Online Title Loans at the Best Rate

An online title loan is a secured loan that uses the borrower’s car as collateral. Online title loan companies have higher interest rates than typical bank loans and are used by people who need fast cash and have no other options. To apply for a title loan, one must complete a loan application and submit the required loan documents. Understanding the title loan terms and title loan amounts before committing is essential. Afterward, the borrower must sign a loan contract with the lender.

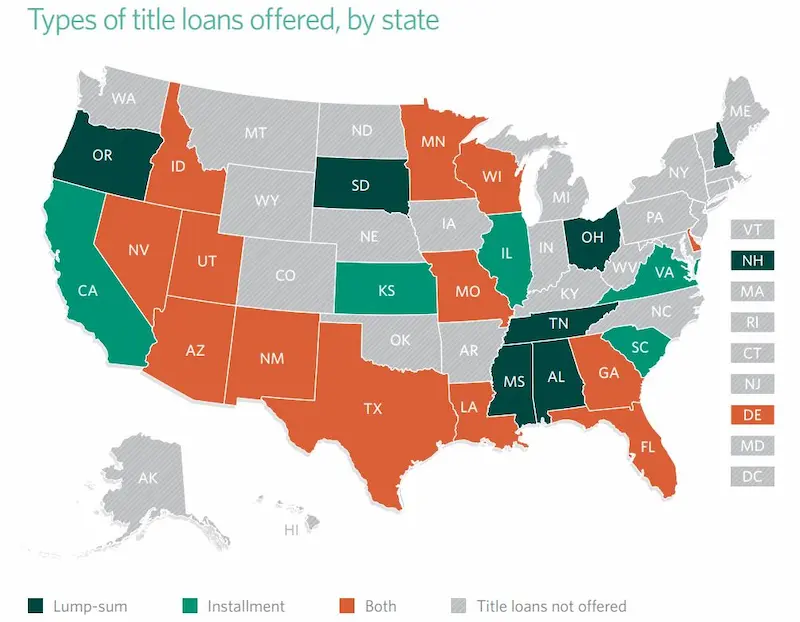

It is important to familiarize the state laws and regulations before obtaining a title loan from online title loan companies and submitting the loan documents. Upon approval, the vehicle title is transferred to the lender as collateral until the debt is fully repaid. The lender legally repossesses the vehicle as they hold a lien in case of default.

GreenDayOnline makes it easy for borrowers to get title loan funds online. Borrowers get responses from potential online lenders in just minutes by completing an application process on their website. Their technology analyzes the value of the collateral that has been submitted and provides borrowers with options from top-rated lenders. The secure platform facilitates a paperless application process and eliminates the need for physical store visits. Funds are quickly received through the mail or direct deposit with the possibility of same-day funding as soon as the next business day. The streamlined application process offers borrowers efficient access to the financial resources they require.

In Mississippi, title loans are becoming increasingly popular as a way to access cash. Mississippi title loan companies offer fast processing of loans secured by car titles, RVs, boats, or other physical property. You can use title loans in Mississippi to solve short-term financial emergencies and get access to cash quickly without a credit check.

SUMMARY

- A title loan is a secured loan that uses a vehicle as collateral.

- Title loans have higher loan interest rates than traditional bank loans and are used by people who need fast cash and have limited options.

- The auto title loan process of obtaining a title loan involves submitting an application, completing necessary documents with the lender, and signing a loan contract.

- Upon approval, the vehicle title is transferred to the lender as collateral until the debt is fully repaid, and the lender legally repossesses the vehicle in case of default.

- Different types of title loans include auto title loans, motorcycle title loans, boat title loans, RV title loans, and truck title loans – all popular among title loan borrowers.

- Requirements for title loans include having a clear vehicle title; the vehicle must be at most ten years old, have a reasonable number of miles, and have full coverage insurance.

What Is a Title Loan?

A title loan is a secured loan that uses a car or vehicle as collateral. It allows borrowers to get quick cash even with poor credit history. Depending on state regulations, individuals can borrow up to a certain percentage of the car’s value, but they must put their car title as collateral. The borrower gives the lender the vehicle title. In return, they are given cash with an agreement to repay the loan amount plus interest and other fees within a set period (usually up to 30 days). The car is repossessed if the borrower fails to make payments on time.

With Loan Max Title Loans, you can apply for an online title loan from anywhere and receive your funds within one business day. The loan process itself is secure, fast, and easy. Enter your information, upload a picture of your vehicle’s title, and select the loan amount you want. As one of the reputable title loan providers, Loan Max is also a direct lender with high approval rates, which means they offer quick loan approval. Once approved, you can sign your documents electronically and receive cash within 24 hours!

How Do Title Loans Work?

