Explore various mortgage options. Even though it may be more expensive, refinancing or acquiring a mortgage for a home with less-than-perfect credit may still be preferable to paying rent. Here are some pointers to help you obtain a mortgage even with poor credit:

Consider exploring various mortgage options to find the best deal for your financial situation. Various types of mortgages are available, such as fixed-rate, adjustable-rate, and interest-only loans. Researching different loan options can help you find a mortgage program that best fits your needs and accommodates your poor credit score.

Consider bad credit mortgage lenders.

Some bad credit mortgage lenders specialize in working with individuals who have less-than-perfect credit. These lenders might offer more flexible qualification requirements or better understand your credit situation. However, remember that interest rates and fees might be higher than what traditional lenders offer.

Look into online mortgage lenders.

An online mortgage lender is a good resource as they often provide an easy-to-use platform and offer more competitive rates. Additionally, some online lenders have more flexible underwriting guidelines, which may increase your chances of getting a mortgage if you have a troubled credit history.

Be wary of loans with “assured” approval.

It’s a warning sign if you encounter advertisements guaranteeing “guaranteed” mortgage approval regardless of credit. There cannot be a “no credit check loans guaranteed approval direct lender” until a lender confirms a borrower’s capacity to repay a mortgage per federal regulations. You might even have a guarantee of acceptance with these proposals, but they will cost too much or be overpriced.

Do not drastically alter your financial situation.

Avoid making significant financial changes while applying for a mortgage, as lenders may view such alterations as a red flag. For example, make small purchases, change careers, or open new lines of credit, as these actions could negatively impact your credit score and jeopardize your mortgage application.

Avoid taking on or applying for additional debt during the mortgage application process since it can lower your credit score. This includes new credit cards and large purchases.

Check to see if you are eligible for down payment aid.

If you have low credit and want to get a mortgage, you might be concerned about saving money for a down payment or wanting to increase your down payment to make up for your credit status. Mortgage lenders often have various credit requirements. You can also look for a mortgage company that offers down payment aid programs.

There may be one that you are eligible for among the more than 2,500 down payment aid programs offered countrywide.

Think beyond banks.

Banks aren’t the only players in the mortgage market; other non-bank, online lenders, credit unions, and other lenders are all vying for your business. Let them compete to see who can provide you with the most incredible price and more favorable mortgage interest rates.

Compare options

There are differences between each mortgage provider; some can provide lower mortgage rates than others. According to research, multiple mortgage rate bids can save you thousands of dollars compared to a 30-year mortgage.

How Can I Quickly Raise My Credit Score?

The best way to raise your credit score and improve your mortgage credit report is by ensuring that all your bills are paid on time every month. This helps in reducing your monthly mortgage payment. If you need help keeping track of your finances, consider using an app like Mint or Personal Capital. They’ll keep tabs on your spending habits so that you can better manage your budget.

You also need to pay off any outstanding debts as soon as possible. The longer you leave unpaid balances, the worse your credit score will become. Achieving loan approval could also become difficult with a poor credit score.

You can also improve your credit score by opening new accounts. For example, you could open a store card at a department store or gas station. It doesn’t matter what type of account you use, just that you do something to show that you’re responsible enough to handle credit.

What Is the Minimum credit score to get a mortgage?

The minimum credit score needed to qualify for a mortgage depends on your chosen loan product. A conventional mortgage requires a FICO score of 640 or higher, while a government-backed loan such as VA or USDA requires a 620 or higher score. However, many lenders offer mortgages to borrowers with scores below the minimum credit score requirement. A good rule of thumb is to apply for a mortgage or submit your loan application when your score is around 680 or above.

What are the Eligibility Requirements?

To qualify for a home loan, you must meet certain requirements. These include:

- Your income needs to be high enough to cover the monthly payments.

- You must have a steady source of income.

- You must have adequate insurance coverage for the property.

- It would be best if you did not owe back taxes.

- You must live in the house for at least three years before selling it.

What are Home loans for borrowers with bad credit scores?

Home loans for borrowers with a bad credit scores can be harder to obtain, but they are available through various lenders. These loans typically come with higher interest rates and stricter loan terms to compensate for the increased risk to the lender. Some options for borrowers with bad credit include government-backed loans like FHA, VA, and USDA or working with specialized lenders catering to those with less-than-perfect credit. Shopping around and comparing loan offers is essential to find the best terms and rates for your unique financial situation.

Bad credit home loans are mortgages for which the borrower needs better credit history. The lender may require higher down payments, longer terms, or other conditions. If you want to apply for a loan, check out all options available, especially if you are among the Bad credit borrowers.

What are the tips to boost your chances of mortgage approval?

