Financial struggles are an all-too-common problem in today’s economy. Many people need a quick cash infusion to cover unexpected expenses such as car repairs or medical bills. People without traditional sources of income, like full-time employment, are finding it hard to get approved for a short-term loans since many lenders require borrowers to present income verification.

Certain lenders understand that not everyone has a steady income from a 9-5 job and have developed alternative ways of verifying income to approve loan applications. But options are available for people seeking payday loans with no income verification. This type of loan specifically caters to situations where traditional income verification is impossible. A popular alternative is an emergency loan which can be obtained through an online lending platform. The following article explores how borrowers obtain a payday loan without income verification and what steps they need to take to guarantee their successful application.

Summary

- Payday loans are short-term, high-interest online loans used by individuals who need quick access to cash and cannot wait until their next paycheck. They are usually obtained online or through storefront lenders and have significant risks.

- Eligibility criteria for payday loans include being at least 18 years old, having a regular source of income, an active bank account, and a valid government-issued ID.

- Borrowers who can’t present income verification are still eligible for payday loans, but certain lenders offer online loans without requiring income verification, albeit with higher interest rates and fees.

- Borrowers must research potential lenders that do not require income verification or accept alternative sources of income, check state regulations, gather necessary documents, complete the loan application, and review loan terms with flexible repayment options.

- A co-signer with a good credit score and stable income helps borrowers get a payday loan approval without income verification by providing added security for the lender and flexible repayment options.

- Alternatives to payday loans include credit union loans, personal loans, and borrowing from friends or family, with lower interest rates, fees, and more flexible repayment options.

What Is A Payday Loan?

A payday loan is a short-term, high-interest loan that must be repaid within two weeks to a month. It is designed for individuals who need quick access to cash and cannot wait until their next paycheck. Payday loans are used by people with bad credit scores or who have difficulty obtaining traditional loans.

Payday loans seem like a simple solution to financial problems, but they have significant risks and must only be used as a last resort option. Payday loans usually require little documentation and are obtained through an online application process or through storefront lenders. The high-interest rates associated with payday loans quickly lead to debt traps, making it difficult for borrowers to repay the full amount on time.

Who Qualifies For A Payday Loan?

The eligibility criteria for payday loans vary depending on the direct lender and the state regulations. Unlike credit check loans, these loans are more accessible to those with poor financial histories. But many of them require the same thing. Listed below are the general qualifications for a payday loan.

- Age – The borrower must be 18 or older to qualify for a payday loan.

- Income – The borrower must have a regular source of income, such as a job or government benefits. Lenders need proof of income to see if the borrower can repay the loan on time. However, some lenders may offer a loan without proof or income verification loans for those with an alternative form of income or a stable employment history.

- Bank account – The borrower must have an active bank account where loan funds are deposited, and repayment is withdrawn.

- Identification – The borrower must have a valid government-issued ID, such as a driver’s license or passport.

Borrowers who can’t present an income verification or have an alternative monthly income are still eligible for payday loans. But it depends on the lender and the state regulations. Certain lenders offer payday loans without requiring income verification. But such loans usually have higher interest rates and fees than usual to offset the increased risk to the lender.

How To Get A Payday Loan Without Income Verification

Borrowers must follow the lender’s application process when applying for a payday loan without income verification. Each lender has specific requirements and procedures for loan applications, and following the lender’s instructions helps guarantee a smoother loan process. Borrowers must carefully review the lender’s application requirements and provide all necessary information and documentation to complete the loan request accurately. Loan agreements are essential in securing financial assistance through a loan program. By adhering to the terms and conditions of the loan agreements, borrowers can receive the needed support on time.

- Research potential lenders. Borrowers must research potential lenders that do not require income verification or accept alternative sources of income, such as government benefits or pension payments. Look for secured loans offered by traditional lenders that cater to loans to people with alternative income sources. It is necessary to verify the lender’s reputation and credentials by checking online reviews, requesting referrals from friends or family, and reviewing their website and customer service policies. Ensure they offer competitive interest rates and reasonable origination fees.

