You can see the complete breakdown below, but a $500 payday loan will cost you $547 within a fortnight, $593 after a month, and $774 after a month.

Loan Term Paid Interest & Fees

- 2 Weeks $47 $547

- 1 Month $93 $593

- 6 Weeks $139 $639

- 8 weeks $184 $684

- 30 days $274 $774

- (4) Months $364 $864

People who need emergency cash or a little additional cash before their next paycheck from work frequently use online payday loans from direct lenders (online lenders) (which are usually at the end of the month). The typical type of loan is for $300 to $500 and is taken out for two to four weeks, sometimes referred to as short-term loans or cash advance.

The annual percentage rate (APR) for payday lenders often ranges from 300 to 600 percent, depending on the state where you reside and your circumstances, such as your credit history and residency status, which can affect the amount you are charged. Unfortunately, these types of personal loans can sometimes lead borrowers into a cycle of debt due to high-interest rates and short repayment periods.

The ability to borrow money quickly for a crisis and receive payment upfront makes this loan type useful even though it is not the lowest option. Since most lines of credit are automated, they are frequently finished and funded within an hour or the same day as submission.

However, using our example, it is crucial to understand what a payday loan costs because, in addition to being more costly, the more you borrow, the fees also start to mount if you cannot make your monthly payments on time.

The Main Costs

A $500 payday loan will cost you $546 after two weeks and $592 after four. This is primarily due to the high finance charges and loan interest rates associated with such loans.

Although getting payday and title loans is quick and efficient in times of need, they should never be used continuously. A more affordable option for individuals struggling with emergency expenses might be to consider a credit union that offers lower interest rates or look into installment loans with manageable monthly payments.

Due to their unsecured nature and frequent need to cover high default rates, payday loans are expensive. Additionally, the credit check conducted may impact your credit score if you fail to repay the loan on time.

The loan interest is computed as if it lasted a year, even though it typically only lasts a few weeks, which results in a high APR.

If you cannot make payments on time, you may be subject to further late penalties, increased interest, and a drop in your credit score. It’s important to consider your monthly income and have proof of income to ensure you can afford the loan.

Is a $500 payday loan overly expensive?

A $500 bad credit payday loan has a higher cost than other financial products like credit cards or unsecured loans, although they are frequently utilized temporarily. Online loans provide multiple loan options and can present different loan amounts depending on the situation.

A payday loan can be useful to get you through a difficult period if you have an unexpected need, such as auto repair, house maintenance, or the requirement to pay your rent. Before getting one, it’s important to consider your available loan options and choose the most suitable for your needs.

Payday loans can become highly expensive and strain your finances if you start using many, fall behind on payments, or utilize “top-ups” (also known as rollovers). Remember, the loan amounts you borrow affect your ability to repay the loan.

Payday loans are useful in some situations, but perhaps you should always plan how you’ll pay them back on time to prevent debt burden or late payments. Carefully calculating your monthly income and submitting your loan application can help you avoid getting into a cycle of debt.

Looking for average loan loans for 5000 dollars? Learn about the high cost of dollar payday loans compared to other types of loans, even if they’re utilized temporarily. While a payday loan can help during a difficult period, multiple loans, late payments, and “top-ups” can become highly expensive and strain your finances. Plan and ensure you can repay your loan on time to avoid debt burdens. Cash advance loans can be an option, but you must consider the loan period and other factors.

