Is it Worth It to Apply for the Aspire Credit Card?

Aspire Credit Card is a type of credit card offered by Aspire Financial Services. It is used for various purchases and applied online through a credit card application. It has a range of features and benefits. These include rewards programs and cashback options. Card charges, interest rates, and fees may vary. Credit rating and income requirements may apply for credit approval. Unsecured credit cards like the Aspire Credit Card are for persons with a poor credit profile.

Benefits of Aspire’s Credit Card

Aspire Credit Card, issued by American Express, offers various benefits to cardholders, but you must consider potential drawbacks such as high-interest rate and card charges. Aspire’s Credit Card advantages are the same as other credit cards. It has no annual fees and is designed explicitly for people with poor credit. It needs to be clarified how much credit limit you need. However, according to their conditions, they forbid raising credit limitations. The borrowers only get what they are entitled to.

It has a top-tier hotel credit card feature, the Hilton Diamond status for the card’s life. One of the main perks of this luxury credit card is earning Hilton Honors points with every purchase. Borrowers redeem the points for free nights at hotel chains like Hilton properties and other rewards. These include flights, car rentals, and merchandise. Cardholders enjoy premium perks at Hilton properties, including free room upgrades, hotel night stays, and hotel breakfasts.

Another valuable benefit of the Aspire Credit Card is the access to exclusive events and experiences. They are achievable through the American Express Invites program. Cardholders enjoy a $250 annual travel credit, known as the Hilton resort statement credit. People use the top-tier hotel credit card toward eligible purchases at any Hilton resort with this top-tier hotel credit card.

The Hilton Honors American Express Aspire Card benefits frequent Hilton guests and those who value premium travel perks like travel rewards credit cards. They enjoy an annual airline fee credit, a $100 property credit on stays of two or more nights at select properties, and a complimentary weekend night reward after spending $60,000 on the card in a calendar year. It offers premium travel protections such as baggage insurance and travel accident insurance.

The main benefit is the kind of product it is an unsecured credit card. It doesn’t require an enormous security deposit provided by credit card issuer. Secured credit cards work like unsecured cards because the borrower makes money but leaves the residue untouched. The borrower’s deposit amount serves as their cap, which is “secured” by the deposits. When using the Aspire Credit Card, avoid making deposits as it’s a product from credit card companies that doesn’t require them. Furthermore, they often come with additional benefits such as a Priority Pass for lounge access and avoiding extra charges on your travels, making the most of the annual airline fee credit provided.

The following are some other highlights of the Aspire Credit Card and the inclusions of their membership.

- Complimentary breakfast

- Chase Ultimate Rewards Hotel Credit

- Weekend night awards

- Hilton Surpass Card

- Gift cards

- Eligible airline free credit

- Airport lounge access

- Beverage credits

Aspire Credit Card Fees

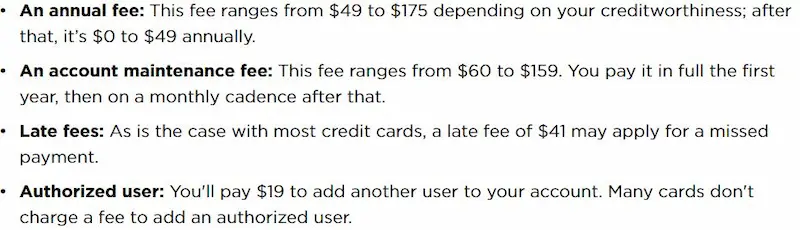

The Aspire Credit Card’s fee structure includes service fees, which may vary depending on the card issuer. The card offers benefits such as airline credit and the highly sought-after elite status. The comprehensive list of fees is available on the card issuer’s official website.

The Hilton Aspire Card has substantial fees. It adheres to its overarching agreement with the cardholder. Expect to pay between $0 and $175 in annual fee card fees the first year, then between $49 and $175 afterward. What causes the large credit ranges needs to be made clear. However, it’s because of the cardholder’s credit status.

Moreover, a maintenance fee of $60 and $159 per year. A cardholder monthly cost of up to $12.50 is applicable after the first year. Pay the equivalent of $25 for the year to have someone else use it as the authorized user when obtaining an additional Card.

How does this compare with other credit cards with no security?

Let’s quickly examine the Credit One Bank Platinum Visa for Credit Rebuilding.

The fee increases to $99 annually from $75 annually after the first year. The fees for the Aspire Credit Card are greater than usual. It is more costly with a more expensive top-of-the-range. I love it. A Credit One Card costs twice as much when paying $175. The approval odds might vary as the credit limit is subject to the business day approval process. Various service providers might offer different conditions to cardholders, which can impact the overall costs and benefits of owning such a card.

Better Methods to build credit

Building credit is quite easy with the Aspire Credit Card. However, there are better or, at the very least, more reasonably priced alternatives. One important factor in building credit is to have a good credit report. Borrowers must research Chime Credit Builder, a business credit card that uses the Chime account. There are no charges. It is less expensive than other credit cards, such as the Aspire Credit Card, and helps you understand the different types of credit scores. It gives your information to the three credit bureaus and helps improve credit scores lenders look for.

