Hardship loans are personal loans with more advantageous terms, such as faster funding, cheaper interest rates, and postponed payments in many circumstances. They offer various loan options to cater to borrowers’ needs during tough times.

They’re especially beneficial to borrowers in difficult times, as is the COVID-19 epidemic. Some financial institutions have even gone so far as to provide coronavirus financial hardship loan programs designed to assist families in keeping up with essential and crucial line items like rent, electricity bills, and credit card balances.

It might be tough to qualify for a hardship or a traditional personal loan if you’re going through financial difficulty, whether due to the pandemic, unemployment, or another unforeseen incident. However, you may have a few options and alternatives to help you get by in a pinch, such as utilizing the hardship loan proceeds when needed.

The fundamentals of a hardship loan

To be considered for a hardship loan, applicants must meet specific eligibility criteria set by the lender. These criteria may include proof of financial stress and explaining how you plan to use the funds to overcome the hardships. They ensure that only those needing assistance can benefit from these favorable loan terms.

Before COVID-19, there was no such thing as a personal loan designed particularly for persons in need. Plus, receiving a loan while unemployed has always been tricky since most lenders want proof of income to ensure that the debt can be repaid.

However, several financial institutions have offered coronavirus hardship loans with more favorable conditions in recent months and years, such as speedier funding and payment deferral. Focus Federal Credit Union, for example, marketed three-year hardship loans for up to $1000 in January 2023, with a 2.75 percent interest rate and a 90-day grace period.

Community banks and credit unions are the most common lenders of these hardship loans, which are defined by:

- Small sums of money

- Interest rates are at historic lows.

- Short repayment terms

- Deferred payments

While national internet lenders don’t need to market coronavirus hardship loans directly, it’s worth checking whether your current bank or credit union provides them. If you still need to, you might always take out a traditional personal loan to cover your expenses. Expect the same characteristics, such as low APRs and initial deferments, absent. Also, consider looking into personal loan lenders specifically catering to your needs.

What are the most prevalent uses for hardship loans (and personal loans)?

- Basic living expenses such as housing, food, and transportation

- Bills for essential costs such as healthcare

- Unexpected expenses that could not be anticipated or avoided

- There are four hardship loans to consider, including bad credit hardship loans.

Although not technically hardship loans, you can utilize the following four forms of personal loans in small sums to help you move beyond financial difficulties. Depending on your needs, these loans are available from various personal loan lenders.

- Loans for people with bad credit

Unsecured personal loans don’t require collateral, and lenders evaluate your financial profile, including your credit score, to establish your eligibility and interest rate. On the other hand, some personal loan providers cater to consumers with bad credit. Many online lenders offer a range of financial products designed for people with bad credit scores.

One caveat: Emergency personal loans might be a pricey borrowing alternative if you have terrible credit. Because your credit history significantly influences your APR, bad-credit applicants may only be eligible for personal loans with high APRs. A high APR indicates a costly loan because APRs are an annualized indicator of a loan’s cost.

- Personal loans with collateral

Personal loans are generally unsecured. However, secured loans may be an alternative for borrowers who don’t qualify for unsecured loans. You may use a car or money in a savings account or CD to get a personal loan. It may be simpler to be eligible for a secured personal loan but bear in mind that if you don’t repay, the lender may take your collateral. One important factor to consider when taking out a personal loan is the monthly payments.

Borrowers in financial distress and want a loan may need more funds in their savings accounts to serve as collateral. Some lenders may also require a minimum credit score to qualify for their installment loans, impacting the repayment period.

- Personal loans are taken out jointly (or with a cosigner).

Borrowers with subprime credit who have a credit-worthy spouse or family member may choose to explore a combined personal loan. If you enlist the support of a co-borrower, it may be easier to apply for a personal loan with a lower APR. It can help you manage monthly payments and ensure a smoother repayment period.

When you take out a joint personal loan, the debt is shared by both persons who sign the loan agreement. Because both borrowers would suffer the risks of failing on a joint loan, including the possibility of a financial crisis, you’ll want to select someone you can trust to make loan payments on time.

Consider personal loans with a cosigner if you have a creditworthy individual prepared to assist you in qualifying for a loan rather than directly and immediately returning it. Your cosigner will be legally accountable if you don’t make your payments, which could lead to a financial crisis for them as well.

- Personal loans from credit unions

Credit unions are not-for-profit, member-owned financial entities, unlike traditional banks and Internet lenders. Long-term members of credit unions may be more ready to take out loans, even if their credit is subprime, as they are more likely to make their payments on time and avoid a financial crisis.

Consider these other options for payday loans: Payday alternative loans (PALs) are available through federal credit unions: These small-dollar loans range in value from $1000 to $2,000, with a maximum APR of 28 percent and repayment terms of one to twelve months. The National Credit Union Administration (NCUA) regulates these loans, so check with your local credit union branch to see if they’re available.

