When in tough circumstances, you will need a loan with bad credit. A personal emergency loan for financial emergencies can give you the cash; however, if you have bad credit, you may wonder if you are eligible for bad credit emergency loans.

Yes, you can qualify for an emergency loan bad credit even if you have bad credit. However, your options could be restricted.

If you have poor credit scores, paying a significant loan amount in interest rates is common, so it’s essential to shop around to reduce your expenses.

Optional Emergency Loan for people with Poor Credit

If you’ve seen some unexpected expenses arise and you need cash fast, plenty of lenders are willing to lend you money.

In reality, getting a loan secured by bad credit can be slightly more difficult due to the potential risks for lenders. Research shows that those with bad or low credit scores are likelier to fail than those with good ones.

To assist you in starting your research, below are a few alternative loans suitable for bad credit loans. These include types of emergency loans for urgent needs.

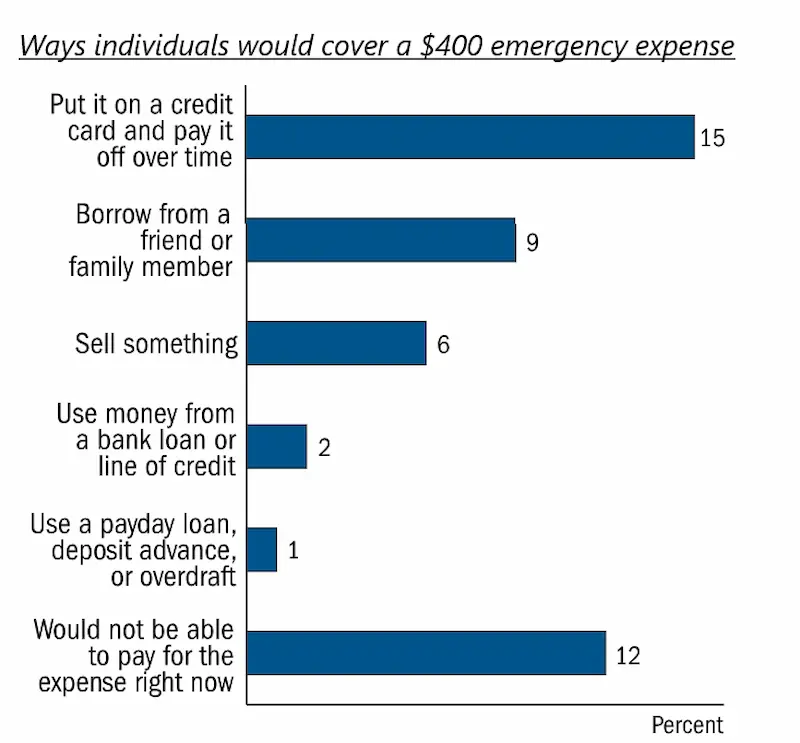

For those who are currently unemployed but need emergency funds, some potential options include borrowing from family or friends, pawning personal items of value, credit cards if you still have available credit, payday alternative loans from credit unions, and hardship assistance from non-profit organizations. However, unemployed borrowers will have very limited loan choices, so it is important to exhaust other alternatives before taking on high-interest debt that will be challenging to repay without stable income.

Online Lenders

Some lenders manage all their operations online. Since they don’t have the overhead expenses of having branch locations, they can typically offer more access to personal loans for bad credit than traditional banks. Many of these emergency loan lenders can also serve as emergency loan provider with a quick approval process.

However, the repayment terms and interest rates differ greatly between online lenders, and some even charge an annual percentage rate (APRs) of three digits for their short-term loans. It’s crucial to compare the options for emergency loans and the rate for emergency loans before deciding.

To avoid these costly costs, Green Day Online will show you rate offers from various lenders that could be a good fit depending on your minimum credit score requirement. Explore emergency loan options and find loans for emergencies that meet your needs.

