Payday loans are short-term, high-interest loans with exorbitant fees and interest rates. They are helpful in emergencies but trap borrowers in a cycle of debt in certain cases. There are US states that have made payday loans illegal to protect consumers from predatory lending practices.

It is best for individuals who need quick access to cash to know which states prohibit payday loans in order to avoid falling into debt traps. The following blog post provides an overview of the US states where payday loans are illegal and explores the reasons behind their prohibitions.

Understanding the laws surrounding payday lending in different states allows readers to make informed decisions about their financial options and take steps toward achieving greater financial stability.

Summary

- Payday loans are short-term, high-interest loans with exorbitant fees and interest rates.

- 17 US states prohibit payday loans to protect consumers from predatory lending practices.

- Payday lending is widely criticized for its predatory nature and high-interest rates that trap borrowers into a cycle of debt.

- Payday loans are regulated by both federal and state laws to protect consumers.

- Alternative options to payday loans include credit union loans, personal installment loans, credit card cash advances, local assistance programs, and negotiating with creditors.

The Legal Landscape Of Payday Loans In The Us

The legal landscape of payday loans in the United States varies from state to state. State-by-state analysis reveals that certain states have taken a strong stance against the payday loan industry, while others continue to allow it with varying degrees of regulation. The issue has been the subject of much debate and controversy, with industry lobbying and consumer advocates on the other.

Borrower demographics play a significant role in shaping legislative responses to payday loan usage. Low-income individuals who do not qualify for traditional forms of credit turn to high-interest loans as a last resort.

Studies have shown that borrowers easily become trapped in cycles of debt due to the exorbitant interest rates and fees charged by lenders. There is disagreement about the economic impact of payday lending, with others arguing that it provides necessary access to credit while others claim it exacerbates financial instability among vulnerable populations.

States With Prohibitions On Payday Loans

The prohibition on payday lending varies from state to state, with others having outright banned it while others have placed a cap on interest rates or limited the amount borrowed. There are currently 17 states in the United States where payday loans are illegal. Listed below are the states where payday loans are illegal.

- Arizona

- Arkansas

- Connecticut

- Georgia

- Maryland

- Massachusetts

- New Jersey

- New York

- North Carolina

- Pennsylvania

- Vermont

- West Virginia

- Washington D.C.

The impact of the prohibitions has been mixed. They protect vulnerable borrowers from predatory practices by unscrupulous lenders and reduce instances of indebtedness and financial exploitation within communities.

Enforcement efforts have been weak due to lobbying efforts by the payday loan industry. Studies show that borrower demographics tend to indicate that people who get payday loans are already financially vulnerable and likely to face greater difficulties without this form of credit.

Understanding The Risks Of Payday Loans

Payday lending is widely criticized for its predatory nature and high-interest rates that trap borrowers into a cycle of debt. More than 80% of payday loans are rolled over or renewed within two weeks, according to a report by the Consumer Financial Protection Bureau (CFPB). It leads many borrowers to pay more in fees than they originally borrowed.

The consequences of getting caught in a debt cycle are severe, including damaged credit scores, bank account closures, and even bankruptcy. People who get payday loans lack financial literacy or access to other forms of credit, making them particularly vulnerable to predatory lenders.

It is necessary for individuals getting a payday loan to fully understand the terms and conditions before signing any agreement and explore alternative options such as budgeting assistance programs or small-dollar loans from community banks or credit unions.

Consumer Protection Laws And Regulations

Payday loans are regulated by both federal and state laws to protect consumers from predatory lending practices. Here are the key consumer protection laws and regulations regarding payday loans.

- The Truth in Lending Act (TILA) – Payday lenders must disclose the annual percentage rate (APR) and other fees associated with the loan to borrowers. It guarantees that borrowers have clear information about the true cost of the loan.

- The Military Lending Act (MLA) – Sets a maximum interest rate of 36% for payday loans and other types of loans to active-duty military members and their families.

- State Interest Rate Caps – Many states have laws that cap the interest rates that payday lenders charge.

- State Licensing and Regulation – States require payday lenders to be licensed and regulated. It guarantees that lenders comply with state laws and regulations and protects consumers from predatory practices.

- Payment Plan Requirements – Certain states require payday lenders to offer borrowers the option of an extended payment plan if they are unable to repay the loan on time.

- Prohibition – Other states have outright banned payday loans to protect consumers from high fees and interest rates. The states include Arizona, Arkansas, Connecticut, Georgia, Maryland, Massachusetts, New Jersey, New York, North Carolina, Pennsylvania, Vermont, and West Virginia.

Consumers must know the laws and regulations and carefully assess their options before getting a payday loan. It is best to read the terms and conditions of the loan carefully, understand the interest rates and fees, and explore alternative options.

Alternatives To Payday Loans In Prohibited States

There are still alternative options available for obtaining quick cash for people living in states where payday loans are illegal. Listed below are the common payday loan alternatives.

- Credit union loans – Credit unions offer less expensive loans than payday loans. These loans have longer repayment terms, lower interest rates, and fewer fees.

- Personal installment loans – Personal installment loans allow borrowers to repay their loans in installments over time. They have lower interest rates and longer repayment terms than payday loans.