In times of unexpected financial challenges, our company is committed to supporting individuals and families across the United States. We understand that emergencies can arise without warning, causing financial hardships that require immediate attention. With that in mind, we have expanded our services to numerous states nationwide, ensuring those in need can access the financial assistance they require. The table below outlines the American states where our company is active, offering emergency hardship loans to help individuals navigate difficult circumstances and regain stability. Please refer to the table to see if your state is among them, as we strive to be there for you during financial distress.

| AL / Alabama | AK / Alaska | AZ / Arizona |

| AR / Arkansas | CA / California | CO / Colorado |

| CT / Connecticut | DE / Delaware | DC / District Of Columbia |

| FL / Florida | GA / Georgia | HI / Hawaii |

| ID / Idaho | IL / Illinois | IN / Indiana |

| IA / Iowa | KS / Kansas | KY / Kentucky |

| LA / Louisiana | ME / Maine | MD / Maryland |

| MA / Massachusetts | MI / Michigan | MN / Minnesota |

| MS / Mississippi | MO / Missouri | MT / Montana |

| NE / Nebraska | NV / Nevada | NH / New Hampshire |

| NJ / New Jersey | NM / New Mexico | NY / New York |

| NC / North Carolina | ND / North Dakota | OH / Ohio |

| OK / Oklahoma | OR / Oregon | PA / Pennsylvania |

| RI / Rhode Island | SC / South Carolina | SD / South Dakota |

| TN / Tennessee | TX / Texas | UT / Utah |

| VT / Vermont | VA / Virginia | WA / Washington |

| WV / West Virginia | WI / Wisconsin | WY / Wyoming |

How to Obtain a Hardship Loan

Different types of hardship loans are available to cater to various emergency expenses. Applying for hardship loans may follow the same steps as applying for standard personal loans, depending on the lender. Before approaching payday lenders, consider alternatives to avoid high-interest rates and fees.

- Examine your credit report.

Your credit score and report are the first signs of your capacity to repay debt. However, if your present misfortune has impacted your credit or income, lenders of hardship loans may be ready to consider your banking history. While some lenders may have more lenient requirements, it’s essential to understand how your credit may affect the loan application process.

- Speak with many lenders to get pre-qualified.

Speaking with multiple lenders can help you find the best rates, terms, and loan amounts for your specific needs. Remember that some payday lenders are notorious for charging extremely high-interest rates and excessive fees. Therefore, exploring various lending options can save you money and make repaying your loan easier in the long run.

Prequalification for hardship loans is only sometimes feasible, but the most respectable personal loan providers do. You’ll be able to validate your eligibility and get pricing quotations without worrying about your poor credit.

- Examine your lending options.

Before picking a lender, you should have at least a few bids to compare. Though APRs are significant, they go beyond rates and fees to ensure that the hardship loan meets your demands, including dealing with a financial emergency. Ensure to review the loan documents to make an informed decision thoroughly.

- Submit a formal application to your desired lender.

Once you’ve decided on a lender, you’ll need to verify your information and submit it to a hard credit inquiry, which may lower your credit score briefly. Please keep the prequalification approval you received.

- Sign the final paperwork.

You’re only a few signatures from getting your money and starting repayment. Ascertain that you have a strategy to meet your monthly obligations so that the loan funds can assist you in overcoming adversity without negatively impacting your credit record. Check the maximum loan amounts available, and opt for quick funding to cover unexpected costs.

| Statistic | Value |

|---|---|

| Average interest rate | 15% |

| Average term | 36 months |

| Default rate | About 20% |

| Pros | Can help you cover unexpected expenses, may have lower interest rates than credit cards, may have more flexible repayment terms than other loans. |

| Cons | Can be expensive, may be difficult to repay, can damage your credit score. |

There are several alternatives to taking out a hardship loan.

A personal loan is sometimes a choice if you need money to get by during financial trouble. Here are some alternative options for getting financial assistance when you need it:

- Programs to help people in financial distress offered by banks

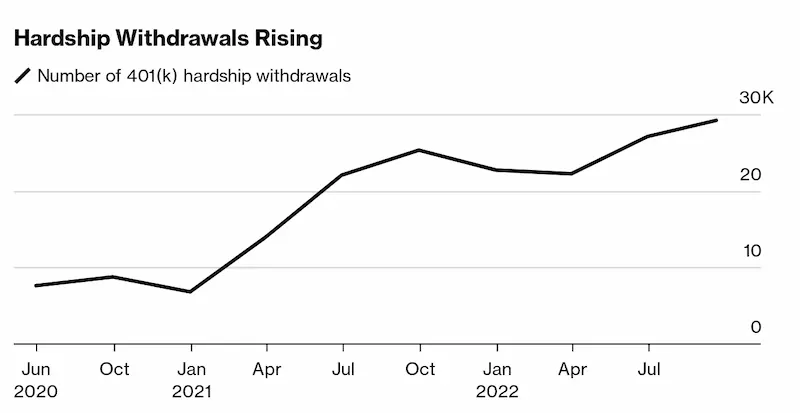

- Hardship withdrawals from a 401(k)

- Apps for getting a payday loan online

- A home equity loan or a home equity line of credit

Apply for assistance from your bank or credit union.