Finding financial support during challenging times can be crucial, especially when you have bad credit. At Green Day Online, we understand the urgency of such situations and are dedicated to assisting needy individuals. Our emergency loan services are available in various states across the United States, providing a lifeline to those who require immediate financial assistance. To help you determine if you reside in one of the areas we serve, please refer to the table below, which lists all the American states where our company is actively offering our services.

| Alabama | Alaska | Arizona |

| Arkansas | California | Colorado |

| Connecticut | Delaware | District Of Columbia |

| Florida | Georgia | Hawaii |

| Idaho | Illinois | Indiana |

| Iowa | Kansas | Kentucky |

| Louisiana | Maine | Maryland |

| Massachusetts | Michigan | Minnesota |

| Mississippi | Missouri | Montana |

| Nebraska | Nevada | New Hampshire |

| New Jersey | New Mexico | New York |

| North Carolina | North Dakota | Ohio |

| Oklahoma | Oregon | Pennsylvania |

| Rhode Island | South Carolina | South Dakota |

| Tennessee | Texas | Utah |

| Vermont | Virginia | Washington |

| West Virginia | Wisconsin | Wyoming |

Unions Credit Unions

Credit unions are not-for-profit institutions that are owned through their membership. Therefore, instead of increasing profits for shareholders of third parties, they use their profits to offer lower interest rates and fees for their members. These institutions often have a minimum income requirement for their members, but they also cater to borrowers with credit scores that may not be ideal.

The payday-alternative loans are one consequence of this agreement. The secured loans or bad credit loans are available from $200 to $1,000, with a repayment term ranging from 1 month to 6 months. These loans typically have some of the lowest rates available to consumers.

By federal regulations, the maximum interest rate that a credit union can set is 28% which can be lower than other options.

There is a caveat that some credit unions do not offer unsecured loan for paydays, and you must be a member of financial institutions that provides them for at least one month before you can apply.

Various loan offers cater to emergency expenses, but a well-informed loan application process is essential to choose the right one. That’s why the credit union is not a good option for borrowers with urgent costs like emergency expenses unless you’re already an active member of one which offers this kind of bad credit loan. If you’re already a member in that situation, it could make a huge difference in dollars.

Lending Circles

A lending circle might be a viable option if you have an organization that is a non-profit or community group in your local area that has these.

Lending circles can also be a great alternative to handle emergency expenses. This type of lending operates by gathering a group of between six and 12 individuals who alternately receive loans for bad credit from one another and then pay them back each month. The interest rates are usually meager or even zero.

According to the business, the monthly payments may be reported to National credit report organizations (Green Day Online, TransUnion, Credit Union, and Equifax). It will help you build credit the same way you would get with a traditional loan, bad credit personal loan, secured loan, or unsecured loan.

The only downside is that being involved in a lending circle takes time. Also, it’s not a guarantee that you’ll be the first to get loan funds, which isn’t enough for immediate requirements. It may be the most affordable option if you can time it correctly.

Emergency Cash Loans and Urgent Loans

For those needing quick financial assistance, emergency cash loans and urgent loans can be viable options. These loans typically have a simpler online application process, allowing borrowers to secure funds quickly. While these loans can help in a pinch, consider the potential consequences of missed or late loan payments.

Here are some statistics on Optional Emergency Loan for people with Poor Credit:

| Statistic | Value |

|---|---|

| Average interest rate | 36% |

| Average fee | $350 |

| Average repayment term | 6 months |

| Default rate | 20% |

Credit Card Cash Advance

A cash advance on your credit card is an option if you have a bank account that permits it, but it shouldn’t be the primary item you consider.

If you want to request emergency personal cash advances, take the card to an ATM or a bank branch to determine the amount you need and then provide your PIN. This can also be referred to as an emergency payday loan.

The cost of cash advances is often high. Unlike regular purchases using your credit card, there is no grace period. Therefore, the interest begins accruing right away. This type of loan can be expensive if not managed well.

Cash advance Annual Percentage Rate (APR) can be greater than those for purchases. Cash advances are typically charged a fee of at least 5% of the amount you advance.

A final thing to remember: The cash advance limits could be significantly less than your card’s spend limit. You can check your online account or your latest statement or contact the number printed on the back of the card to discover the limit you have set.

In addition, there are no fixed terms for repayment period with credit cards, which means should you not be careful, you may end up with excessive interest for a long time. It’s essential to consider the repayment period and plan to repay the cash advance as soon as possible.

However, a credit card cash advance might be better if the only option is triple-digit APRs for an individual loan (or payday loans).