- Check state regulations. Payday lending regulations vary from state to state, and borrowers must check their state regulations to ensure that lenders can offer loans without income verification. Certain states prohibit payday lending altogether, while others limit the loan amount, interest rates, or the fees lenders charge. Borrowers must verify that the lender is licensed to operate in their state and comply with all applicable state and federal laws.

- Gather necessary documents. Certain lenders do not require income verification, but borrowers must provide other documents to prove their identity, address, and bank account information. The required documents include a valid government-issued ID, proof of address, and a recent bank statement or voided check. Borrowers must be prepared to provide any added information or documentation requested by the lender.

- Complete the loan application. Borrowers must fill out the loan application and provide the required documentation. Borrowers must be honest and accurate when completing the application and guarantee that all information provided is up-to-date and correct. Other lenders perform a credit check or other types of verification to assess the borrower’s ability to repay the loan.

- Review loan terms. Borrowers must carefully review the loan terms, including the interest rate, fees, repayment period, and any penalties for late or missed payments. Borrowers need to understand the loan terms and the total cost of borrowing, including all fees and interest charges. They must review the lender’s loan renewal policies, extensions, and other applicable terms and conditions.

At GreenDayOnline, we understand that financial emergencies can arise unexpectedly, leaving individuals needing immediate assistance. We are committed to providing accessible solutions to help customers bridge the gap between paychecks. Our company is proud to offer payday loans with no income verification in several American states, ensuring that individuals facing temporary financial constraints can access the support they need quickly and conveniently. Below is a comprehensive list of the states where we operate, providing our reliable and hassle-free payday loan services. Please refer to the table below to find out if we are active in your state and how we can assist you during times of financial urgency.

| Alabama / AL | Alaska / AK | Arizona / AZ |

| Arkansas / AR | California / CA | Colorado / CO |

| Connecticut / CT | Delaware / DE | District Of Columbia / DC |

| Florida / FL | Georgia / GA | Hawaii / HI |

| Idaho / ID | Illinois / IL | Indiana / IN |

| Iowa / IA | Kansas / KS | Kentucky / KY |

| Louisiana / LA | Maine / ME | Maryland / MD |

| Massachusetts / MA | Michigan / MI | Minnesota / MN |

| Mississippi / MS | Missouri / MO | Montana / MT |

| Nebraska / NE | Nevada / NV | New Hampshire / NH |

| New Jersey / NJ | New Mexico / NM | New York / NY |

| North Carolina / NC | North Dakota / ND | Ohio / OH |

| Oklahoma / OK | Oregon / OR | Pennsylvania / PA |

| Rhode Island / RI | South Carolina / SC | South Dakota / SD |

| Tennessee / TN | Texas / TX | Utah / UT |

| Vermont / VT | Virginia / VA | Washington / WA |

| West Virginia / WV | Wisconsin / WI | Wyoming / WY |

Get A Co-Signer

A co-signer helps a borrower with bad credit get a payday loan approval without income verification by providing added security for the lender. Lenders require income verification to guarantee that the borrower can repay the loan. But they deem the loan too risky and deny the application if the borrower does not have a regular income or has poor credit histories.

A co-signer with a good credit score and stable income help mitigate the lender’s risk by agreeing to take joint responsibility for the loan. The co-signers income and creditworthiness are considered when the lender reviews the loan application, increasing the chances of approval. The co-signer agrees to make the monthly payment if the borrower cannot, reducing the risk to the lender. Thus, finding a reputable lender is crucial for both the borrower and co-signer, making sure they make informed financial decisions.

Alternatives To Payday Loans

Not all borrowers can find payday lenders who approve loans without income verification or accept alternative sources of income. Borrowers must explore alternative options to meet their financial needs in such cases. Several payday loan alternatives, such as credit union loans, personal loans, and borrowing from friends or family, are available. Certain alternatives have lower interest rates, fees, and more flexible repayment terms, but borrowers must review the terms and conditions carefully before accepting any loan offer. Unemployment benefits and social security may also help to address immediate financial needs.