If you want to buy a home, you should start preparing early, including obtaining a Mortgage preapproval. You want to take advantage of the perfect opportunity because you didn’t plan. Here are some things you can do to help ensure that you get approved for a mortgage:

- Research the type of mortgage you qualify for, such as conventional or FHA loans.

- Please ensure you are attractive to lenders as applicants with credit scores that meet their requirements.

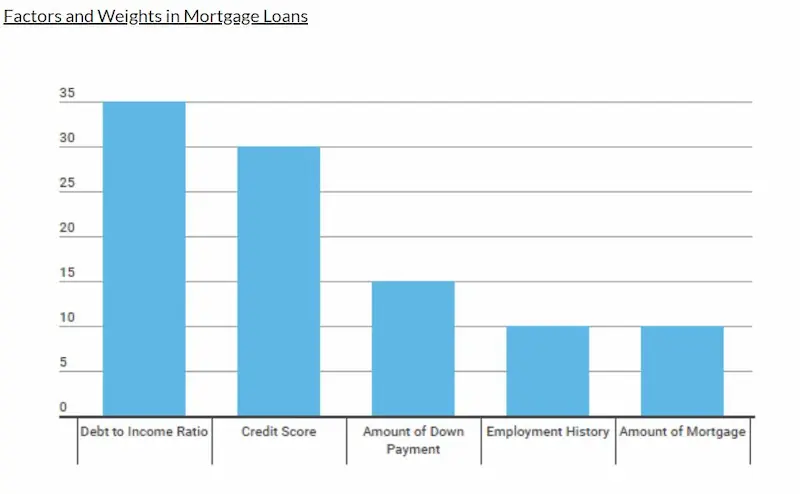

- Understand that the Loan decision could depend on several factors, such as your debt-to-income ratio, loan-to-value ratio, and employment history.

By being proactive and following these tips, you can increase your chances of securing the mortgage you need to purchase the home of your dreams.

- Start building your credit history now. This includes paying your bills on time and establishing a solid credit history. Be aware of the credit score minimums for each mortgage type when planning.

- Get pre-approved for a mortgage. This gives you an idea of how much money you can borrow. Explore various types of mortgages to determine the best option for your financial situation.

- Get a copy of your credit report from one of the major credit reporting agencies. Make sure that everything looks accurate.

- Apply online for a mortgage through an online application. Many lenders offer their services online. You can compare different products and find the one right by completing an online form.

- Be sure to apply for a mortgage before the last minute. This means that you won’t have time to make changes if necessary.

Should you get a mortgage or increase your credit score first?

The answer depends on how much money you need for your down payment and closing costs. If you’re buying a home, you should start with a mortgage. However, it would help if you first focused on increasing your monthly income to build up your credit score. This way, when you apply for a loan, you can show lenders that you’ve been responsible with your finances.

Can I get a loan with bad credit?

Yes! Several types of loans will allow you to purchase a home despite bad credit. They include options for borrowers with credit scores below the minimum score required by traditional lenders. These loans may have a simpler loan process and could be more forgiving of an average credit score that is lower than ideal.

- A home equity line of credit (HELOC) allows you to tap into your existing home equity by borrowing against it.

- Fixed-rate mortgage – This loan offers a fixed interest rate for a period.

- An adjustable-rate mortgage (ARM) – This type of loan adjusts its interest rate periodically based on market rates.

- FHA Loan – This loan program was created to help low-income families afford homes. It provides lower down payments and better credit scores than most other programs.

- VA Mortgage – This loan is offered to veterans who served our country. It also offers lower down payments and better financing than most other programs.

How do you get bad credit?

You might not think about this, but there are many reasons why someone could have bad credit. Some common causes include:

- Late payments

In some cases, private lenders can offer loans to borrowers that are tailored to their specific needs and financial situations, even providing options for borrowers without credit scores.

- Too many open accounts

Requesting loan details from multiple sources, like traditional banks or private lenders, can help you decide which option is best.

- Credit card debt

- A bankruptcy

- Repossessions

Private lenders are more inclined to work with high-risk borrowers and may provide more flexible terms and options than traditional banks.

Where to find bad credit mortgage loan lenders?

There are plenty of companies that specialize in providing bad credit mortgage loans. These lenders work closely with borrowers to provide the best possible deal. They understand what it takes to qualify for a loan and know exactly what information they need to see. When you contact these lenders, they’ll ask you questions like:

- Your income

- Your employment status

- Your assets

- Your debts

- Your Reputation Score

They’ll also examine your credit report to determine whether you meet their minimum requirement and loan type criteria.

