The debate surrounding payday lending has intensified over the years. Critics argue that payday lenders are predatory and exploit vulnerable individuals who are not able to afford high-interest rates. Payday lending supporters assert that payday services provide a necessary societal function by filling gaps left by traditional financial institutions.

Borrowers are able to understand better if payday lending truly provides a valuable service or exploits borrowers in need by examining why individuals turn to payday loans and analyzing the market conditions that allow for their existence. The process discussion is going to shed light on one of the most contentious issues facing modern finance and help us determine how best to address it moving forward.

Who Uses Payday Loans?

Demographic studies reveal that low-income individuals, minorities, and single parents are the most likely to use payday loans. Financial status determines borrowing frequency, as lower-income earners tend to borrow more usually.

People turn to payday loans for various reasons, such as unexpected expenses like medical bills or car repairs, needing more time to get approved for traditional bank loans due to poor credit history, or quick cash.

Many borrowers have negative experiences with payday lending. They complain of high-interest rates and fees and difficulties repaying the loan on time, leading to rollovers that add more costs, resulting in a cycle of debt for many borrowers.

The Pros And Cons Of Payday Loans

Payday loans are able to offer financial support to borrowers who experience emergency cash flow issues and need quick access to funds. They are usually associated with high-interest rates and fees, making them a costly borrowing option.

Borrowers risk becoming trapped in a cycle of debt due to the short repayment period. Payday loans, on the other hand, are able to provide a convenient and secure way for borrowers with bad credit to access funds in need.

Pros Of Payday Loans

Payday loans are able to provide quick access to funds that alleviate stress when you face a sudden financial crisis. The process type of loan has become increasingly popular due to its quick approval process, no credit check, and flexible repayment options. There are pros and cons to assess before getting a payday loan.

Listed below are the pros of payday loans.

- Quick approval process

Payday loans usually have a very quick approval process, unlike traditional bank loans. You are able to receive funds within hours of submitting your application, which is a huge advantage when you need money urgently. - No credit check

Most payday lenders do not conduct credit checks, meaning you are still able to apply for a payday loan even if you have poor credit or no credit history. - Flexible repayment plans

Payday lenders commonly offer flexible repayment plans for different income levels and lifestyles. The process makes it easier for borrowers to repay their debt without incurring more charges. - Convenient and accessible

Payday loans are very convenient and accessible. You are able to apply online or in-store, and the process is generally very straightforward. - Helps in building credit

Making timely payments on your payday loan are able to help you build your credit score. The process is because payday lenders usually report to credit bureaus, meaning your responsible borrowing behavior is reflected in your credit report.

Cons Of Payday Loans

Payday loans are short-term loans that provide emergency funding to borrowers in financial distress. Several downsides must be carefully assessed before deciding to get a payday loan, while there are advantages to a payday loan.

Listed below are the cons of payday loans.

- High-interest rates and fees

Payday loans usually have high rates and fees that are able to add up quickly. The process makes it difficult for borrowers to repay their loans and leads to a debt cycle. - Debt cycle

Borrowers are able to easily fall into a debt cycle where they continuously borrow money to pay off previous debts, leading to financial ruin due to the high-interest rates and fees. - Predatory lending practices

Several lenders engage in predatory lending practices by targeting financially vulnerable individuals who are not able to repay their debt on time. The process increases stress and anxiety for borrowers who face aggressive collection tactics or legal action if they default on their loan payments. - Impact on credit score

It is able to positively impact their credit score, making it more difficult to obtain credit in the future if borrowers are able to pay back their payday loans on time. - Limited borrowing amounts

Payday loans commonly offer small borrowing amounts, which must be increased to cover all emergency expenses. The process is able to lead to borrowers getting multiple loans, further exacerbating the debt cycle.

Alternatives To Payday Loans

Credit Unions, as an alternative to payday loans, offer more competitive loan rates and flexible repayment plans. Budgeting Apps allow individuals to track and manage their finances and set up automatic payments for recurring bills. Credit Unions are able to provide a more personalized service to customers than payday lenders. Budgeting Apps are able to help individuals build up an emergency fund to lessen the impact of financial shocks.

