Paying utilities on time can help increase your credit score. Utilities provide services like electricity, gas, water, and trash removal. These companies report your payment history to the major credit bureaus, which can help improve your credit file and score.

Your credit score is a number that lenders use to decide whether to give you a loan and how much interest to charge you. A higher credit score means you’re seen as a lower-risk borrower, which could lead to a lower interest rate on a loan. Factors like your credit utilization rate and credit scoring model play a role in determining your credit score.

Paying your electric bills and other utilities on time is an excellent start if you’re trying to improve your credit score or seeking financial assistance. Paying your utilities on time can help you build a good credit history, leading to a higher credit score. This can also positively impact your credit situation.

Do utility payments affect my credit score?

If you consistently pay your water bills and other utility services on time, it will improve your credit score. However, making timely or timely payments will help your credit score, and you may incur late charges. Utility companies report your bill-paying history to credit agencies, which can affect your credit score.

Your credit score is a three-digit number that lenders use to decide whether to give you a loan and what interest rate to charge you. A high credit score means you’re a low-risk borrower, which could lead to a lower interest rate on a loan. A low credit score could lead to a higher interest rate, and you won’t be approved for a loan.

Utility companies don’t report information to credit agencies on customers with good payment histories. So, having a good history of paying your utility costs on time won’t positively impact your credit score. However, positive credit behavior, such as paying your utility bills on time, will positively impact your credit score, potentially leading to an increased credit limit. Conversely, if you’re late on utility payments, it will harm your credit score.

Should I pay utilities with a credit card?

There are a few things to consider when deciding whether or not to pay utilities with a credit card.

The first is whether or not the utility company accepts credit cards. Some do, and some don’t, so checking is essential. The second is whether or not a fee is associated with paying by credit card. Some companies charge a small fee for credit card payments, typically around 2-3%. If there is a fee, you’ll need to decide if the convenience of paying by credit card is worth the fee.

Regarding rent payments and Utility Billing, it’s important to discuss payment arrangements with your landlord or property management company. They may have specific procedures for handling billing residents for utilities and allow you to use credit accounts or debit cards for payments.

The third thing to consider is whether or not you’ll earn rewards by paying with a credit card. With a rewards credit card, you can earn points, cash back, or other rewards for paying your utility bill. You’ll need to weigh the value of the tips you’ll make against the fee you’ll pay if there is one. Ultimately, whether or not to pay utilities with a credit card comes down to personal preference and managing your Utility accounts.

What ongoing expenses can help your credit score?

You can do a few things to help improve your credit score. One is to update you on your credit score rating and utilization levels. You can do this by monitoring your credit report regularly.

Another is to keep your credit balances low. This means using less than 30% of your credit limit. This will help improve your credit score by showing that you use less available credit.

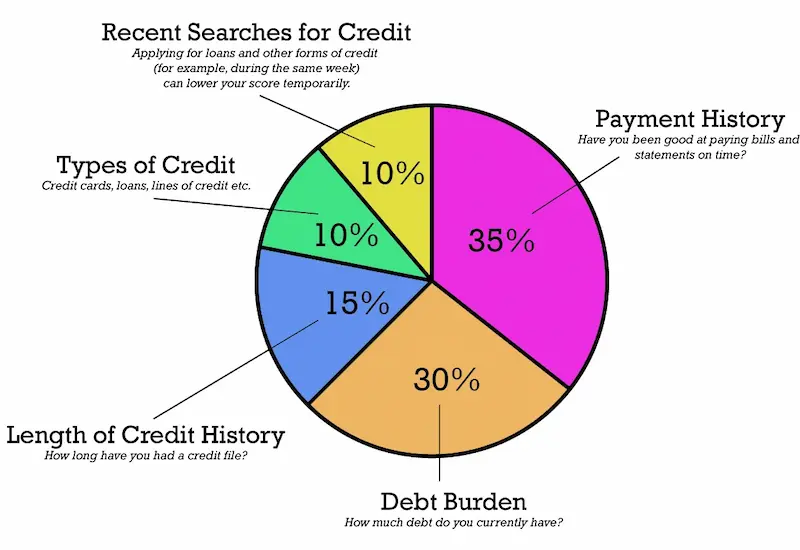

Finally, you can make timely payments on your debts. This will help improve your payment history, one of the most important factors in your credit score. Making timely payments will show that you’re a responsible borrower and that creditors will be more likely to extend your credit. Additionally, being aware of the application process for new credit can give you a better understanding of how to build a healthy credit profile.

