Payday Loan Consolidation & Relief in Texas

Payday loan consolidation & relief in Texas allows borrowers to combine several payday loans into one single loan, such as personal loans. The single loan has more manageable monthly payments with a payment plan. These include federal student loan debt, payday loans, and payday consolidation loans.

It helps borrowers to improve their credit scores and get out of the debt cycle of high-interest debt. Payday loan consolidation & relief companies in Texas work with borrowers to create a debt management program. The Payday debt consolidation loan application plan lowers the total interest and fees paid on the loans. Furthermore, the monthly payment plan helps borrowers to pay off their payday loans faster and with less financial strain.

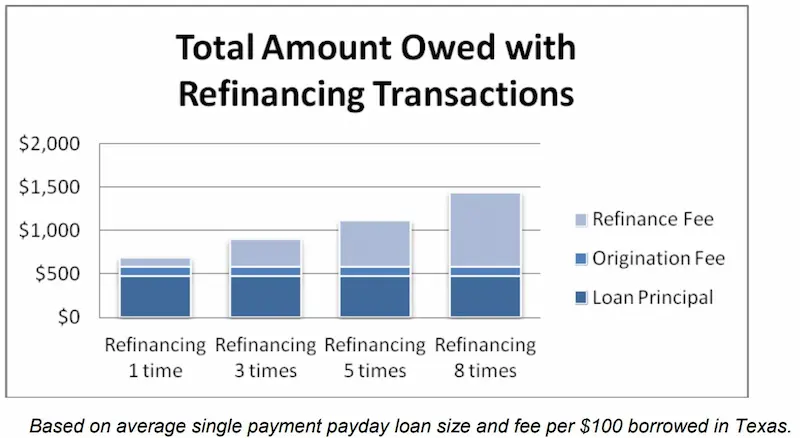

Some companies offer relief services for other types of unsecured debt. These include federal student loans, auto, installment, and credit card debt. Alternative loan options and loan debt consolidation programs are also available. Debt consolidation loan lenders work with lenders to lower interest rates or reduce the total debt payments owed. The payday loan cycle no longer traps borrowers. Texas boasts 1,675 payday lenders at retail, with more than $1.2 billion in fees. There is a solution to the problem for Texas residents struggling with several payday loans and household debt. Debt consolidation companies can help by providing a payday loan consolidation loan that simplifies the loan payments.

Texas Payday Loans

Bad credit cash loans are short-term loans offered by payday loan creditors to people who need same-day payday loan. These loans range from small, usually around $100, to larger ones, up to $1,500. The loan term is typically 2-4 weeks. They are often sought-after by individuals with bad credit scores experiencing financial troubles. Most of them need help to get traditional forms of credit. They are a temporary solution for unexpected expenses and help to avoid late payments. They are due on the borrower’s next payday. However, these loans often have high-interest rates and fees, leading to short-term loan debt. It makes them a costly option for borrowers.

It’s essential to consider BBB-accredited payday loan companies as they follow a specific set of ethical standards, ensuring some level of protection for borrowers. Remember, though, that regulations on payday loans differ across various states and jurisdictions.

The following are the payday loan statistics in Texas:

- Number of payday lenders: 1,675

- Payday lenders per thousand: 834

- Maximum Loan Amount: None

- Outstanding Debt: Various, depending on the borrower and lender

- Repayment periods: Typically 2-4 weeks

- Average Loan Amount: $460

- Maximum Loan Term: 180 Days

- APR Cap: None

- Average 14-Payday Loan APR: 41%

- Collect Fees: 5% of the payment or $7.50 depending on which is higher

- Poverty rate: 15.9% (2015)

- Interest rates

- Texas Office of Consumer Credit Commissioner is the regulator.

Texas Debt Consolidation Options

A consolidation loan is an option for many borrowers stuck with high-interest loans. Payday loan consolidation is sometimes called credit consolidation or payday loan relief. Debt relief options are available through various debt consolidation services offered by a debt consolidation company. Payday loan consolidation has changed the lives of thousands of Texans. It’s something that payday loan defaulters must look into. There are two types of payday loan debt solutions: payday relief programs provided by payday loan relief companies and payday consolidation loan services offered by a debt consolidation company. These options can provide borrowers with better access to cash and help them manage their financial situation.

