A co-signed personal loan with a co-signer is where a borrower with poor credit applies for a loan with the help of a co-signer. A co-signer is someone with good credit and willing to take on some of the financial responsibility for the loan. The co-signer guarantees to the lender that they will repay the loan even if the borrower cannot make the payments on time. Having a co-signer makes getting loan approval easier for someone with bad credit. The lender has less risk and is more willing to approve the loan, increasing the chances of approval.

Credit unions are offering loans with cosigners and cross-agreements.

In addition to banks, credit unions are increasingly offering co-signed personal loans as well. These institutions may provide more flexible loan requirements and better interest rates, making it a viable option for borrowers needing assistance from a co-signer.

A personal loan with a co-signer is where a borrower applies for a loan with the help of a co-signer. The co-signer guarantees the loan, promising to make the loan payments if the borrower fails to do so. People with a limited credit history or poor credit scores often use the loan. The co-signers good credit helps the borrower qualify for a loan and secure a better interest rate. Co-signers are family members, friends, or anyone willing to take on the risk of co-signing the loan. They must have a good credit history. It is because the lender considers their creditworthiness when evaluating the loan application. The co-signer is responsible for the loan payment. Thus, they must understand the terms of the loan and be able to make the payments before agreeing to co-sign.

To qualify for a personal loan with a co-signer, both the borrower and the co-signer must meet certain eligibility requirements set forth by the lender. Some of these requirements include having a stable proof of income and meeting credit score requirements. Sometimes, lenders may offer credit with co-signer options, allowing individuals with lower credit scores or limited credit history to obtain a loan using a co-signer with a stronger credit profile. It improves approval chances and may result in more favorable loan terms. Before opting for credit with co-signer options, it is essential for both parties to discuss and understand their responsibilities and obligations regarding the loan.

Credit unions often offer credit personal loans with co-signers. They are non-profit financial institutions owned and controlled by their members. They have more flexible lending criteria than traditional banks. They are more willing to work with borrowers with poor credit profiles. Another alternative to a personal loan with a co-signer is getting a credit card. Some credit card companies offer credit cards to people with a limited credit history or poor credit rating with the help of a co-signer. It is a good option if borrowers only need a small loan and can make timely payments. Furthermore, personal loan lenders and credit limit flexibility can be found among credit unions, making them an attractive option for those seeking financial assistance.

Taking out a personal loan with a co-signer is risky for both parties. Borrowers must have clear and open communication with their co-signer so they understand the risks they are taking on. Credit unions are an excellent place to start for any personal loan. They have low-interest rates and work with borrowers to make personal loans affordable even with bad credit scores (629 FICO score or lower). Co-signers and co-borrowers are allowed by many large banks and credit unions for unsecured loans. Federal and local banks cannot charge upwards of 18% APR. PNC and Wells Fargo provide joint applications for loans, although few banks enable you to add a guarantor or borrower to your loan. Achieving an excellent credit score would increase your chances of obtaining competitive interest rates on your loan.

Types of loans: What are the Differences Between a Co-signed and a Joint Loan?

Online Co-signed and Joint Loans

Co-signed and joint loans are similar in involving more than one person responsible for the loan. However, there are some key differences between the two. A co-signed loan is when a good credit individual, known as the co-signer, guarantees the loan. The co-signers good credit helps the borrower qualify for the loan and secure a better interest rate. The primary borrower, who has bad credit or limited credit history, applies for the loan through the online co-signed loans process.

Legal Responsibility in Co-signed Loans

The primary borrower is the one who is responsible for making the loan payments. The co-signer becomes accountable for repaying the loan if they fail. It is known as legal responsibility. Both parties need to understand that when using online co-signed loans, they share responsibility for repaying the loan on time.

Credit Requirements for Co-signed Loans

In most cases, the primary borrower with bad credit or limited credit history may need to independently meet the credit requirements. By having a co-signer with good credit, they can increase their chances of getting approved for the loan. The co-signers good credit helps the borrower qualify for the loan and secure a better interest rate while lowering the lender’s risk.

A joint loan is when two or more people apply for a loan together and are both responsible for repaying the loan. The loan is in both names, and the lender considers both borrowers’ credit when evaluating the application process. The other borrower is responsible for repaying the loan if one borrower fails to pay. The main difference between a co-signed and a joint loan is the level of responsibility for the loan repayment. The primary borrower is responsible for repayment, and the co-signer guarantees a co-signed loan.

Furthermore, both borrowers are accountable in a joint loan and have equal liability. They also need to maintain a good payment history to avoid any issues with the loan. The loan proceeds can be used for various purposes, and the lender assesses the borrowers’ eligibility and financial stability during the application process. Keeping a positive payment history is crucial for both borrowers as it directly impacts their credit score and future borrowing ability.

