Payday loans warnings & Downsides

Usually, these are short-term loans of a modest amount of loan. The borrower typically writes a check for the loan amount to get a payday loan fee. The check might be left with the lender, and he will cash it once the repayment is due.

If the borrower can’t repay when the loan is due, he can sometimes “roll to extend the loan extended. However, the fees keep accumulating. Some states either outlaw rollovers or limit the number of possible renewals.

Payday loans are sometimes offered as “no credit check” loans. The borrower doesn’t need a good credit score, and approval is easier than traditional loans. As a result, they are popular among people facing financial difficulties.

Unfortunately, there are very few situations where a cash advance or payday loans are helpful. Before you use one, make sure you understand the costs and risks.

Online Payday Loan Warning Signs

When taking out payday loans online, you should remember that the Consumer Federation of America (CFA) has long advised consumers to exercise extreme caution. This is particularly important when using Internet payday loan websites, where loans can cost up to $30 per $100 borrowed, and the annual interest rates (APRs) are 650%.

According to a CFA survey, small, electronic access to consumer checking accounts poses high risks to consumers transmitting personal financial information online. An online cash advance is popularized through email, online search, paid ads, and referrals. Usually, a consumer fills out an online application form with his personal information, bank account numbers, Social Security Numbers, and employer information. He then applies for the online payday loan with copies of a check, a recent bank statement, and signed paperwork.

Payday Loans and Access to Customers’ Bank Accounts

Payday loans could cost up to $30 per $100 borrowed and must be repaid or refinanced by the borrower’s next Payday. Let’s say that the borrower’s Payday is in two weeks. A $500 loan would cost $150. This means $650 will be electronically withdrawn from the borrower’s account.

Many lenders automatically renew loans by electronically withdrawing the charges from the borrower’s checking account on Payday. If consumers need more money to cover the charge or repayment, the lender and the bank impose sufficient funds fees.

The High Cost Comes With a High Risk

Online payday loans are dangerous for cash-strapped borrowers. They combine the high borrowing costs and collection risks of check-based payday loans with the security risks of sending bank account numbers and Social Security Numbers over web links to unknown lenders.

The CFA’s survey showed that loan amounts could range from $200 to $2,500, with $500 being the most frequently offered amount. Finance charges range from $10 up to $30 per $100 borrowed on a most frequent rate of $25 per $100, or 650% annual interest rate (APR) if the loan is repaid in a few weeks.

Not all sites will disclose the annual interest rates for loans or their finance charge before the customers complete the application process. The most frequently posted APR is 652%.

Although loans are due on the borrower’s nearest Payday, many sites automatically renew the loan, withdraw the finance charges from the borrower’s bank account and extend the loan for another pay cycle. Some sites permit loan renewals with no reduction in principal.

Some direct lenders require consumers to take additional steps to repay the loan. After several renewals, some direct lenders require borrowers to reduce the loan amount with each renewal.

Contracts usually include a range of one-sided terms such as mandatory arbitration clauses, agreements not to participate in class action lawsuits, and not to file for bankruptcy. Some lenders require their customers to agree to keep their bank accounts open until loans are fully repaid. Others ask for wage assignments even in states where they are illegal.

Therefore, CFA advises consumers to refrain from borrowing money to give a postdated paper check or electronic access to a bank account. Payday loans are too expensive and hard to repay in the short term. CFA advises consumers never to transmit bank account numbers, Social Security numbers, or other personal financial information via the Internet or fax. They search for lower-cost credit, comparing the finance charge and the APR. Consumers seek credit counseling or legal assistance.

Payday Loan Pitfalls

The main pitfall with payday loans is their cost. The fees are incredibly high and dissolve the borrower’s financial problem borrower. If they already have financial difficulties, payday loans worsen because of high-interest paydays. For example, payday loans will likely only do more harm as a long-term strategy than good for an emergency repair for your car so that you can get to work and keep earning Payday.

Bounced checks that the borrower writes to the payday loan lender can end up in his ChexSystems file, resulting in overdraft charges from the bank. Banks and retailers may then be unwilling to work with that customer. The lender may also sue him or send his account to collections, harming his credit. Also, if constantly stretching out payday loans, the borrower will pay far more in interest and fees than he has ever borrowed in the first place.