It’s important to note that credit cards with $2000 limit guaranteed approval may not always be the best option for a cash advance. While cash advance APRs can be higher than purchase APRs and may include fees up to 5% of the advanced amount, a credit card cash advance could still be a better alternative to triple-digit APRs associated with individual or payday loans. Just be aware that cash advance limits may be significantly lower than your card’s spending limit, and there are no fixed loan terms for repayment, so be cautious to avoid excessive interest charges over time. Additionally, consider your payment history and potential approval rates when deciding on the best option for obtaining loan funding.

Cash Advances for Payday Loans

Payday loans have a hefty interest rate–you will likely see to pay around 400% or more. Additionally, they generally require full repayment within a couple of weeks. Staying clear of cash advances when in financial trouble is generally recommended.

Payday loans are comparable to loans that are same day with high-interest rates. In most instances, you’ll have alternative alternatives that are less expensive and come with better repayment terms. Learn more about same-day loans to discover the options.

How to Prepare for Emergencies: Poor Credit Loans

When faced with emergency costs, exploring alternative options that cater to people with credit scores varying from good to poor is essential. These alternatives are ideal for emergency loans, as they provide a more affordable solution than payday or same-day loans.

Loan decision timeframes vary among lenders, but some options may offer fast approvals, granting loans to borrowers even with lower credit scores when they need it the most. So, it’s always wise to explore these opportunities to find the best solutions during emergencies.

If you have bad credit, finding a lender that will approve you for a loan can be challenging. However, bad credit cards guaranteed approval no deposit may be an option for people with bad credit to consider. Despite the guaranteed bad credit loans, carefully weigh the fees and interest rates. A loan agreement should be reviewed thoroughly, and the approval process must be understood. Planning and building an emergency fund can also help you avoid the need for loans in the first place and ensure quick approval when needed.

The idea of taking on debt each time an unexpected expense arises isn’t the best, but at times it’s the only option. When you’ve chosen the best solution for your needs, plan to pay back the loan as fast as possible. Be sure to fully understand the loan agreement before committing. Take some time to plan for the possibility of events.

It’s impossible to determine when an incident will occur again, so the earlier you begin the process, the more effective it will be.

The best way to prepare for unexpected expenses is to create emergency savings account. You can do this using an existing savings account, and certain banks may allow you to establish an account that is not mixed in with other funds you’ve saved to fund the future.

When you’ve got the account, you should set the goal of putting aside the business day amount you need each month. This may not be much based on your budget, but even a small saving can mean a huge difference if you require it. During the application process, you may find promotional offers or tools to help you track your savings progress.

Suppose you have space in your budget to reduce certain discretionary expenses. In that case, it might be worthwhile to do so for a short period until you have a security net covering living expenses and other major expenses. This way, you can avoid late payments in case of emergencies.

These funds can be used if you are fired, get into medical bills, or require repairs for your home or car.

Credit Building Can Also Help You Prepare

When creating your emergency savings account, figure out what you must take to improve your bad credit score. Begin by examining your rating and credit history to see the state of your credit and what areas require attention. Major credit bureaus

For instance, if you’re behind on certain accounts, Ensure you catch up as fast as possible and make payments on time going forward.

If your debts with credit cards are excessive, try to pay them off. If you’ve made an application for lots of credit lately, you should consider taking breaks.

When you’ve taken this and many other ways to build your credit and minimum credit score, you’ll have greater options should you ever require money to cover an emergency or anything else.

Frequently Asked Questions

What are the options for getting an emergency loan when you have bad credit?

Options include payday alternative loans from credit unions, bad credit personal loans, borrowing from family or friends, using low-rate credit cards, or nonprofit assistance.

Can you qualify for an emergency loan with bad credit, and if so, what are the requirements?

You can qualify but will pay higher rates. Lenders review income, debts, and credit history. Minimum scores around 500-600 are often needed.

Are there any specific tips or strategies for improving your chances of securing an emergency loan with a low credit score?

Enlist a cosigner, provide collateral if possible, show steady income that covers living expenses and minimum payments, and minimize other recent loan inquiries.

What are the potential risks and pitfalls to be aware of when seeking an emergency loan with bad credit?

Be aware of very high interest rates and aggressive collections for nonpayment. Only borrow what you can realistically repay to avoid further credit damage.