A title loan is a secured loan where the borrower temporarily puts up their car or another vehicle as collateral in exchange for cash. Individuals who need money quickly but need help to qualify for more traditional financing often seek these loans from title loan providers. To begin, an individual must have a clear (lien-free) title on their vehicle. The borrower then presents the car’s heading to the lender and gives up possession for some time in exchange for cash. Loan approval is typically much faster for title loans than traditional loans, making it an attractive option for those needing funds quickly.

The vehicle is returned to the borrowers with no lien on its title once the loan has been paid in full, plus any interest or fees that have been added. Interest accumulates on the balance, which must be repaid when the loan is due. The lender can repossess the car and process it through a full sale at auction to recoup some of its losses if monthly payments are not made. The type of loan affects the terms and conditions, including the possibility of falling into a cycle of debt if payments are not managed properly. Alternative loans may be considered if the borrower cannot meet the loan requirements.

What Are the Different Types of Title Loans?

Listed below are the different types of title loans.

- Auto Title Loan. Auto title loans are typically short-term loans secured by a vehicle’s title. Borrowers must fully own their car. Auto Title Loan carries higher interest rates than other types of loans.

- Motorcycle Title Loan. Like auto title loans, motorcycle title loans are secured with the borrower’s motorcycle as collateral for a loan. Motorcycle loans are shorter term than auto title loans requiring the lender to take ownership of the bike until repayment is complete. As with any loan, borrowers evaluate all costs associated with repaying the loan, including interest and fees.

- Boat Title Loan. Boat title loans use a boat as collateral to secure funds from a lender like auto and motorcycle title loans. Review all costs associated with repaying principal and interest on time, as failure to do so results in creditors taking possession of a vessel as compensation for unpaid debt before borrowing against a boat.

- RV Title Loan. RV title loans likewise use recreational vehicles (RV) as collateral when requesting funds from lenders. RVs are usually reconditioned after being seized by debt collectors in cases where borrowers don’t make payments or violate terms outlined in their agreements with lenders respectively. Be sure to read through all stipulations before entering into an RV title loan agreement, as it carries risks like other forms of secured credit, such as damage caused during repossession and loss due to changing market conditions, for instance, if borrowing against an aging model that drops drastically in resale value over time.

- Truck Title Loans. Truck title loans offer cash advances based on trucks owned by consumers with enough equity accumulated within their car (s). This allows them to secure these entities when looking for quick financing options via digital channels, online financiers, etc.

Below are some statistics about different types of Title Loans:

| Loan type | Average amount | Interest rate | Term |

|---|---|---|---|

| Motor loan | $3,500 | 15%-30% | 12-36 months |

| Truck loan | $5,000 | 15%-30% | 12-36 months |

| Title loan | $1,500 | 15%-30% | 12-36 months |

What Are the Requirements of Title Loans?

Listed below are the following eligibility requirements for title loans. We will also discuss the loan terms and some alternatives to title loans to help you make the best decision.

- Vehicle Title: The most important requirement for a title loan is that the borrower must provide the lender with the title of the car they intend to use as collateral. The vehicle is evaluated and undergoes a process of evaluation, which includes an inspection, to determine its value before approving the loan.

- Age of Vehicle: The age of the vehicle is something that lenders consider when evaluating it for a title loan, as older vehicles tend to have less financial value than newer models. Borrowers need cars that are at most ten years old to qualify for a title loan.

- Mileage: Mileage is an important factor in value assessment regarding car title loans. A higher number of miles indicate increased wear and tear, leading to the vehicle’s decreased value over time. Most lenders require cars with 100k miles on them for a borrower to qualify for a loan.

- Insurance: Most lenders require that all borrowers have full coverage insurance on their vehicle to obtain a title loan. Insurance protects both lender and borrower if any unexpected events occur while the car is pledged as collateral against the loan and provides revenue if anything happens regarding theft or accidents that deem damages beyond repairable means.

- Income Source & Ability To Repay: Lenders typically look at income source and ability to repay when assessing potential borrowers for car title loans. However, they sometimes are lenient if proper background checks are run and approved accordingly by established standards set forth by state law regulations surrounding the financial service industry.

What Are the Things to Consider Before Applying for a Title Loan?

Listed below are the things to consider before getting a title loan, including various loan products and the convenience of an online loan application through the Loan Center.

- Interest Rates. Interest Rates are important when applying for a title loan. Shop around before signing a contract, as lenders have different interest rates and terms. Knowing the rate allows borrowers to compare with other lenders and make an informed decision.

- Repayment Terms. Before taking out a title loan, understand the repayment terms. Do research on how long the time is, if there are early payment options, and if automatic payments are available; plan and budget accordingly without getting stuck in debt.