Bank Payday Loans’ Disadvantages

Banks also act as payday loan lenders, most likely to earn more revenue. While qualification for traditional bank loans is based on the customer’s credit, income, and assets, they can be a better alternative. Bank payday loans are no better than common payday loans. They’re still expensive and risky.

Payday loans from banks can be even worse than those from a payday loan store. This is because the bank has access to the client’s checking account, and he agrees to let them pull funds from it to repay the loan. If they want their money, they’ll take it as soon as it’s available, regardless of whether the client needs money for a mortgage or car payments. When the borrower seeks financing elsewhere, he may have more control over how and when his money leaves his bank account. Nevertheless, the bank can offer better terms.

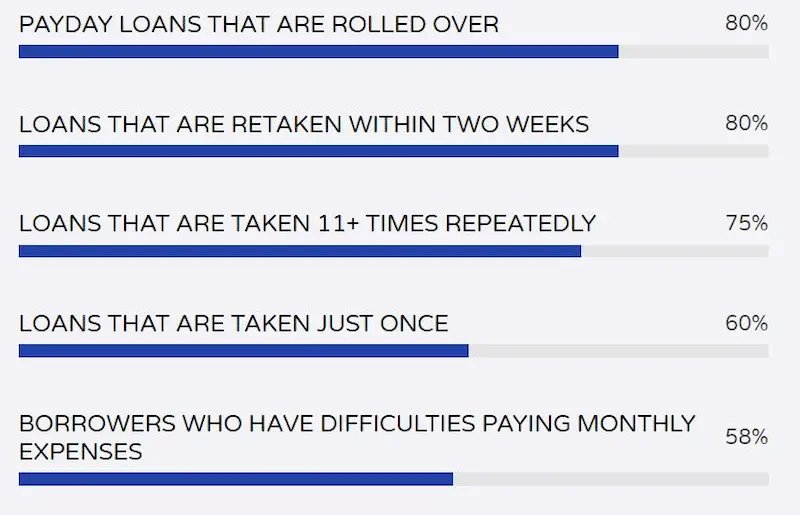

Here are some statistics about the disadvantages of bank payday loans:

| Statistic | Value |

|---|---|

| Average interest rate: | 300% or more |

| Average fees: | $15-$30 per $100 borrowed |

| Risk of default: | 25% |

| Difficulty getting out of debt: | 60% of borrowers take out multiple payday loans each year |

The Problem With Rollovers

The core problem with rollovers is the “spiraling” fees. How do they work? If you have a job, a payday lending company will allow you to write a postdated check and charge a very high-interest rate. Suppose you borrow $300 for two weeks from a payday lender for a fee of $45 and decide to roll over the loan instead of repaying – you’re supposed to pay the $45 fee. Then you will owe $345 or the principal plus the fee on the second loan. If you paid the loan, you would have paid $90 in fees for two $300 payday loans.

Payday lenders often advertise their two-week loans as the solution to short-term financial emergencies. Indeed, about half of initial loans are repaid within a month. However, about 20% of new payday loans are rolled over six times or three months. Hence, the borrower pays more in fees than the original principal.

Payday loans fill a niche – subprime borrowers who need money before their next paycheck.

According to some researchers, 20% of borrowers who roll over repeatedly are sometimes selves about how quickly they can repay, either by lenders or by themselves loans. Behavioral economists have concluded that some people don’t always act in their best interest – they can make systematic mistakes that jeopardize their welfare. If chronic or, indeed reflect, behavioral problems, capping them would benefit those prone to such problems.

The CFPB Warnings About the Payday Loan Industry

Consumer Financial Protection Bureau is a new independent agency under the US Federal Reserve. They make rules that bind financial institutions and investigate consumer complaints about financial institutions. It can monitor, and issue reports on markets and financial products.

The accounts they studied with identifiable payday loans paid an average of $2,164 over the 18 months and $185 in overdraft and non-sufficient fund fees to their banks. Of those fees, $97 is charged on payment requests not preceded by a failed payment request. $50 on average is set because of the re-presentment of a payment request after a prior request has been unable to be, and $39 is charged because a lender submits multiple payment requests on the same day.