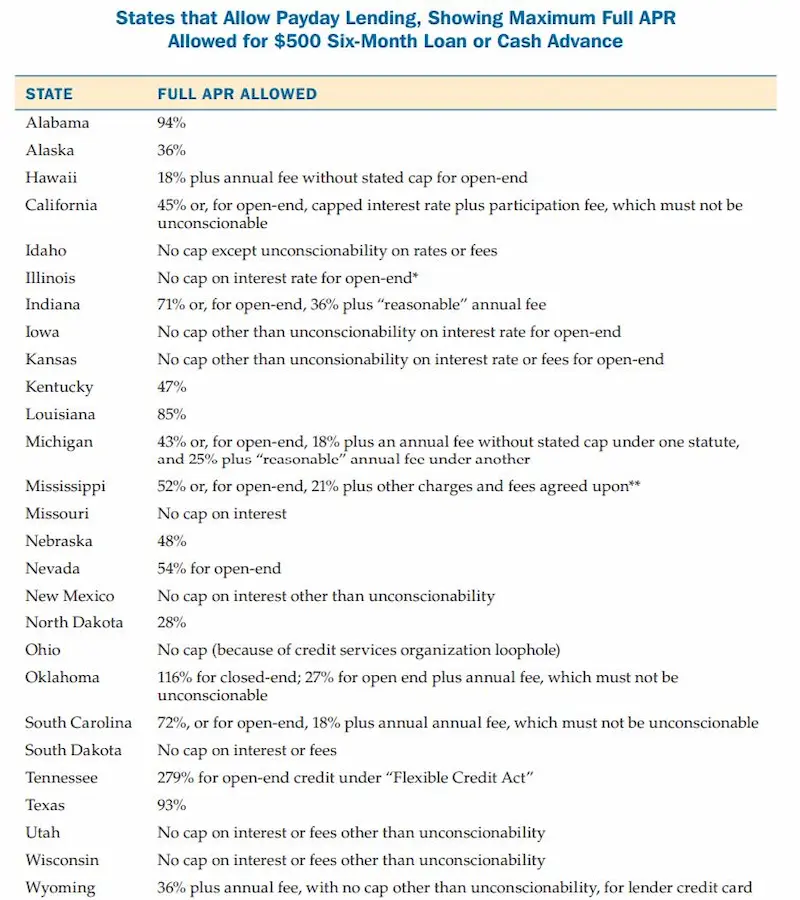

The following table provides a comprehensive list of American states where our company serves customers actively. We understand the financial challenges individuals may face occasionally, and our goal is to provide accessible solutions that meet their needs. As a reputable provider of payday loans, we strive to assist individuals with short-term financial obligations, offering a straightforward repayment process. Please refer to the table below to find out if your state is among those where we currently operate, ensuring you have access to the necessary information regarding a $500 payday loan.

| Alabama | Alaska | Arizona | Arkansas |

| California | Colorado | Connecticut | Delaware |

| District Of Columbia | Florida | Georgia | Hawaii |

| Idaho | Illinois | Indiana | Iowa |

| Kansas | Kentucky | Louisiana | Maine |

| Maryland | Massachusetts | Michigan | Minnesota |

| Mississippi | Missouri | Montana | Nebraska |

| Nevada | New Hampshire | New Jersey | New Mexico |

| New York | North Carolina | North Dakota | Ohio |

| Oklahoma | Oregon | Pennsylvania | Rhode Island |

| South Carolina | South Dakota | Tennessee | Texas |

| Utah | Vermont | Virginia | Washington |

| West Virginia | Wisconsin | Wyoming |

Why Do Payday Loans Cost So Much?

There are several reasons why payday loans are pricey.

They are unsecured, so if you can’t repay the loan, the lender won’t be able to collect anything or seize your property because you didn’t put up any guarantee or collateral when you applied. These unsecured debts can be riskier for lenders.

This implies that your eligibility is determined by variables like your regular income, employment, and credit score.

However, the lender must charge you more than the ordinary loan since if you default, the lender suffers a loss and cannot seize your property to recoup their losses. This is where alternative loans like a bad credit loan or a cash loan can come into play, offering different options for those needing financial assistance.

They have a high probability of default – The proportion of consumers who cannot make time payments on payday loans is high, from 15% to 25% from lender to lender. As a result, it is categorized as “bad debt,” and the lender eventually suffers a loss.

Unfortunately, this necessitates a slight increase in rates to cover the losses of other persons. This is where a debt management plan might become useful, allowing individuals to organize their financial obligations and make payment arrangements with their creditors.

Does this imply that loyal clients may pay a little extra for loans? This may be the case, but that’s how the product is designed. This is why it’s essential to carefully review the loan agreement before committing to any lending product.

They are short-term – Because this funding is intended to be used briefly, the rates are much higher to accommodate this and ensure that the lender will profit.

Since they are taking on a lot of risk by lending you a sizable chunk of money—say, $500 or $1,000—for only two weeks, they must make it profitable by charging you a respectable interest rate. Financial experts often recommend seeking other options, such as a payday alternative like a credit card cash advance or larger loans with more affordable payments.

Another illustration: A home lender or bank may charge modest monthly rates of merely 3 or 5 percent, but the loan term may be 5, 10, or 25 years. Keeping your bank statements updated is crucial to ensure accurate documentation.

In this case, the overall interest rate is proportional to the loan’s term.

Why are payday loans’ APRs so high?

