Payday loans are short-term borrowing with high-interest rates and fees. They appeal to borrowers who need quick cash, but they negatively impact an individual’s credit rating. One common question among borrowers is how long a payday loan stays on their credit report.

Payday loan company lenders use credit reports to determine a borrower’s creditworthiness and ability to repay debt. Having negative items on the report makes it hard for an individual to secure loans or rent and lease properties. The following blog post looks at how long a payday loan stays on a credit report and how borrowers can ensure timely loan repayment to avoid them.

Summary

- Various payday loans negatively impact a borrower’s credit report, appearing for up to 7 years from the date of repayment or default, per the Fair Credit Reporting Act (FCRA).

- Defaulting on a payday loan leads to collections, legal action, and other negative consequences that harm a borrower’s credit score and financial status.

- Borrowers must read and understand the terms and conditions of the loan before taking it out and only borrow what they can repay on time to avoid defaulting. Choosing a reputable payday loan lender is essential to ensure fair terms and conditions.

- There are different types of payday loans, including single-payment and installment loans, and payday loan borrowers must carefully examine which type is best for their financial situation and time repayment ability.

- Payday loans are expensive due to high-interest rates, short repayment terms, and renewal or rollover fees.

- Borrowers must make timely payments, reduce credit utilization, and regularly check their credit reports for errors to improve credit scores. This practice mitigates the risks of dealing with a payday loan lender and ensures a more manageable borrowing experience.

Payday Loans On The Credit Report

Payday loans harm a borrower’s credit report. The lender reports the loan to one or more credit bureaus when a borrower takes out a payday loan. The loan appears on the borrower’s credit report, which records their credit history.

Borrowers who repay the loan on time generally have a neutral effect on their credit score. But those who cannot repay the loan and it goes into default receive a significant negative impact on their credit score. This can lead to a bad credit score due to an unpaid payday loan.

Defaulting on a payday loan can happen due to several reasons. One common reason is the failure to fulfill the terms of the payday loan agreement. Defaulting leads to collections, lawsuits, and other legal action, appearing on the borrower’s credit report and harming their credit score. Payday loans appear on a borrower’s credit report for up to 7 years from the date of repayment or default, per the Fair Credit Reporting Act (FCRA).

Defaulting On A Payday Loan

Failing to repay a payday loan is why it appears as a negative item on their credit report. Defaulting on a payday loan leads to collections, legal action, and other negative consequences that harm their credit score and financial status. One such consequence is having an unpaid debt.

But there are ways to avoid defaulting on a payday loan. Borrowers must read and understand the terms and conditions of the loan before taking it out, and they only borrow what they can repay on time. Late repayment is a factor that contributes to a worsening credit history. They can communicate with the lender if they are having trouble repaying the loan and explore options such as repayment plans or extensions. Different payday loan debt options are available that match different financial situations.

Different Types Of Payday Loans

Borrowers must carefully examine which type of payday loan is best for their financial situation and repayment ability. There are different payday loans, including types of loans such as single-payment and installment loans. Single-payment loans require borrowers to repay the entire payday cash loan amount with fees in one lump sum on their next payday. Installment loans allow borrowers to repay the loan in smaller, more manageable installments over a longer period.

What Makes A Payday Loan Expensive?

Borrowers need to know what makes payday loans expensive to avoid the pitfalls that lead to a debt cycle. Payday cash loans get expensive in certain cases, but borrowers have control over the cost of their loans. Listed below are the factors contributing to the high payday loan cost.

- High-interest rates – Payday loans have very high-interest rates, exceeding 300% APR, according to the Federal Reserve Bank of St. Louis. The lenders justify the high rates as necessary to compensate for the risk of lending to borrowers with poor credit ratings or no credit history.

- Short repayment terms – Payday loans are usually due on the borrower’s next payday, meaning the repayment period is usually only a few weeks or a month. The short repayment period makes it difficult for borrowers to repay the loan on time, leading to more fees and interest charges, especially for those with a poor credit rating.

- Fees – Payday lenders charge various fees, such as loan origination, application, and late payment fees. The fees add up quickly, making the loan even more expensive.

- Renewal or rollover fees – Borrowers who cannot repay the loan on time can renew or roll over the loan for an extra fee. It leads to a cycle of debt where the borrower repeatedly extends the loan and pays added fees each time.

Cost Of Payday Cash Advance Loan

The cost of a payday cash advance loan varies depending on the lender, the borrower’s credit history, and the amount borrowed. The fees for a payday cash advance loan range from $10 to $30 for every $100 borrowed, with an average annual percentage rate (APR) of around 400%, according to Incharge.org.

| Scenario | Lender | Credit Score | Loan Amount | Fee (per $100) | APR | Total Cost |

|---|---|---|---|---|---|---|

| A | Lender A | Excellent (800+) | $500 | $15 | 391% | $90 |

| B | Lender B | Good (700-799) | $500 | $20 | 417% | $120 |

| C | Lender C | Fair (600-699) | $500 | $25 | 435% | $150 |

- Scenario A – Lender A charges $15 for every $100 borrowed. The total fee is $75, and the total cost for a $500 loan is $575. The monthly payment depends on the agreement with the financial institution and the chosen financial product.

- Scenario B – Lender B charges $20 for every $100 borrowed. The total fee is $100, and the total cost for a $500 loan is $600. In this case, the monthly payment might be higher than in Scenario A, considering the financial institution and the type of financial product.

- Scenario C – Lender C charges $25 for every $100 borrowed. The total fee is $125, and the total cost for a $500 loan is $625. The monthly payment can be the highest among the three scenarios based on the financial institution and financial product selected.