- Collateral Requirements. Title loans require collateral, such as a car or motorcycle, as security for the loan amount. The lender can repossess the collateral if payments are not made to recoup their loss. Before taking out a title loan, it is important to familiarize the state laws and regulations to understand the consequences of defaulting on payments.

- Required Documentation. Most lenders require documents like proof of residence, proof of income, license/ID, insurance information, and vehicle registration to get approved for a title loan, so ensure that all information requested by the borrower’s lender is provided accurately and promptly to avoid delays or declines in processing the application.

- Fees & Charges. Be aware of any costs associated with taking out a title loan – including application fees (if applicable), origination fees, late payment penalties, etc. – so there are no surprises with hidden costs or penalties later on down the line.

What Are the Advantages and Disadvantages of Title Loans?

The advantages of title loans are listed below, including loans to borrowers and various loan offers.

- Loans to borrowers: Title loans provide a quick and easy way for borrowers to access funds using their vehicle as collateral. They don’t require a credit check or a lengthy application process, making them an attractive option for people with low credit scores or limited credit history.

- Loan offers: Due to the nature of title loans, borrowers can often find a range of competitive loan offers, including competitive rates and installment loans, which can make it easier for borrowers to compare options and choose a loan that best suits their needs.

However, there are also some disadvantages to be aware of when considering title loans as a financial solution.

- Fast Approval and Access to Cas: One of the main advantages of title loans is that it is approved quickly, and customers can access the funds in as little as 24 hours, which makes them a great financial solution for those who need cash in a hurry or are facing an emergency.

- No Credit Check: Unlike traditional loans from banks or other lenders that require a credit check, title loan lenders do not perform credit checks, meaning anyone with any credit history – including no credit – can qualify for a loan.

- Affordable Repayment Plans: Title loan lenders typically offer repayment plans that make it more manageable for customers to pay off the loan within a specified timeframe, often allowing for better debt management than traditional loans.

- Keep Car During Loan Repayment: An advantage of title loans is that borrowers can retain possession of their vehicle while repaying the loan, providing peace of mind and preventing loss of transportation while financial stability is regained.

- Low-Interest Rates: Some state laws limit the interest rate charged on title loans, making them attractive to customers compared to payday and other short-term loan options with exorbitant rates and fees.

- Funds Can Be Used for Any Purpose: With most title loans, borrowers are free to use their loan proceeds however they wish, making them incredibly versatile when tackling different expenses such as bills, groceries, travel, medical expenses, and more.

- Easy Online Process: Many lenders now offer the convenience of online application processes where borrowers fill out forms online and submit documents via email or fax without having to visit store locations during business hours physically, which allows customers to apply whenever they want without having to take time off work or worry about finding time away from their busy schedule.

Listed below are the disadvantages of title loans.

- Unsecured loans: Title loans are considered unsecured, meaning they don’t require collateral. However, this could make the loan riskier for lenders, leading to higher interest rates.

- Predatory lenders: Some title loan companies can be considered predatory lenders, taking advantage of borrowers with limited options for obtaining credit or funds.

- Expensive loan: Due to the limited regulation and high-interest rates, title loans can become an expensive loan option for the borrower, leading to a cycle of debt.

- Lack of competitive interest rates: Compared to other types of loans, title loans usually have less competitive interest rates, making them a less attractive option for borrowers seeking financing.

- High-Interest Rates: The main disadvantage of title loans is that they come with very high-interest rates, ranging from 25–300% APR in many cases, which is a form of predatory lending, meaning it takes advantage of someone who doesn’t have access to more traditional or affordable forms of credit.

- Short Terms: Another disadvantage of title loans is that they usually have short terms, often ranging from 15–30 days for the initial loan repayment scheduling before an extension is requested or granted.

- Loss Of Car Ownership: The Borrower’s car is repossessed due to the lender if a borrower fails to pay back a title loan within the stipulated period. The borrower’s ownership rights are immediately terminated, and any outstanding fees are added to the balance due.

- Low Loan Amounts: Title loans often provide lower amounts than other types of personal loans because they require using borrowers’ cars as collateral against the borrowed money. It means if the borrower doesn’t have a nice or expensive car, they will only qualify for such higher loan amounts if specific qualifiers like income level come into play.

- Negative Impact On Credit Score: Failure to make payment on a title loan agreement negatively affects borrowers’ credit scores and makes it harder for them to obtain other credit in the future since lenders consider past performance when making subsequent decisions about giving out credit facilities which stops potential employers from feeling borrowers for open positions since most employers check credit history during their hiring process.

- Legal Action: Title lenders have aggressively attempted to recover unpaid debt dues. They resort to legal action even when failure has been unintentional due to circumstances outside their control or knowledge. Postponing payments must only automatically lead to taking such measures after hearing both sides before making any decisions.