Compared to credit cards, which have an APR of about 16 percent, payday loans have absurdly high APRs ranging from 300 to 600 percent. In some cases, borrowers might have to deal with a collection agency if they fail to repay the loan.

However, the main reason the APR is so high is that it treats the loan as if it were a 12-month loan since that is how the APR works—it is an “annual” measurement to make it simple to compare to other lending products.

In reality, it’s equivalent to taking a service that will only last 2 to 4 weeks and repeatedly compounding it as if it were an annual product, which inflates the price and makes it seem more expensive. This could lead to accumulating medical bills and struggling to maintain an adequate emergency fund.

This is not to imply that payday loans are inexpensive—they most certainly are not—but you can compare the cost in various ways, such as by looking at the daily rate of interest or using a repayment plan example spread over two or one month, to get a good notion of the cost. This can help you determine if a short-term auto loan or deposit loans might be better for your needs.

Below are some statistics about the repayment cost of a $500 payday loan:

| Item | Value |

|---|---|

| Loan amount | $500 |

| APR | 15% |

| Origination fee | 10% |

| Total amount of loan | $550 |

| Repayment period | 14 days |

| Late fee | $15 |

| Total cost of loan | $675 |

What Will Happen if You Cannot Make Repayments?

Payday loans can become very expensive if you cannot pay on time. The entire balance begins to rise due to late fines and additional interest, and it will also negatively affect your credit rating, making it difficult to obtain financing in the future. To avoid such complications, it’s essential to maintain a stable source of income and plan for timely loan repayment. A lender may also add a payment fee to your account, and if the situation worsens, your loan could be transferred to a debt collection agency.

If you haven’t racked up a sizable debt, it’s unlikely that you’ll end yourself in court for unpaid payday loans. However, it would be best always to consider how to pay off your loan on time to prevent legal proceedings and additional expenses.

To ensure Sufficient Funds for your utility bills and other Non-interest bills, consider setting up a utility payment plan with the help of national banks. This can help you manage your finances better and prioritize your debts and expenses, such as disability funds if applicable.

1000 loan bad credit, a payday loan may seem like a quick solution. However, if you cannot repay on time, the loan can become expensive and harm your credit rating. Late fines and additional interest can cause the balance to skyrocket, making it even more challenging to pay off in the future. It’s crucial to consider how you’ll make your payments on time to avoid legal proceedings and further expenses.

Frequently Asked Questions

How much will I need to repay in total for a $500 payday loan?

For a $500 payday loan, the total amount to be repaid will depend on the interest rate and repayment terms. Typically, payday loans have an interest rate around 400% APR, so on a 2-week $500 loan the interest would be around $60. With the $500 principal, the total repayment could be around $560. However, fees and rollover costs can make the total repayment much higher.

What is the interest rate typically associated with a $500 payday loan?

The typical interest rate on a $500 payday loan can be anywhere from 300% to 500% APR. Most states cap the interest around 400% APR, so for a 2-week $500 payday loan the interest charge is often around $60. This equates to an interest rate close to 30% for the 2 week period. However, fees and roll-overs can effectively increase the interest rate much higher.

Can you explain the repayment terms and fees for a $500 payday loan?

For a typical $500 payday loan, the repayment terms are usually 2 weeks or the borrower’s next pay date. The fees on a $500 loan are around $15-$30 for the origination fee, plus interest of around $60. So for a 2 week term, the total repayment is the $500 principal plus fees and interest, equalling approximately $575-$590. If it is not repaid in full, fees apply to roll over the loan into a new term. This can lead to very high costs.

Are there any additional charges or hidden costs when repaying a $500 payday loan?

Yes, there can be additional hidden costs when repaying a $500 payday loan beyond the upfront fees and interest charges. If the borrower cannot repay the full amount when due and needs to roll over the loan, there are additional rollover fees. Also, if the automatic repayment fails due to insufficient funds, the borrower may incur NSF fees from both the lender and their bank. Late fees and collection fees can also apply if the loan becomes delinquent. Even the act of repaying can have costs if done through a third party processor.

What is the usual repayment period for a $500 payday loan, and how does it impact the overall cost?

The typical repayment period for a $500 payday loan is two weeks or until the borrower’s next pay date. This short repayment period increases the overall cost. Interest rates on payday loans can be 400% APR or higher, so on a $500 loan over two weeks the interest charge alone can be around $60. Additional fees apply, and if the borrower cannot repay in full, rolling over the loan with additional fees and interest significantly increases the total cost of the $500 loan.