Credit Unions

Many individuals are in dire financial situations and are left with no option but to seek payday loans. Payday loans usually have exorbitant interest rates and fees that are able to trap borrowers in a cycle of debt. Credit unions provide an alternative to payday lenders by offering more affordable loan options. Credit unions have many benefits over traditional banks, including lower fees and better interest rates on savings accounts and loans because they are member-owned rather than profit-driven.

Credit unions commonly offer community involvement opportunities, such as volunteering or donating funds to local organizations. They prioritize financial education programs for their members so they are able to make informed decisions about their finances.

- Low fees

- Competitive interest rates

- Community involvement initiatives

- Access to educational resources

- Various loan options tailored toward individual needs

Individuals are able to establish healthy financial habits while building meaningful relationships within their communities by choosing a credit union instead of turning toward high-interest payday loans.

Budgeting Apps

Another alternative to payday loans is the use of budgeting apps. Personal finance has become easier with the help of technology, and numerous budgeting apps are now available to assist individuals in managing their finances effectively. The apps offer various features such as tracking expenses, creating a personalized budget plan, setting financial goals, and providing saving strategies.

They provide users with insightful reports on their spending habits, which are able to lead to better debt management. The budgeting apps promote financial literacy by educating users on managing money wisely through investment tips and other helpful resources.

The convenience of having all the information at one’s fingertips encourages responsible financial behavior and helps people make informed decisions about their finances. They are an excellent option for borrowers who want to control their finances by not using high-interest loans or credit cards. At the same time, budgeting apps are only suitable for some.

Understanding The Risks Of Payday Loans

Many low-income individuals have limited options for borrowing money in real life. The process is where payday lenders come in. They offer short-term loans with quick approval processes for borrowers who need cash fast. Payday loans are able to be incredibly expensive despite their convenience. The true cost of payday loans usually goes beyond the interest rates advertised on their websites or storefronts.

Borrowers only pay more fees if they are able to repay on time or choose to renew their loan. Many fall into a debt cycle that becomes difficult to escape. Such predatory lending practices exploit borrower vulnerability and contribute to financial instability among low-income communities.

Regulation And Consumer Protection Measures

Understanding the risks associated with payday loans highlights the importance of government intervention to address predatory practices and borrower exploitation. They usually come at a high cost, making them unsustainable for many borrowers, while the option short-term loans are able to solve urgent financial needs quickly. The lack of regulation in the industry has led to unethical lending practices that further exacerbate financial instability among vulnerable consumers.

Consumer protection measures are necessary to guarantee loan affordability and promote financial literacy among borrowers. One approach is implementing interest rate caps or limiting the number of loans a borrower is able to obtain within a specific period.

Regulations must require lenders to disclose all fees upfront and assess if borrowers are able to repay their loans without experiencing undue hardship. Providing access to alternative financing options, such as credit unions or microfinance institutions, helps reduce reliance on payday loans.

The issue of payday lending requires significant attention from policymakers and stakeholders alike. Borrower exploitation must be addressed through effective regulations prioritizing consumer welfare while allowing for viable business operations.

Government interventions combined with improved financial education will protect individuals from falling into debt traps and create a more inclusive economy where everyone has equal opportunities for growth and prosperity.