Several financial institutions provide services for clients enduring financial hardship, such as loan forbearance and fee exemptions. If you qualify for an emergency assistance program, you may be eligible for aid with your mortgage, personal loan, vehicle loan, or credit card payments.

Contact your financial institution for assistance if you’re having problems making loan payments or keeping up with your credit card debt due to medical expenses or other unforeseen circumstances. Forbearance on credit cards might be a suitable short-term option. Emergency medical situations might also be a suitable reason to apply for aid.

Consider taking a 401(k) hardship distribution.

If you qualify for a 401(k) hardship withdrawal, you can access the assets in your retirement account. The following are examples of qualifying circumstances:

- Medical expenses for you, your spouse, or dependents

- Preventing foreclosure on or eviction from your primary residence

- Paying college tuition or related educational expenses

- Funeral expenses for a family member

- Paying off prepayment penalties on a loan

- Satisfying an income ratio requirement for a loan or mortgage.

Remember that tapping into your 401(k) should be considered a last resort, as it could significantly impact your retirement savings.

- Healthcare costs

- Expenses for the funeral expenses

- Tuition and room and board are examples of educational expenditures.

- Expenses incurred in the purchase or restoration of a home (excluding mortgage payments)

- Expenses associated with avoiding eviction or foreclosure

The amount you can withdraw is usually limited to the amount required to cover the cost.

You are not required to refund the withdrawal, but you may lose the funds from your retirement account. In addition, if you’re under 59, you may be subject to income taxes and a 10% early withdrawal penalty.

Install a payday advance app on your phone.

A paycheck advance app can be a good option if you’re working and need a little cash to tide you over until your next paycheck. Earnin, for example, allows you to access money from your forthcoming paycheck depending on the number of hours you’ve already worked. Many apps offer same-day or business-day funding, which can help you cover urgent funeral expenses.

Most paycheck advance applications are free and don’t need a credit check; however, some charge a monthly fee or ask for a voluntary tip. Limitations may apply depending on where you bank and work.

Paycheck advance applications should only be a last option rather than regular ones.

If you have to borrow money before being paid, it might indicate that your budget needs to be adjusted.

A home equity loan or a home equity line of credit

If you’re a homeowner, you may be able to use the equity you’ve built up in your house to help you get out of debt. A home equity loan or line of credit would provide an infusion of cash but at the risk of re-mortgage the house.

Closing expenses and the possibility of losing your house if you can’t make payments down the road are the drawbacks of this type of financing.

Frequently Asked Questions

What are emergency hardship loans, and how do they differ from regular personal loans?

Emergency hardship loans provide immediate funds for essential expenses during a financial crisis. They differ from regular personal loans by factoring in the borrower’s situation versus just credit scores, offering expedited approval and funding, having higher interest rates, smaller loan amounts, faster repayment terms, and flexibility if more time is needed.

What are the eligibility criteria for obtaining an emergency hardship loan?

Common eligibility criteria for emergency hardship loans include proof of temporary income disruption due to a qualifying emergency, steady employment and income history prior to hardship, valid ID, Social Security number, contact information, bank account ownership, one personal reference, and supporting documentation verifying the emergency such as medical bills.

Can you provide more details about the four options for financial help mentioned in the article?

The four options are 1) Emergency assistance loans from non-profits 2) Paycheck advance services and apps 3) Negotiating bills and alternative repayment schedules 4) Crowdfunding through sites like GoFundMe. Each has specific requirements but provides quick access to funds during hardship if eligibility criteria is met. Consulting a financial advisor can help identify the most suitable option.

What documentation or proof of hardship is typically required when applying for these loans?

Typical proof of hardship includes pay stubs prior to income disruption, letter of unemployment from employer, bank statements showing income changes, past-due utility and medical bills, eviction or foreclosure notices, proof of unexpected expenses like car repair invoices, doctor’s notes for medical emergencies, and police reports for applicable crises.

Are there any risks or drawbacks associated with taking out emergency hardship loans, and how can they be mitigated?

Risks include high interest rates, short repayment terms, falling further behind if unable to repay quickly, and eligibility fraud. Mitigation strategies include reviewing all terms before accepting funds, borrowing only essential amounts, creating a repayment budget, communicating with lenders if more time is needed, and providing valid documentation to avoid fraud charges.