Credit Union Loans

Credit union loans are a payday loan alternative available to borrowers who cannot find payday lenders that offer loans without income verification. Credit unions are not-for-profit financial institutions owned by their members and offer lower interest rates, fees, and more flexible repayment terms than traditional payday lenders. Personal loan lenders can also provide a valuable alternative, especially for those receiving unemployment benefits or social security as their primary source of income.

Borrowers must become credit union members, which requires meeting certain eligibility criteria, such as living or working in a certain geographic area or being affiliated with a specific organization to obtain a credit union loan. Only credit union members can apply for a loan and must provide proof of income, credit history, and other documentation. Credit union loans offer lower interest rates and fees than payday loans but have stricter eligibility criteria and longer processing times.

Personal Loans

Personal loans, including title loans and bad credit loan options, provide borrowers with more flexible access to funds when compared to traditional credit union loans. These loans can be tailored to meet individual needs and do not require membership to a specific organization. However, borrowers should be aware that interest rates and fees may be higher than those offered by credit unions.

Personal loans are another alternative to payday loans that borrowers must assess if they cannot find lenders that offer a range of loan options without income verification. Personal loans are unsecured loans that banks, credit unions, and online lenders offer. They offer higher loan amounts, longer repayment periods, and competitive rates compared to payday loans. The average personal loan interest rate is 10.82%, according to Bankrate.

During a typical business day, you can apply for a personal loan through various platforms and receive funds within as little as one day. It is essential to plan your loan payments wisely to avoid penalties and maintain a good credit score. Many lenders offer flexible payment options allowing borrowers to make payments directly from their bank accounts or even using credit cards. As a borrower, always compare the available options and choose a loan that best suits your needs and financial situation.

| Scenario | Loan Amount | Repayment Period | Interest Rate | Total Interest | Total Repayment |

|---|---|---|---|---|---|

| A | $2,500 | 24 months | 10.82% | $611.21 | $3,111.21 |

| B | $5,000 | 36 months | 9.5% | $1,168.93 | $6,168.93 |

| C | $10,000 | 48 months | 8% | $2,336.31 | $12,336.31 |

- Scenario A – A borrower takes out a personal loan of $2,500 with a 24-month repayment period and an interest rate of 10.82%. The total interest paid over the life of the loan is $611.21, and the total repayment amount is $3,111.21. This scenario may help to cover an emergency expense.

- Scenario B – A borrower takes out a personal loan of $5,000 with a 36-month repayment period and an interest rate of 9.5%. The total interest paid over the life of the loan is $1,168.93, and the total repayment amount is $6,168.93. This option could suit someone with a minimum credit score.

- Scenario C – A borrower takes out a personal loan of $10,000 with a 48-month repayment period and an interest rate of 8%. The total interest paid over the life of the loan is $2,336.31, and the total repayment amount is $12,336.31. This alternative can help in cases of late payments or if someone is considering taking an instant loan or a cash advance.

The loan amounts, repayment periods, and interest rates vary, but personal loans offer higher loan amounts, longer repayment periods, and lower interest rates than payday loans. The borrower takes out a personal loan as an alternative to a payday loan in all three scenarios. Medical expenses and financial support for unemployed people can also be covered through personal loans, as they usually cater to a wide range of purposes.

Borrowing From Friends And Family

Borrowing from friends and family is another alternative to payday loans, especially when the person is between jobs or waiting for their next regular paycheck. It offers more flexibility and lower interest rates than payday and other loans. Borrowers can negotiate or discuss the loan terms directly with the lender.

But it is necessary to approach the option cautiously and treat it as a formal financial transaction. Borrowers must discuss the loan terms and repayment schedule with their family and friends and write everything to avoid misunderstandings or conflicts.