The Costs of Payday Loans versus Other Types of Loans

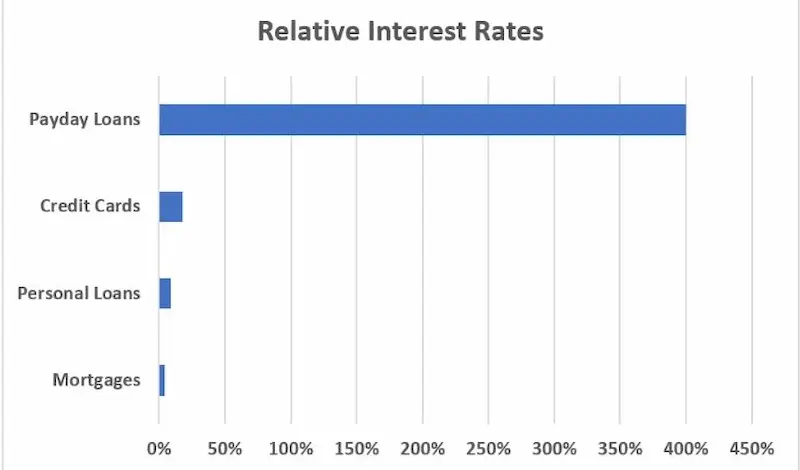

Payday loans are seen as a quick fix for financial emergencies, but they have high-interest rates and fees that are able to trap borrowers in a cycle of debt. The average interest rate on a payday loan is a staggering 391%, according to InCharge, which makes it difficult for borrowers to pay off the loan in full.

| Loan Type | Average Interest Rate | Repayment Term | Maximum Loan Amount |

|---|---|---|---|

| Payday loans | 391%-600% | Two weeks | $1,000 (varies by state) |

| Credit cards | 15%-30% | Varies | $10,000-$100,000 |

| Debt management | 8%-10% | 3-5 years | None Specified |

| Personal loans | 14%-35% | 1-7 years | $100-$100,000 |

| Online lending | 10%-35% | 3 months-5 years | $1,000-$100,000 |

It becomes clear how expensive payday loans are compared to other types of loans. Payday loans have become notorious for their high-interest rates, which reach 600%. Credit cards, debt management programs, personal loans, and online lending have much lower interest rates than payday loans.

Personal loans and online lending offer much larger loan amounts than payday loans. The repayment terms for payday loans are generally only two weeks, while other types offer more flexible repayment options ranging from several months to several years.

The Bottom Line

The rise of payday lenders has been a controversial topic in recent years. Others see them as predatory and taking advantage of vulnerable individuals, while several argue they are filling a need for borrowers with limited options.

Understanding the pros and cons of option loans and the available alternatives is necessary. The risks associated with payday loans must not be ignored. High-interest rates and fees quickly add up, leaving borrowers in even worse financial situations.

Consumers must know about the industry’s potential scams and fraudulent activity. Such cases must be carefully evaluated individually rather than relying solely on the type of borrowing, while there are instances where payday lenders provide a necessary service. Consumers must weigh their options carefully and seek out resources or assistance from reputable sources facing financial difficulties.

Frequently Asked Questions

How do payday lenders operate and what services do they provide?

Payday lenders offer short-term, high-interest loans that are typically due on the borrower’s next payday. They operate through storefront locations and online, providing cash advances secured by the borrower’s paycheck or bank account. Payday loans are intended to provide emergency funds until the next paycheck.

What are the main reasons people turn to payday lenders for loans?

The main reasons people use payday loans are to cover unexpected expenses or bridge a temporary cash shortfall between paychecks or government benefits. Payday loans allow people access to cash quickly without lengthy credit checks. However, the high fees mean they should only be used as a last resort.

What are the typical interest rates and fees associated with payday loans?

Payday loans typically have very high interest rates, often 400% APR or higher. In addition to interest, lenders charge fees upfront for each loan. Combined, fees can be $15-$30 for every $100 borrowed. So a $500 loan can cost over $150 in fees. This makes the cost of short-term lending expensive.

Are there any alternatives to payday loans for individuals facing financial emergencies?

Alternatives include borrowing from family/friends, credit cards, bank personal loans, employer advances, credit union payday alternative loans, or nonprofit organizations that offer low-interest assistance programs. While credit card debt can also be costly, it is preferable to payday loan debt in most cases.

What are the potential risks and consequences of using payday loans as a financial solution?

Risks include getting trapped in a cycle of renewing loans due to inability to repay in full by the due date, resulting in spiraling fees and perpetual debt. Defaulting can mean harassment by lenders, bank overdrafts, or lawsuits. Long-term use correlates with increased financial stress and hardship.