- The inability of the Owner to Finance Cars Anymore: The inability of the owner to finance cars puts limits on what kind of cars are owner financeable through regular dealerships just as much as through Title Loans companies themselves, so if there’s ever an issue that arises while leasing a vehicle out with them (which, unfortunately, does happen), sometimes it’s no longer possible afterward ever again, even with proper and timely payments established at least up until then.

Is a Title Loan a Good Option?

Yes, a title loan is a good option for those needing fast cash and limited access to traditional credit, such as payday loans or bad credit loans. Title loans provide much-needed liquidity, usually within minutes of being approved. A title loan is helpful when a borrower is in an emergency expense situation and needs money quickly. However, they must not be used as a long-term financial solution because they charge high-interest rates and lead to more debt if the borrower needs to pay off the loan promptly. Therefore, it is important to consider other options and understand the approval process carefully before deciding on a title loan.

We are pleased to present the comprehensive list of American states where our company actively offers online title loans at the best rates. As a trusted provider in the financial industry, we strive to bring accessible and affordable borrowing options to individuals nationwide. With our commitment to transparency and customer satisfaction, we have expanded our services to cover various states, ensuring that residents can conveniently access the financial support they need. Whether you need quick funds for unexpected expenses or looking to consolidate debts, our online title loan solutions provide a reliable avenue to secure the funds you require. Please refer to the table below to find the states where our company operates, allowing you to explore the possibilities of our exceptional loan offerings.

| Alabama / AL | Alaska / AK | Arizona / AZ |

| Arkansas / AR | California / CA | Colorado / CO |

| Connecticut / CT | Delaware / DE | District Of Columbia / DC |

| Florida / FL | Georgia / GA | Hawaii / HI |

| Idaho / ID | Illinois / IL | Indiana / IN |

| Iowa / IA | Kansas / KS | Kentucky / KY |

| Louisiana / LA | Maine / ME | Maryland / MD |

| Massachusetts / MA | Michigan / MI | Minnesota / MN |

| Mississippi / MS | Missouri / MO | Montana / MT |

| Nebraska / NE | Nevada / NV | New Hampshire / NH |

| New Jersey / NJ | New Mexico / NM | New York / NY |

| North Carolina / NC | North Dakota / ND | Ohio / OH |

| Oklahoma / OK | Oregon / OR | Pennsylvania / PA |

| Rhode Island / RI | South Carolina / SC | South Dakota / SD |

| Tennessee / TN | Texas / TX | Utah / UT |

| Vermont / VT | Virginia / VA | Washington / WA |

| West Virginia / WV | Wisconsin / WI | Wyoming / WY |

Conclusion

A title loan is a secured loan that uses a car or vehicle as collateral. It is a quick way for individuals to get cash, even with poor credit. The process involves submitting an application, working with a lender to fill out necessary documents, and signing a contract. After the loan is approved, the borrower transfers ownership of the vehicle title to the lender until the debt is paid in full. Although title loans can be a viable option in an emergency, exploring alternatives like payday loans or bad credit loans before committing to a title loan is crucial. It’s also essential to consider your credit bureaus report to ensure you secure the most favorable terms available.

The lender places a lien on the car so that if the borrower defaults on payments, they repossess the vehicle. There are different types of title loans, such as auto, motorcycle, and boat title loans, each of which uses the respective vehicle as collateral. However, they all come with a higher interest rate, and it’s important to review the terms carefully before signing an agreement. Regular monitoring of your credit bureaus reports can help improve your chances of securing favorable terms for future loans.

Frequently Asked Questions

How can I find the best online title loan rates?

Compare APR and fees across multiple lenders. Look for low origination/monthly fees. Check eligibility requirements. Read customer reviews. Consider lenders offering rate discounts for autopay, existing accounts, etc.

What factors determine the interest rates for online title loans?

The main factors are state regulations, loan amount, loan term, credit score, income, debt-to-income ratio, collateral vehicle value, and lender competitiveness. Higher risks lead to higher rates.

Are there online title loan options with low or no credit checks?

Most online title lenders require credit checks. However, some may only do a soft pull that doesn’t affect your score. These lenders focus more on collateral vehicle value. Bad credit may get higher rates.

What documents and information do I need to apply for an online title loan?

You’ll need government ID, vehicle title showing sole ownership, insurance, recent paystubs, bank account info, references, vehicle photos, mileage, and an application with personal details. Income and debts will be verified.

What are the risks associated with online title loans at the best rates?

Even the best rates have risks of repossession if unable to repay, along with potential loan renewals leading to a debt cycle. There may also be prepayment penalties and higher default rates than other loans.