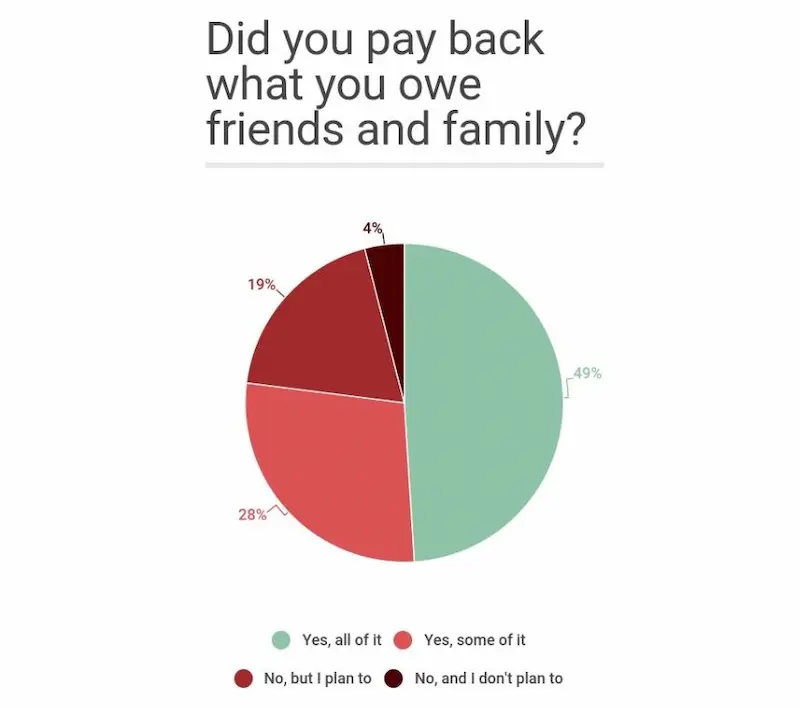

Below are some statistics on borrowing from friends and family:

| Statistic | Value |

|---|---|

| Percentage of Americans who have borrowed money from friends or family in the past year | 20% |

| Average amount borrowed | $2,000 |

| Most common reasons for borrowing | To cover unexpected expenses, such as medical bills or car repairs |

| Percentage of borrowers who repay their loans in full within 6 months | 50% |

| Percentage of borrowers who take more than a year to repay their loans | 20% |

| Pros of borrowing from friends and family | Easy to get approved, no credit check required, may have lower interest rates than other types of loans, can build trust and strengthen relationships |

| Cons of borrowing from friends and family | Can damage relationships if payments are not made on time, may feel awkward asking for money, may not be able to afford to repay the loan, may not be able to get the full amount you need |

Conclusion

Payday loans are a quick solution for individuals needing cash, but they have high-interest rates and significant risks. People who do not have traditional sources of income still qualify for payday loans without income verification. Still, they must research potential lenders, check state regulations, gather necessary documents, and review the loan terms before applying. A co-signer helps mitigate the lender’s risk and increase the chances of approval. But borrowers must explore alternative options if they cannot find a payday lender who accepts their income sources.

Frequently Asked Questions

Is it possible to obtain a payday loan without providing proof of income?

It is generally not possible to obtain a legitimate payday loan without providing some evidence of your income level to determine your ability to repay the loan per underwriting requirements.

What are the alternatives to income verification for securing a payday loan?

There are no recommended alternatives, as payday lenders require income verification to comply with lending laws. Unverified loans should be avoided.

How do lenders determine eligibility for payday loans without income verification?

Reputable payday lenders do not offer loans without income verification. Lenders that do not check income should be avoided, as it signals potentially predatory lending.

Are there specific requirements or qualifications for obtaining a no income verification payday loan?

Payday loans without income verification are risky and not advisable. Genuine lenders will always verify income to determine loan eligibility and avoid predatory lending practices.

What should borrowers consider before applying for a payday loan without income verification?

Borrowers should consider that unverified payday loans are high risk, likely predatory, and could lead to unmanageable debt levels and aggressive collection actions if unable to repay. Income verification is essential.