A joint loan is when two people want to apply for a loan together and share the responsibility for repayment. Another difference is that a co-signed loan happens when one person has a bad credit history and needs a potential borrower co-signer to help them qualify for a loan. Borrowers must know that the loan and repayment terms vary depending on the lender and the loan. They must read the terms and conditions of the loan and ensure they understand the risks and obligations.

A Co-signer Can Help

A co-signer is a fantastic choice for people with bad credit. They help potential borrowers obtain a loan they would otherwise be unable to get. The interest rate becomes cheaper. The following are factors that influence the interest rates paid on these loans:

- The credit score of the primary borrower and potential co-signer: The primary borrower’s and potential co-signers credit score plays a vital role in determining the interest rate on these loans. Suppose the primary borrower has bad credit or limited credit history. The potential co-signer’s excellent credit is necessary when determining the interest rate.

- Type of loan: Interest rates on unsecured loans, such as personal loans, tend to be higher than on secured loans, such as car loans or mortgages.

- Soft credit inquiry: Some lenders conduct a soft credit inquiry when evaluating a loan application. The lender checks the primary borrower’s and potential co-signer’s credit without affecting their credit score.

- Repayment history and steady income: Lenders consider the borrowers’ repayment history and their steady income when determining the interest rate. Suppose the primary borrower has a history of making on-time payments and a steady income. They qualify for a lower interest rate. A late payment record, on the other hand, may result in a higher rate.

- Lender’s policies and online application: Different lenders have different policies. Shopping around and comparing rates from other online lenders before applying for a loan is vital. Moreover, many lenders offer an online application process, making applying for different financial products and comparing their features easy.

Borrowers must remember that the interest rate on a loan with a co-signer is not only determined by the credit score of the primary borrower. The credit report of the potential co-signer is also necessary. The lender considers both credit scores when determining the interest rate. A good credit score of the potential co-signer helps the primary borrower qualify for a better rate. Some lenders check the borrower’s debt-to-income ratio. A higher ratio means the borrower uses most of his income to repay debts.

We are pleased to share the comprehensive list of American states where our company is actively providing personal loans with co-signer options, even for individuals with bad credit. We understand that financial difficulties can arise unexpectedly, and securing a loan can be challenging for those with less-than-ideal credit histories. Our commitment to assisting individuals in these situations has led us to extend our services across multiple states, enabling us to provide accessible and inclusive financial solutions. Please refer to the table below for an overview of the states where our services are available, and discover how we can help you overcome your financial obstacles with personalized loan options tailored to your needs.

| Alabama / AL | Alaska / AK | Arizona / AZ | Arkansas / AR |

| California / CA | Colorado / CO | Connecticut / CT | Delaware / DE |

| District Of Columbia / DC | Florida / FL | Georgia / GA | Hawaii / HI |

| Idaho / ID | Illinois / IL | Indiana / IN | Iowa / IA |

| Kansas / KS | Kentucky / KY | Louisiana / LA | Maine / ME |

| Maryland / MD | Massachusetts / MA | Michigan / MI | Minnesota / MN |

| Mississippi / MS | Missouri / MO | Montana / MT | Nebraska / NE |

| Nevada / NV | New Hampshire / NH | New Jersey / NJ | New Mexico / NM |

| New York / NY | North Carolina / NC | North Dakota / ND | Ohio / OH |

| Oklahoma / OK | Oregon / OR | Pennsylvania / PA | Rhode Island / RI |

| South Carolina / SC | South Dakota / SD | Tennessee / TN | Texas / TX |

| Utah / UT | Vermont / VT | Virginia / VA | Washington / WA |

| West Virginia / WV | Wisconsin / WI | Wyoming / WY |

How can a Co-Borrower Help?

A co-borrower is a joint loan that helps borrowers get approved for more favorable loan terms. Having a co-borrower with a good credit score can increase the approval chances and secure the lowest rates available. However, some lenders need borrowers to have minimum credit score requirement. Other online lenders have specific requirements for joint loans with a co-signer.

Here are some statistics on co-signed personal loans:

| Statistic | Value |

|---|---|

| Percentage of personal loans that are co-signed | 25% |

| Average interest rate for a co-signed personal loan | 10% |

| Average loan amount for a co-signed personal loan | $15,000 |

| Average term for a co-signed personal loan | 5 years |

| Approval rate for co-signed personal loans | 75% |

| Default rate for co-signed personal loans | 5% |

The Following Steps are to Check Personal Loan Rates

- Check your credit score and your co-borrower’s credit score to know your minimum credit score requirement.

- Shop around for lenders offering the lowest rates for co-signed personal loans.

- Compare the terms and approval chances of different lenders.

- Submit your loan application, the necessary documents, and information about your co-signer.

- Wait for the lender’s review and decision on your application. If approved, you’ll get a loan with a specific interest rate based on your credit scores, which will help you achieve the lowest rates possible.