Can Late Phone and Utility Bill Payments Affect Credit?

Yes, late phone and utility bill payments can affect credit. When a bill is 30 days or more past due, it is considered a delinquent account and will be reported to the credit bureaus. This can negatively impact your credit score and make it more challenging to get approved for credit.

If you need help paying your bills on time, you can do a few things to stay caught up.

First, set up automatic payments for your phone and utility bills. This way, you can ensure the prices are on time each month. You can also set up reminders for yourself so that you remember to make a payment.

If you need to catch up on your bills, the best thing you can do is contact your creditors as soon as possible. Many creditors are willing to work with you to set up a payment plan that works for your budget. By doing this, you can avoid having the late payment reported to the credit bureaus.

In financial hardship, especially during the COVID-19 crisis, you can seek emergency assistance from various organizations and government programs that help people with a reduced income. This assistance can help you manage your monthly income more effectively and explore different budget options.

Additionally, consider using Secured credit cards as an alternative to help you build or rebuild your credit score while managing your expenses.

How Do Utility and Phone Bill Payments Appear on My Credit Reports?

Your utility and phone bill payments may appear on your credit reports in one of two ways: as a hard inquiry or as a tradeline. A hard inquiry will appear on your credit reports if you applied for a new service and require a credit check. This type of inquiry will remain on your credit reports for two years. A tradeline will appear on your credit reports if you have an existing account in good standing. This type of account will remain on your credit reports for as long as the account is open.

For households with a significant reduction in household income, there are programs to assist with their housing expenses, such as rental payments. These programs usually have specific income limits and may assist for months.

Below are some statistics about how paying utilities can increase your credit score:

| Statistic | Value |

|---|---|

| Percentage of people with a FICO® Score☉ below 680 who saw an improvement in their score after adding utility payment information to their report | 75% |

| Average credit score increase | 10 points |

| Maximum credit score increase | 30 points |

| Period of time for which people who paid their utilities on time saw the biggest boost in their credit scores | At least 12 months |

Are Utility Bills Reported to Credit Bureaus?

Utility bills should be reported to credit bureaus. However, if you have a past due balance on your utility bill, they may report this to a collection agency, which may report the debt to the credit bureaus. This can negatively impact your credit score.

Access to clean water is essential, and many utility bill assistance programs also help families maintain this basic necessity in their homes.

If you struggle to pay your utility bills, you can do a few things to get help. You can contact your utility company and ask about their hardship programs. You can also get help from a government assistance program. To apply for these programs, you must fill out an application form and provide proof of your current residence as your primary residence.

You can do a few things to avoid having your utility bill go to collections. First, try to pay your account on time. If you can’t do this, contact your utility company as soon as possible to explain your situation and ask for help. You can also set up automatic payments, so you don’t have to worry about forgetting to pay your bill. Property owners should also ensure they collect a security deposit from tenants to cover any unpaid utility bills.

Lastly, use additional resources to help you manage your utility expenses, such as budgeting tools and energy-saving tips.

Frequently Asked Questions

Can paying my utility bills on time actually help improve my credit score?

Yes, consistently paying utility bills on time shows financial responsibility and can improve your credit, as many utility companies report payment history to credit bureaus.

What types of utility bills can positively impact my credit, and which ones don’t?

Phone, gas, electric, water, cable and garbage collection bills can help credit if paid on time. Rent, insurance and cell phone bills typically don’t get reported.

Is there a specific credit score boost I can expect from consistently paying utilities?

While the score increase varies, regularly paying major utilities like electric, gas and phone bills can add up to 100 points or more over time by demonstrating positive payment behavior.

Do utility companies report payment history to credit bureaus, and if so, which ones?

Most major utility companies report history to Equifax, TransUnion and Experian. Smaller or local providers are less likely to report.

What should I be aware of when using utility payments to build or repair my credit?

Make sure accounts are in your name, set up autopay, review reports for accuracy, and allow 6 months of positive history to see score impacts.