- Credit card cash advance – Borrowers take a cash advance on their credit card. Choosing this option is expensive, but the interest rates and fees are lower than payday loans.

- Local assistance programs – Certain local assistance programs offer emergency financial assistance to people in need. They provide short-term loans or grants to help cover expenses.

- Negotiating with creditors – Borrowers are free to negotiate with their creditors to work out a payment plan or settlement. Doing so helps them avoid the high fees and interest rates associated with payday loans.

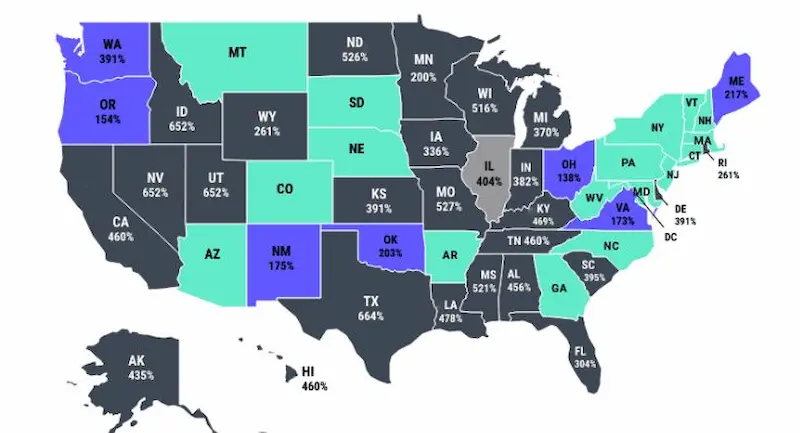

Cost of Payday Loans

Certain lenders charge extremely high-interest rates in states where payday loans are legal. The interest exceeds 400% APR, according to Incharge.org. It means that a borrower ends up paying back significantly more than they borrowed, making it difficult to break the cycle of debt. The high-interest rates associated with payday loans are particularly problematic for low-income borrowers who are already struggling to make ends meet.

| State | Maximum APR Charged by Payday Lenders |

|---|---|

| Alabama | 456% |

| Idaho | 652% |

| Kansas | 391% |

| Louisiana | 391% |

| Nevada | 652% |

| Oklahoma | 390% |

| South Carolina | 459% |

| Texas | 662% |

The table shows that certain lenders charge extremely high-interest rates in states with legal payday loans. The interest rates exceed 400% APR in all the listed states, with certain states charging as high as 662% APR. It highlights the exploitative nature of payday lending and the urgent need for stricter regulations to protect vulnerable borrowers from falling into debt traps.

How To Avoid Expensive Payday Loans?

Borrowers must know that payday loans don’t have to be expensive. Certain lenders charge high fees and interest rates, but there are ways to avoid falling into a cycle of debt. Here are three steps to avoid expensive payday loans.

- Create a budget. Create a budget to see if there are other ways to cover expenses. Try cutting back on non-essential expenses, such as eating out or cable TV, and look for ways to increase income, such as taking on a part-time job or selling unwanted items.

- Explore alternative sources of credit. Check alternative sources of credit, such as credit cards, personal loans, or borrowing from friends or family. They are not ideal, but less expensive than a payday loan.

- Research lenders. Borrowers must research lenders carefully. Look for lenders that offer reasonable interest rates and fees, and avoid the ones that engage in predatory lending practices, such as making loans to people who are unable to repay them or charging excessive fees.

Conclusion

Payday loans seem like a quick solution to financial problems, but they have high-interest rates, fees, and potential debt traps. Seventeen states in the United States have prohibited payday loans due to their predatory nature, with varying degrees of regulation in the states still allowing them.

It is best for borrowers to understand the risks of payday loans and explore alternative options such as credit union loans, personal installment loans, credit card cash advances, local assistance programs, and negotiating with creditors. Understanding consumer protection laws and regulations is necessary to make informed decisions about payday loans.

Frequently Asked Questions

What states in the United States have banned payday loans?

16 states and Washington D.C. have banned payday loans by setting interest rate caps low enough to essentially prohibit them. These states are Arizona, Arkansas, Connecticut, Georgia, Maryland, Massachusetts, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, South Dakota, Vermont, West Virginia.

Are payday loans legal in all 50 U.S. states?

No, payday loans are not legal in all 50 states. Currently 16 states and Washington D.C. prohibit payday lending by capping interest rates on small loans at 36% APR or less. The remaining states either regulate payday loans or have no restrictions on interest rates.

Which states have the strictest regulations on payday lending?

States with the strictest payday loan regulations include Connecticut, Maryland, Massachusetts, New Jersey, New York, Pennsylvania, Vermont, and West Virginia which cap APR at 24-30%. They limit loan amounts and renewals while mandating extended repayment options.

Are there any federal laws regulating payday loans across all states?

There are no federal laws capping interest rates on payday loans. The Military Lending Act caps rates on loans to active military at 36%. The CFPB previously had payday lending regulations, but they were rescinded in 2020. Regulation primarily occurs at the state level.

What alternatives to payday loans are available in states where they are illegal?

Alternatives in states banning payday loans include installment loans, credit union payday alternative loans with lower interest, borrowing from friends/family, credit cards, bank personal loans, employer cash advances, and assistance from nonprofits and charities.