It has become obvious that the number of entirely successful borrowers was only half of the population of payday loan borrowers.

The “re-presentment” used by the CFPB means the following:

Payday loan borrowers are among the lowest-rate borrowers. They often do not borrow loans with the intent of repaying them. Therefore, an ender is to split payments into multiple requests to recover some of the payments. A debt of $300 would be split into three requests of $100. After all, a lender should receive more repayment than none at all.

However, if the first one fails and the bank charges the borrower an overdraft fee, would the lender keep receiving payment for the other two requests? Sometimes there is a grace period, but sometimes requests happen on the same day.

Usually, 5-7 days or 14 days are the most common retry dates, with two weeks being the most common successful retry date. Some of the 0-day pings are successful but are causing overdrafts.

The people who take out payday loans are often desperate. Other credit options turn a 2-week paycheck cycle into real liquidity. Payday loans and auto title loans fill an underserved niche.

The CFPB has proposed a framework to regulate payday loans. Google banned all ‘payday loan ads. Repayment dates under 60 days or effective APRs over 36% from the AdSense ecosystem.

Nevertheless, 50% of borrowers are completely successful with payday loans. Cleaning up the industry could force them to seek out worse alternatives.

Tips When Using Payday Loans

There are three important things to consider when taking out payday loans. First, you should be aware of why you will use one. The average consumer can pay up to 400% interest on a two-week loan of approximately $100. Therefore, you should not take out a loan for general living expenses if you don’t wish to be in a cycle of consumer debt.

Effectively meet an unexpected, providing short-term relief to a financial crisis. However, they could be more suitable for helping you settle monthly bills or living expenses.

Secondly, be certain whether you can afford to repay the interest. The interest rates can fluctuate wildly between different states and the united states. They started at approximately 237%, depending on the individual lender and the duration. Therefore, it was important to calculate the total amount that would be repayable at the end.

Lastly, use only one lender. This can be an illegal and entirely inappropriate practice. You should only secure a single loan against any given paycheck. Having more than one advance on a salary payment is an offense.

Alternatives to Payday Loans

Instead of using a payday loan, people in need should consider other alternatives. They can build up an emergency cash fund in their savings account. Build credit to borrow from mainstream lenders. They can also keep an open credit card for emergency expenses. Or even get a signature loan from a bank or credit union. Another option is to negotiate a payment plan with their lenders or investigate overdraft protection plans for their checking accounts. Peer-to-peer lending services are also viable options.

Conclusion

Payday loans are very useful if an emergency or an unexpected event arises. Consumers have to understand their nature and use them responsibly.

Paying attention to the loan terms and the interest rate is critical. This will help you decide whether it is suitable for you and afford it. Otherwise, you may risk becoming trapped in a debt cycle.

Frequently Asked Questions

What are the risks associated with payday loans?

Risks include very high interest rates leading to debt spirals, insufficient funds when repayment is due resulting in more fees, potential damage to credit if not repaid, and lack of consumer protections compared to mainstream loans.

How do payday loans work and what should I watch out for?

You provide a post-dated check or electronic debit authorization for the amount borrowed plus a fee. On your next payday, the lender cashes the check or debits your account. Watch out for roll-over fees if you can’t repay and high default interest rates.

Are there alternatives to payday loans that I should consider?

Better alternatives are asking your employer for an advance on your paycheck, borrowing from family/friends, using a credit card, or taking out a personal loan from a bank/credit union at a lower interest rate.

What are the potential consequences of defaulting on a payday loan?

Potential consequences include additional fees, continuous debt collection calls, lawsuit threats, wage garnishment, closed bank account due to lender withdrawals, and harm to your credit score or negative marks on your credit report.

How can I determine if a payday lender is reputable and trustworthy?

Check if they are licensed in your state, read online reviews, make sure they disclose all fees transparently, and avoid lenders who try hard sales tactics or pressure you. Reputable lenders won’t call excessively or threaten consequences.