Credit counseling involves working with a credit counselor to create a budget and plan to pay off debt. It includes negotiating with creditors to reduce interest rates and monthly payments. A debt management plan involves making one monthly payment to a credit counseling agency. It, in turn, pays off the payday loan debt assistance borrower’s debts to creditors. It often includes reduced interest rates and waived fees.

Here are statistics on Payday Loan Consolidation in Texas:

| Statistic | Value |

|---|---|

| Legal Status | Legal |

| Number of Lenders | Over 100 |

| Average Interest Rate | 291% APR |

| Average Repayment Term | 36 months |

| Total Amount Taken Out Annually | $1 billion |

| Risks | High interest rates, long repayment terms, risk of default |

| Alternatives | Personal loans, credit cards, government assistance programs |

Another option is debt settlement. It involves negotiating with creditors to pay off a portion of the debt rather than the full amount. Debt settlement companies can help with this process. It harms credit scores if borrowers do not follow it. Texas payday loan relief programs involve working with a debt relief company to help understand the different loans owed. They handle all the paperwork and negotiate terms with payday loan lenders. They aim to lower the payday loan borrower’s existing loans. They deal with payday collectors and close the bank account from the auto draft. A debt relief program can effectively manage debt and find relief from high-interest loans.

In addition to debt settlement, other debt relief services may be available, such as a debt settlement program designed to negotiate with creditors on your behalf. A loan debt consolidation company may offer assistance with consolidating multiple loans into a single, more manageable payment. It can help borrowers reduce the overall amount they are paying in interest and achieve financial stability more quickly.

At our company, we are committed to providing effective solutions for individuals seeking relief from the burdens of payday loans in the Lone Star State. Our comprehensive payday loan consolidation services have enabled countless Texans to regain control over their financial situations and pave the way towards a brighter future. With our expertise and dedication, we have established a strong presence across several key cities in Texas, catering to individuals in need of assistance. The following table showcases the major cities where our company is actively empowering individuals through our payday loan consolidation services.

| Houston | San Antonio | Dallas |

| Austin | Fort Worth | El Paso |

| Arlington | Corpus Christi | Plano |

| Lubbock | Laredo | Irving |

| Garland | Frisco | McKinney |

Texas Payday Loan Assistance: Payday Loan Help

It’s crucial to take action if you are a Texan struggling with the stress and struggle of a cash advance. Payday loan borrowers need national payday loan consolidation help to regain financial stability. It is in the form of either a legitimate payday loan consolidation loan, official payday loan consolidation programs, or legal payday loan consolidation services. These solutions provide relief from payday loans, manage medical debt, and make the whole process smoother with payday loan debt settlement options.

Frequently Asked Questions

What are the options for payday loan consolidation in Texas?

In Texas, you can consolidate multiple payday loans through a debt management program, taking out an installment loan, borrowing from friends/family, or taking a bank loan. Consolidating reduces fees and interest.

How does payday loan relief work in the state of Texas?

Texas has no specific payday loan relief laws. Borrowers can negotiate an extended payment plan, debt management program, or bankruptcy to relieve payday loan debt. Non-profits also assist with financial counseling.

Are there specific laws and regulations regarding payday loan consolidation in Texas?

No, Texas does not have specific laws regarding payday loan consolidation. Payday lenders are regulated under the Texas Finance Code but consolidation is not addressed. Borrowers must follow generic debt consolidation regulations.

What are the benefits of consolidating payday loans in Texas?

Benefits include lower interest rates, single monthly payment, improved credit score, debt management assistance, and avoiding aggressive collections. It brings short-term high-interest debt under control.

Can I consolidate payday loans from multiple lenders in Texas?

Yes, Texas borrowers can consolidate payday loans from different lenders through a debt management program, debt consolidation loan, borrowing from family, or a personal bank loan. All unsecured debts can be combined.