Are you searching for a bad credit mortgage loan but worried about your approval chances? Look no further! Our company is proud to offer guaranteed approval on mortgage loans, even for individuals with less-than-perfect credit scores. We understand that financial hardships can happen to anyone, and we believe in providing opportunities for homeownership to as many individuals as possible. To simplify the process, we have expanded our services across several states throughout the United States. Below, you’ll find a comprehensive table listing all the American states where our company actively assists with bad credit mortgage loans. Take a look and discover if your state is among those where we can help you achieve your homeownership dreams.

| Alabama – AL | Alaska – AK | Arizona – AZ | Arkansas – AR |

| California – CA | Colorado – CO | Connecticut – CT | Delaware – DE |

| District Of Columbia – DC | Florida – FL | Georgia – GA | Hawaii – HI |

| Idaho – ID | Illinois – IL | Indiana – IN | Iowa – IA |

| Kansas – KS | Kentucky – KY | Louisiana – LA | Maine – ME |

| Maryland – MD | Massachusetts – MA | Michigan – MI | Minnesota – MN |

| Mississippi – MS | Missouri – MO | Montana – MT | Nebraska – NE |

| Nevada – NV | New Hampshire – NH | New Jersey – NJ | New Mexico – NM |

| New York – NY | North Carolina – NC | North Dakota – ND | Ohio – OH |

| Oklahoma – OK | Oregon – OR | Pennsylvania – PA | Rhode Island – RI |

| South Carolina – SC | South Dakota – SD | Tennessee – TN | Texas – TX |

| Utah – UT | Vermont – VT | Virginia – VA | Washington – WA |

| West Virginia – WV | Wisconsin – WI | Wyoming – WY |

Here are some statistics on bad credit mortgage loans

| Statistic | Value |

|---|---|

| Percentage of Americans with bad credit | 11% |

| Percentage of Americans with bad credit who own a home | 4% |

| Average interest rate for a bad credit mortgage loan | 5% |

| Average down payment required for a bad credit mortgage loan | 20% |

| Maximum loan amount available for a bad credit mortgage loan | $300,000 |

| Maximum term available for a bad credit mortgage loan | 30 years |

| Average borrower pays in interest over the life of a bad credit mortgage loan | $100,000 |

What happens after you get approved for a mortgage?

Once you’ve received approval for one of their approved loans, you’ll receive a letter stating that you’ve been accepted for a loan with a specific maximum loan amount. The lender will send you all the paperwork needed to complete the transaction. Once you sign the documents, you’ll close on selling your current property and move into your new home.

You can refinance your mortgage if you don’t have enough cash to pay off your old house. Refinancing lets you take out more money from your original mortgage. To start the process, you should fill out the loan request form. This will help you contact active lenders offering favorable terms and affordable rates. Remember that an application fee might be involved in refinancing your mortgage. To learn more about refinancing, visit our guide here.

Frequently Asked Questions

What is a bad credit mortgage loan, and how does it differ from a traditional mortgage?

A bad credit mortgage is a home loan for borrowers with credit scores below 620. These mortgages differ by requiring higher down payments around 10-20%, more documentation of income/assets, and higher interest rates and fees versus traditional mortgages. Approval is based more on debt-to-income ratios, assets, and equity rather than just credit scores.

Is it really possible to get guaranteed approval for a mortgage with bad credit, and what are the requirements?

True guaranteed approval for any mortgage is rare, even with bad credit. Approval is highly likely for bad credit mortgages through specific lenders by meeting requirements like: substantial down payment (10-20%), good debt-to-income ratios, multiple years of steady income and employment, significant liquid assets and cash reserves, and equity and collateral in the home. Strong applications can achieve high-likelihood approvals.

While approval is never 100% guaranteed, following the above tips maximizes your odds of getting approved for a $1000 bad credit loan. The more requirements you can meet, the better your chances.

What steps can I take to improve my chances of getting pre-approved for a bad credit mortgage loan?

Pay down current debts, maintain timely payments on all accounts, keep credit card balances low, avoid new credit inquiries before applying, build savings for a larger down payment, obtain recent tax returns and bank statements documenting stable income, acquire supporting assets/reserves to offset bad credit, and research lenders specializing in bad credit mortgages to apply with.

Are there specific lenders or financial institutions that specialize in offering bad credit mortgage loans with guaranteed approval?

Some lenders specializing in high-approval bad credit mortgages are Churchill Mortgage, Americor Mortgage, Home Point Financial, American Financial Resources, Flagstar Bank, and loanDepot’s mello smartloan. They provide customized home loan programs for borrowers with credit challenges that feature flexible requirements while still meeting Freddie Mac and Fannie Mae standards.

What are the potential downsides or risks associated with bad credit mortgage loans, and how can I mitigate them while seeking pre-approval?

Downsides of bad credit mortgage loans include higher interest rates, larger down payments required, more fees, and difficulty refinancing. You can mitigate risks by comparing multiple lender rates/terms, providing as much documentation of income as possible, making a substantial down payment to get better rates, and asking about refinancing options and timeframes upfront.