Payday loans are short-term lending that has become increasingly popular in recent years. Borrowers obtain payday loans in Florida from various lenders who offer them to individuals looking for quick access to cash without the need for extensive credit checks and collateral.

There are limits to how much a person must borrow at once and how many loans they must have outstanding at any given time, as with any form of borrowing. Understanding such limitations is necessary for anyone evaluating multiple payday loans or relying on such financing regularly.

GreenDayOnline explores the rules surrounding payday lending in Florida, including how many payday loans you must have at any one time and what factors impact your ability to secure extra funding. Providing clear guidance on such issues enables readers to make informed decisions about their financial future and avoid the pitfalls of excessive debt.

Understanding Payday Loans In Florida

The Deferred Presentment Act regulates payday lenders in Florida, which limits how much lenders must charge for fees and interest. Borrowers must not obtain more than $500 at once and must repay the loan within 31 days, according to the law.

Individuals must meet certain requirements set by the lender to be eligible for a payday loan in Florida. Applicants must provide proof of income or employment and have an active checking account. The application process is quick and easy, as most lenders offer online applications or storefront locations where borrowers apply in person. You must carefully review the terms and conditions before accepting a loan to verify that repayment terms are manageable and affordable.

Consumer protections exist in Florida to prevent predatory lending practices from taking place. Lenders must comply with regulations regarding disclosures of fees, restrictions on rollovers or renewals of loans, and limitations on collection activities if a borrower fails to repay their loan on time.

Such measures protect consumers from falling into debt traps caused by payday loans while allowing access to short-term funding when needed. 20% of payday loan borrowers earn a net income of above $40,000 annually, according to MDRC.

| Characteristics | Percent |

|---|---|

| Borrowers earning a net income above $40,000 per year | 20% |

| Homeowners | 33.3% |

| Borrowers with a four-year college degree or higher | 40% |

| Borrowers current on all loan repayments | 42% |

| Borrowers who paid less than the scheduled amount at least once | 73.3% |

| Borrowers who ever defaulted on a loan | 50% |

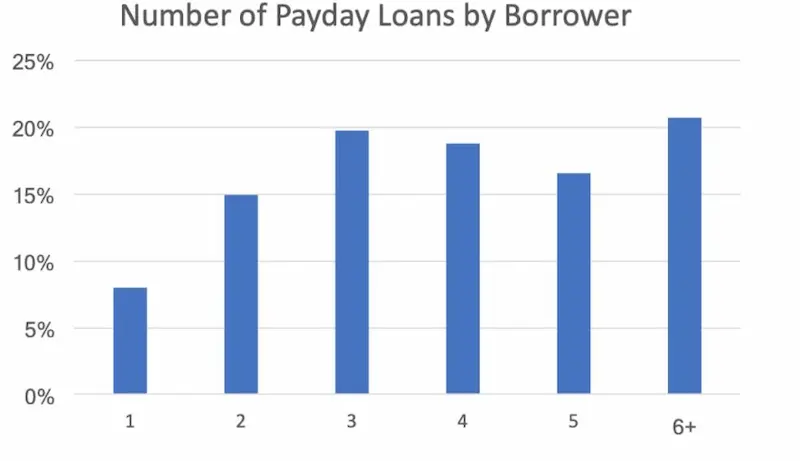

| Respondents who reported rolling over a loan 6 or more times in the previous year | 25% |

| Respondents who had more than one payday loan open simultaneously at least once in their lives | 71% |

One Loan At A Time – Florida’s Limitations

There are restrictions on how many payday loans an individual must borrow once in Florida. The limitations aim to prevent borrowers from becoming trapped in debt cycles they cannot break free from. Florida’s restrictions require that individuals only have one outstanding payday loan at any given time. Lenders must check a statewide database before issuing the loan to verify that the borrower does not already have an active loan with another lender.

Such regulations help protect consumers from obtaining multiple loans and falling into unmanageable debt. Florida’s consumer protection laws provide repayment options, such as installment plans, to borrowers struggling to repay their loans on time. Borrowers who default on their loans face the consequences such as extra fees and even legal action taken against them by the lender or collection agencies.

Payday loans seem like a quick fix for financial difficulties, but Florida’s limitations safeguard against predatory lending practices and overborrowing. Consumers must exercise caution when exploring a payday loan and thoroughly understand their rights regarding repayment options and default consequences under state law. Doing so enables borrowers to make informed decisions on if such financing is right for them without getting caught in a cycle of debt.

Statewide Database Check

Borrowers in Florida must only have one payday loan at a time, but such a rule doesn’t prevent them from obtaining multiple loans from different lenders. Florida established a statewide database that tracks all payday loans issued within the state to address the issue and protect consumers from becoming trapped in debt cycles.

- The statewide database has been in place since 2019 and has received over 5 million inquiries through the system.

- The database verifies that lenders comply with the one-loan-at-a-time rule by allowing them to verify if an applicant already has an outstanding loan.

- The database prevents borrowers from obtaining more than $500 worth of loans in total across different lenders.

- A few lenders have found potential loopholes or ways to work around the system, but they face hefty fines for non-compliance.

- The measure inconveniences a few borrowers who need quick cash but protects consumers from falling deeper into debt.

- Florida’s version is relatively new but has shown promising results compared to other states that use similar databases.

