process. When you need money immediately, we make it possible to get it quickly, so you can take care of your financial obligations without worry or delay.

Get the cash you need fast and conveniently, with direct deposit into your account within 24 hours.

Can I get a 1,000 Dollar loan from GreenDayOnline?

GreendayOnline offers payday loans that give you access to $1,000 even with bad credit. Take advantage of quick, direct deposit to your account and get the funds you need with minimal interest, no hassle, and fast processing.

Are you facing a financial emergency? GreendayOnline is here to help with its network of reliable payday lenders offering quick approval for cash loans up to $1,000. Enjoy the convenience of having immediate access to funds when your bank balance falls short! Just three easy steps, and you can have the money in your account within an hour.

Unlock the potential of payday loans and satisfy your financial needs quickly with same-day acceptance! GreendayOnline allows individuals with bad or no credit histories to acquire funding quickly, ensuring you can promptly meet your life’s demands.

At GreenDayOnline, we are committed to providing fast and reliable financial solutions to needy individuals. With a strong presence across the United States, our services are accessible to individuals in various states, offering convenient access to quick loans without the hassle of credit checks. We understand the urgency and importance of immediate financial support, so our team works tirelessly to ensure a seamless customer experience. Below, you’ll find a comprehensive list of the American states where our company operates, enabling you to take advantage of our $1000 loan in just 60 minutes. Explore the table below to discover if we are active in your state and seize the opportunity to secure the financial assistance you require.

| Alabama / AL | Alaska / AK | Arizona / AZ | Arkansas / AR |

| California / CA | Colorado / CO | Connecticut / CT | Delaware / DE |

| District Of Columbia / DC | Florida / FL | Georgia / GA | Hawaii / HI |

| Idaho / ID | Illinois / IL | Indiana / IN | Iowa / IA |

| Kansas / KS | Kentucky / KY | Louisiana / LA | Maine / ME |

| Maryland / MD | Massachusetts / MA | Michigan / MI | Minnesota / MN |

| Mississippi / MS | Missouri / MO | Montana / MT | Nebraska / NE |

| Nevada / NV | New Hampshire / NH | New Jersey / NJ | New Mexico / NM |

| New York / NY | North Carolina / NC | North Dakota / ND | Ohio / OH |

| Oklahoma / OK | Oregon / OR | Pennsylvania / PA | Rhode Island / RI |

| South Carolina / SC | South Dakota / SD | Tennessee / TN | Texas / TX |

| Utah / UT | Vermont / VT | Virginia / VA | Washington / WA |

| West Virginia / WV | Wisconsin / WI | Wyoming / WY |

Is a $1,000 Loan With No Credit Check Possible?

Yes, you can get the loan you need quickly without thinking about your credit score or running into issues down the road when it counts.

Take control of your finances with a no-credit-check personal loan. Enjoy guaranteed approval with no teletrack and confidential account information, allowing you to apply quickly for up to $1,000 same-day cash advance. Get the peace of mind you deserve and apply online today!

Can I Get a Payday Loan for $1,000 with No Fax?

Yes, No need to wait in line or send any paperwork. Access quick funds without complicated procedures and instantly get the financial support you need. With faxless payday loans, you can enjoy the convenience of fast cash without all the hassle.

Can I Borrow $1,000 if I Am Unemployed?

You can obtain a payday loan from a direct lender or a broker, even without employment. Direct lenders may consider other income sources when assessing the borrower’s ability to repay, meaning that if you have a sufficient-enough monthly income, you can access the cash you need.

Employment is not necessary to be eligible for a credit. Alternative income sources include Social Security benefits, unemployment benefits, disability benefits, SSI payments, and monthly pensions. Regardless of your employment status, if you submit a loan application, you may receive the necessary funds immediately.

How Can I Get a $1,000 Loan Even If I Have Bad Credit?

Don’t let bad credit prevent you from obtaining the funds you require.GreendayOnline is here with fast, convenient payday and personal loan services. Borrow up to $1,000 without worrying about a guarantor or collateral. Get the money you require right away to take charge of your funds. We specialize in lenders with bad credit.

Can a Bank Give Me a Loan?

Traditional banking systems often need to be more flexible to address the needs of those with bad credit. A personal loan can come with unfavorable terms, leaving borrowers feeling out of options when they need money most. Instead, looking outside traditional lenders and finding alternatives prioritizing individual circumstances can open up more opportunities to get the funding required.