Borrowers can choose the Extra Debit Card connected to their current checking account. It figures out how much credit the lender will grant. The Card is a cost-effective substitute for the Aspire Credit Card because it has no fees and can be used for everyday purchases such as at gas stations to earn cash back reward points.

Is Aspire Credit Card Worth it?

Yes, the Aspire Credit Card is worth it. It costs only marginally more than the borrower’s choices or is not qualified for. The Card’s primary advantage is that it helps build credit over time by paying for an account as long as people use it responsibly. However, there are better options, such as a $0-annual-fee credit card. People must browse the possibilities to find out when they can get a more secure credit card with possibly lower application fee credit.

There are many choices; borrowers can look for the same credit card at a lower price. Another option to consider is pre-approval for a credit card, which can help assess whether you’ll get approval without affecting your credit score. It helps to develop credit when considering accepting a contract after receiving one. Aspire Credit Card is in good working order.

Use the Aspire Credit Card outside of the exorbitant fees. Using features such as detailed card statements, a user-friendly mobile app, and earning rewards for every eligible dollar spent can help manage your account better. A high earning rate on rewards can also add value to the credit card.

The $0-annual-fee credit card Initial Credit Limit is displayed on the card carrier when authorizing an Account. You can find the Current Credit Limit on the bill or provide it anytime. Lenders must consent to requests for increased credit limits. It has a 3% initial balance transfer fee and no yearly fee. Subsequent balance transfers might cost up to 5% (see terms). Enjoy the first months of card membership without any worries. There is no reason to have resort credit card debt. Other credit cards provide far richer rewards, such as Cash prices, restaurant credits, annual credits, Average rewards, and Bonus travel rewards.

How is the Customer Service and Support for Aspire Credit Card?

The customer service and support for Aspire Credit Card are generally efficient. Aspire cardholders reach customer support through phone, email, and live chat channels. They access their account information and manage their account online. Additionally, many customers have reported that the customer service representatives are knowledgeable. They help address their concerns. Some have even noted that the customer service team resolves issues quickly and to the customer’s satisfaction.

How to Apply for Aspire Credit Card

Aspire Credit Card is a premium credit card offering users various benefits and rewards. The first step to applying for an Aspire Credit Card is checking eligibility through pre-approval. The card is for individuals with good to excellent credit scores. Applicants must provide basic personal and financial information to the issuer, which includes income and credit history.

Borrowers can use their $0-annual-fee credit card for eligible purchases once approved, earning rewards rates and Hilton Honors points on all purchases with the card. They can use it to redeem free nights, flights, and more. With dollar match promotions, users can amplify their earned points.

This card also comes with tons of statement credits and incidental fee credits which users can benefit from. Moreover, cardholders can attain a higher tier status within the Hilton Honors program as they spend and accumulate points, thus enjoying even more benefits and rewards.

Here are some statistics on the Aspire Credit Card

| Statistic | Value |

|---|---|

| Annual fee | $0 |

| APR | 22.74% – 36% |

| Interest-free period | 25 days |

| Rewards | 3% cash back on gas, groceries, and utilities; 1% cash back on all other purchases |

| Sign-up bonus | $200 after you spend $1,000 in the first 3 months |

| Minimum credit score requirement | 620 |

Frequently Asked Questions

What are the key benefits of the Aspire Credit Card, and do they outweigh the annual fees?

The key benefits of the Aspire Card are airport lounge access, travel and shopping rewards, airline and hotel fee credits, no foreign transaction fees, concierge service, and travel insurance. For frequent travelers, these perks can outweigh the $450 annual fee. But non-frequent travelers are unlikely to reap enough rewards to offset the steep fee.

How does the rewards program of the Aspire Credit Card compare to other credit cards in the market?

The Aspire Card offers 3x points per dollar on airfare and hotel stays versus 2-5x with other premium travel cards. Its points can yield valuable redemptions, especially for Hilton stays. However, cards like the Platinum Card from American Express and Chase Sapphire Reserve provide similar or greater point multipliers and redemption flexibility.

What is the minimum credit score required to be eligible for the Aspire Credit Card, and is it worth improving my credit score to apply?

The minimum credit score to be approved for the Aspire Card is around 700. It could be worth improving your score from fair (630-689) to good (690-719) if you will utilize the $250 annual airline fee credit, airport lounge access and other elite travel benefits to offset the high annual fee. But improving to apply is only beneficial for frequent travelers.

Are there any hidden fees or terms and conditions that I should be aware of before applying for the Aspire Credit Card?

Key terms to know include a $450 annual fee, 2.7% foreign transaction fee, APRs from 15.74% variable and penalty APR of 29.99%. There are no hidden fees, but the airline credit only applies to one airline selected annually and lounge visits are limited to 10 per year. Read all terms carefully to ensure the card aligns to your spending habits and travel frequency.

What are the additional perks or features that come with the Aspire Credit Card, and do they justify the card’s costs?

Besides lounge access and credits, the Aspire Card includes a free weekend night reward annually, concierge service, travel insurance protections, and complimentary Hilton Honors Diamond status. For a very frequent Hilton traveler who will use the perks, the benefits could justify the $450 fee. But for infrequent or budget travelers, the high costs likely outweigh the add-ons.