Borrowing Limits And Loan Amounts

Payday loans are quick and convenient for people needing immediate financial assistance. Strict eligibility criteria and regulations vary by state, including borrowing limits and loan amounts. GreenDayOnline focuses on the specific borrowing limits and loan amounts for payday loans in Florida and the factors to review before applying.

Borrowing Limits and Loan Amounts in Florida.

- Maximum Loan Amount – The maximum payday loan one obtains in Florida is $500 per loan.

- Eligibility Criteria. Borrowers must meet specific requirements such as having a steady income source, being 18 years old, and possessing a valid government-issued identification document.

- Repayment Terms – Repayment terms for payday loans in Florida range between seven days to 31 days after receiving the loan.

- Interest Rates – The interest rates on payday loans in Florida are quite high, with an average annual percentage rate (APR) of around 304%.

- Credit Checks – Credit checks are not necessary when applying for a payday loan. Failing to repay the debt negatively impacts the borrower’s credit score.

- Rollover Options – Rollover options are available but usually have fees and interest charges.

Steps to follow when applying for a payday loan.

- Understanding your financial needs. Evaluate how much money you need and if there are any alternative funding sources.

- Exploring repayment options carefully. Verify you fully comprehend the costs of different repayment plans, including early payments.

- Researching lenders. Look into multiple lenders before deciding to get competitive rates and fair practices.

- Reviewing terms & conditions of each lender. Pay close attention to details such as late payment fees or prepayment penalties.

- Evaluating alternatives. Explore all avenues, like family support groups or community organizations that offer financial assistance.

Payday loans are useful for individuals facing financial emergencies in Florida. Thoroughly researching and reviewing all available options enables borrowers to avoid falling into debt traps and negatively impacting their credit scores. Understanding all aspects of payday lending before making a decision is key.

Risks And Alternatives To Payday Loans

Payday loans have high-interest rates, short repayment terms, and a lack of transparency, leading to financial distress. Payday loans have costly fees and penalties if a borrower defaults. Alternatives to payday loans include credit unions, budgeting, and microloans. Credit unions offer lower interest rates and more transparent terms, while budgeting and microloans provide smaller, short-term loans with lower interest rates.

Risks Of Payday Loans

The risks associated with payday loans are numerous, resulting in a never-ending debt cycle. One major issue is the high-interest rates associated with such loans, which exceed 400% APR, making it difficult for borrowers to pay off their debts promptly.

It leads many individuals into a debt trap, where they must continually borrow new loans to cover the costs of previous ones. Predatory lending practices further exacerbate financial instability for people who rely on payday loans.

Many lenders target low-income individuals or people with poor credit histories, taking advantage of their vulnerable situations by offering them quick cash without fully disclosing the terms and conditions of the loan. The result is an endless cycle of borrowing and repayment that leaves borrowers struggling to make ends meet.

Alternatives To Payday Loans

Payday loans provide quick cash but have high-interest rates and strict regulations that vary from state to state. Individuals seek alternatives that provide financial assistance without trapping them in a cycle of debt. Here are a few options to review.

- Personal Loans from Credit Unions or Traditional Lenders – One alternative to payday loans is to explore personal loans from credit unions or traditional lenders. Such loans have lower interest rates and more favorable repayment terms than payday loans. Understand that personal loans require a credit check, and the application process takes longer than a payday loan.

- Credit Counseling Services – Another alternative is to seek guidance from a credit counseling service. Such services offer budgeting tips and help develop a plan for managing debt. Credit counselors are able to negotiate lower interest rates or repayment plans with creditors.

- State Regulations on Payday Lending – Various states have implemented regulations on payday lending practices to protect consumers from predatory behavior. The regulations include interest rate caps, limits on loan amounts, and mandatory repayment plans. It is worth exploring such options before turning to a payday loan if you live in a state with such regulations.

- Debt Consolidation – Debt consolidation is an option if you struggle with multiple sources of high-interest debt. It involves obtaining a single loan to pay off multiple debts, simplifying the repayment process, and lowering interest rates. Debt consolidation loans require collateral, such as a home or car, and failing to make payments results in the loss of your collateral.

Conclusion

Payday loans in Florida are subject to certain limitations and regulations. The state restricts borrowers from obtaining more than one loan at a time while mandating that lenders check a statewide database before issuing new loans or allowing for the rollover of outstanding ones. Responsible borrowing practices help prevent further financial distress down the road.

There are borrowing limits and caps on loan amounts. Payday loans are helpful in times of financial need, but they have significant risks, such as high-interest rates and fees. Individuals must review all alternatives before resorting to such loans.

Frequently Asked Questions

What is the maximum number of payday loans allowed in Florida?

Florida law restricts borrowers to one payday loan at a time from a single lender, with a limit of $500 including fees. Multiple loans from different lenders are permitted.

Are there any restrictions on how many payday loans a person can have at once in Florida?

Yes, Florida law caps payday loans at one per lender with a maximum value of $500, but does not limit the total number from multiple lenders.

Is it possible to have multiple payday loans from different lenders in Florida?

Yes, borrowers can have multiple simultaneous payday loans from different licensed lenders in Florida as there are no restrictions on total number.

Are there any consequences for having multiple payday loans in Florida?

Consequences include difficulty paying back loans leading to rolled over fees, penalty charges, potential default, and damaged credit scores in Florida if unable to repay.

How can I avoid getting trapped in a cycle of payday loans in Florida?

Avoid payday loan debt cycles by borrowing only what you can repay, checking interest rates, and using alternatives like credit cards or payment plans when possible.