GreendayOnline helps people with poor credit access $1,000 loans without credit checks. Our connection services make it easy to find competitive loan offers and get the money you need.

Frequently Asked Questions On $1000 Loans

What are the fees?

High-interest payday loans are a feature of payday loans. You borrow $1000 only to find yourself owing up to an additional $200 after applying fees and interest. This can be a lifeline when you need money fast and affordable if you repay the loan on time.

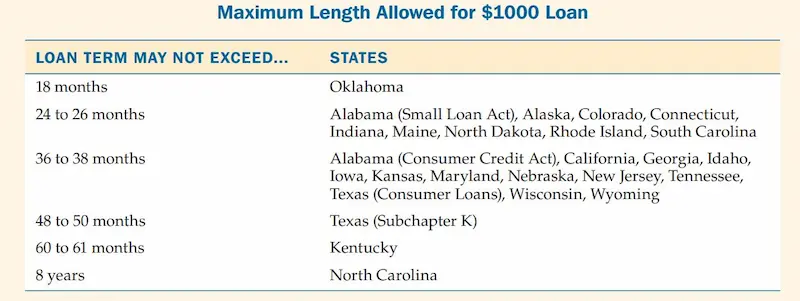

Knowing your state’s legal limits for interest rates can help you make informed decisions about which lenders to work with and protect yourself from loan sharking and other potential abuses. Even if two lending companies offer the same service, their interest rates may differ significantly. Gather all the facts and details to evaluate different lenders and choose the best fit for your needs. Gaining knowledge can give you the power to make informed decisions. With knowledge as your ally, you can trust that your financial decisions will be sound.

Why Should I Use GreenDayOnline?

Yes. Finding a reliable payday loan provider is now easier than ever. GreendayOnline’s online loan broker services mean you can quickly and easily apply to identify legal lenders in your local area. Please don’t waste time searching around-enjoy the convenience of knowing.

GreendayOnline has you covered when it comes to finding dollar payday loans.

Gain access to trusted lenders in minutes! Our extensive network of lenders across multiple cities and states makes finding the financial solution you need easy. Get started on your application process today for a quick approval.

Can a Direct Lender Offer Me a $1,000 Payday Loan?

Yes. For simple access to a payday loan, look for a direct lender in your area that provides small-dollar loans. The loan application process is straightforward via the GreendayOnline website. The process can be completed and submitted in mere minutes.

Take your time with your financial requirements. Take control of the situation now and apply for a loan with us. We work directly with lenders who can move quickly to get you access to the funds you need with minimal effort from you. Fill in the form and let us take care of the rest – fast, secure money solutions are just a few clicks away.

Can I Get A Loan With Regular Monthly Installments?

Yes. Take control of your finances with an installment loan. Get the extra cash you need to cover expenses without breaking the bank. With easy repayment options and low-interest rates, make your money work for you with the flexibility of an installment loan. Enjoy peace of mind knowing that your long-term financial goals are within reach.

Installment loans are an effective tool for budgeting and planning your financial obligations. Through this repayment method, determine the amount owed each month so you can efficiently manage your budget and plan for the future – all while following local regulations.

What Is the Minimum Credit Score Required for a Loan?

Secure and convenient access to your funds can be crucial when facing unexpected expenses or financial uncertainty. Payday lenders are committed to helping people who need to meet the requirements for conventional loans and will consider applications with even the lowest credit scores. Keep going if your credit score makes it difficult for you to get funding.

How Do You Get a $1,000 Loan?

Payday loans offer easy access to quick funds with minimal requirements. If your source of income is dependable, you might be approved for the credit regardless of what it is. So if you need that extra bit of money to cover an emergency expense or a large purchase, payday loans are an accessible and reliable option.

In addition to having a source of income, other eligibility requirements include the following:

- You must be 18 to apply.

- You must be a US legal resident of the loan state.

- You need an official ID.

Here are some statistics on $1,000 Loan With No Credit Check:

| Statistic | Value |

|---|---|

| Average interest rate | 300% – 500% |

| Average loan term | 14 – 30 days |

| Average borrower borrows | $500 – $1,000 |

| Percentage of borrowers who roll over loans | 60% – 80% |

| Percentage of borrowers who default on loans | 10% – 20% |

How Can I Evaluate Different Loans And Lenders?

Compare payday loan companies, considering repayment terms, interest rates, and any additional fees. Penalties for not meeting repayment terms can be steep, so read all loan agreements carefully before you commit – make sure you can manage the loan within your budget.