Borrowers can review their potential rates without affecting credit by pre-qualifying. However, very few pre-qualification processes permit them to add a co-borrower or co-signer. Listed below are the following steps to check personal loan rates while considering missed payments and financial history.

- First, pre-qualify with multiple lenders to determine if you get approval for a loan. Consider adding a co-applicant to the loan application if not eligible or have a high rate. Remember the impact of missed payments on your financial history when evaluating your eligibility for better rates.

- Borrowing money with someone has its benefits and its risks. Borrowers must know the responsibilities of their co-signer before applying for a personal loan, including the possibility of missed payments or a change in their co-signer’s financial history.

- Most lenders conduct a credit check when you apply. It results in a temporary drop in borrowers’ credit scores. Lenders report positive and negative monthly payment information, including missed payments, to the major credit bureaus, which influence your overall financial history.

Methodology

GreenDayOnline reviews and rates personal loans from over 30 lenders. It interviewed representatives from the companies and collected more than 45 data points. Editors and authors at GreenDayOnline undertake an annual fact check and update the site annually. Lenders that offer consumer-friendly features get a higher star rating. These include flexible monthly payment loan options, quick funding times, customer service, reporting to credit bureaus, financial education, transparent rates, loan term, low-interest rates with no origination fee, and easy pre-qualification. Some top features they look for are Loan Amounts, competitive rates, same-day funding, and an online application process to ensure a smooth borrowing experience.

It includes regulation acts by government entities like the Consumer Financial Protection Bureau. These factors weigh based on how they affect consumers’ experience and which are most important. The method applies to lenders with a maximum interest rate of 36%. It is the maximum rate that most financial experts and consumer advocates consider affordable. GreenDayOnline does not receive compensation for its star ratings.

One factor influencing consumers’ experience is the need to provide bank statements as proof of their source of income. It helps lenders determine if borrowers meet minimum income requirements for getting access to loan funds. Furthermore, lenders also check if the borrower can make regular payments on time to ensure a smooth lending process.

Frequently Asked Questions

Can I get a personal loan with a co-signer if I have bad credit?

Yes, having a co-signer with good credit can help you qualify for a personal loan if you have bad credit. The co-signer agrees to be equally responsible for repaying the loan if you default.

What is the role of a co-signer in obtaining a personal loan with bad credit?

The co-signer’s role is to use their good credit to help qualify for and secure a personal loan on behalf of the primary borrower with bad credit. They guarantee the loan balance will be repaid.

Are there specific requirements for a co-signer when applying for a personal loan with bad credit?

Typical requirements include a credit score over 700, low debt-to-income ratio, steady income, no recent bankruptcies or foreclosures, and sometimes a minimum income level based on loan amount.

What are the advantages and disadvantages of using a co-signer for a personal loan with bad credit?

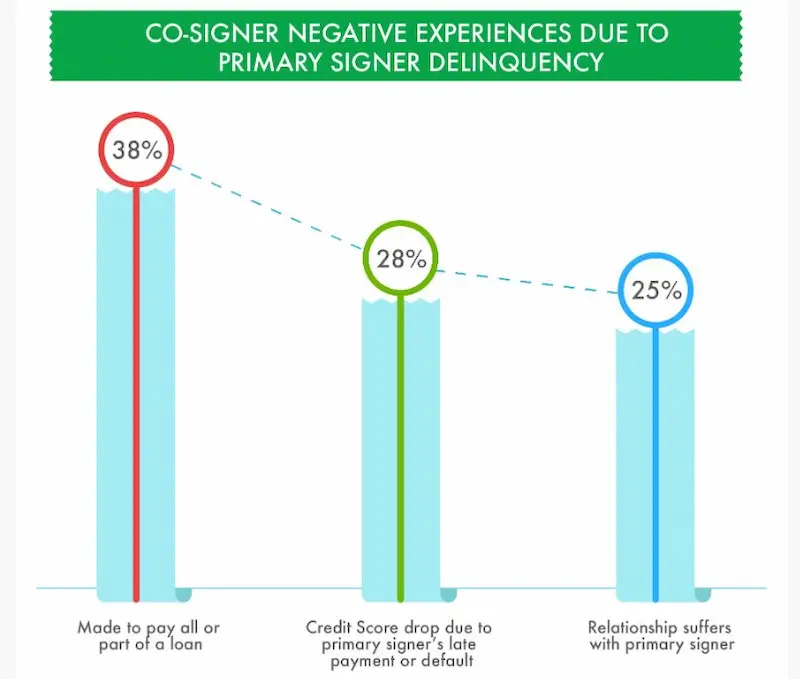

Advantages include higher approval chances and lower interest rates. Disadvantages include putting the co-signer at risk if you cannot repay, and potential damage to the relationship if issues arise.