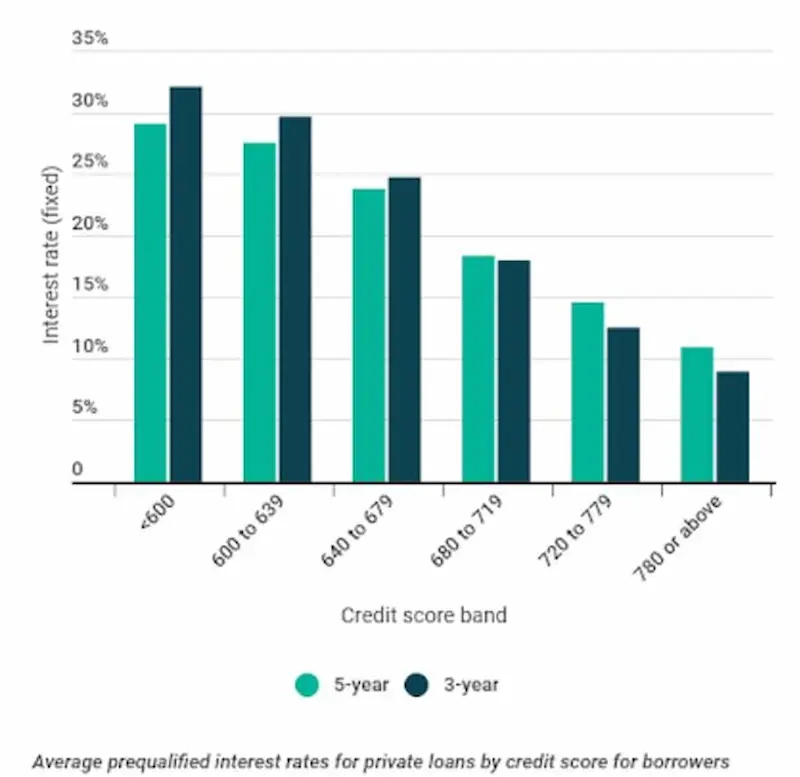

It’s worth noting that borrowers with higher credit scores have access to lower interest rates and fees when it comes to payday loans.

How To Improve Your Credit Score

A credit score is a numerical representation of an individual’s creditworthiness based on their credit history. It’s calculated using various factors, including payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries. Lenders and creditors use credit scores to decide if they want to lend money or extend credit to an individual and what interest rates and terms to offer.

A credit score ranges from 300 to 850, with higher scores indicating better creditworthiness. A score of at least 650 is generally a fair credit score, while scores above 700 are good to excellent.

A good credit score is necessary because it affects an individual’s ability to obtain loans, credit cards, and other forms of credit. A good credit score helps borrowers qualify for better interest rates and terms, which saves them money in the long run.

A credit score impacts other areas of life, such as insurance rates, rental applications, and even job applications in certain cases. A low credit score makes it difficult to obtain credit or results in higher interest rates and fees. There are ways to improve credit scores, such as using payday loan alternatives and paying bills on time. Dealing with a bad credit rating doesn’t have to be a burden, and utilizing alternatives to Payday Lending while repaying loans on time can lead to improvements.

Below are some statistics about how long a payday loan stays on your credit report:

| Statistic | Value |

|---|---|

| The average impact of a payday loan on credit score | The average impact of a payday loan on credit score |

| Percentage of lenders who pull credit reports for payday loans | 50% |

| Percentage of lenders who consider payday loans a negative factor in lending decisions | 30% |

| Average impact of a payday loan on credit score | 50 points |

Using Payday Loan Alternatives

Payday loans are a costly form of credit and must be avoided sometimes. Understanding the various alternatives to payday loans and finding an affordable option is necessary to ensure financial success. Several alternatives are available for people who need quick cash but want to avoid the high costs associated with payday loans. The best payday loan alternatives are listed below, which can be great solutions for those struggling with a bad credit rating and aiming to make loans on time.

- Personal loans – are unsecured loans repaid for one to five years. They have lower interest rates and fees than payday loans, but the approval process takes longer. As a responsible borrower, paying off any unpaid loan to maintain a good credit score is essential.

- A credit cash advance allows borrowers to get cash advances against their credit limit. But it comes with high fees and interest rates. Be cautious about using this option, as it can increase the chances of an unpaid loan.

- Credit counseling – Credit counseling or debt management services can help individuals negotiate with their lenders and create a repayment plan that works for their budget if they are struggling with debt and can’t afford to pay their loans. They can also assist in dealing with a network of payday lenders to find a suitable repayment plan.

Paying Bills On Time

- Paying bills on time. Payment history is a significant factor that lenders assess when evaluating an individual’s creditworthiness. Late or missed payments negatively impact borrowers’ credit scores, making it harder for them to obtain credit in the future. It results in more fees and higher interest rates, which leads to further financial difficulties. Here are certain steps borrowers must take to avoid missing time payments and dealing with unpaid repayment issues.

- Create a budget. Borrowers must create a budget outlining their monthly expenses, including bills, rent/mortgage, groceries, and other necessary expenses. Doing so helps them plan for their payments and guarantee that they have enough money set aside to cover them.

- Set up automatic payments. Borrowers need to set up automatic payments for bills that have a consistent amount each month. It assures that payments are on time without making them manually.

- Use payment reminders and check for approval. Many banks and credit card companies offer payment reminder services through email or text messages. Regularly check for approval and ensure that payments are processed correctly.

- Prioritize bills. Borrowers struggling to pay all their bills on time must prioritize them based on which ones have the highest interest rates or fees. Doing so helps them avoid extra charges and penalties while managing unpaid repayment commitments.

Conclusion

Payday loans harm borrowers’ credit scores for up to seven years, leading to collections and legal action. Borrowers must understand loan terms, borrow what they repay, and communicate with lenders to avoid defaulting. Different payday loans match different financial situations, such as an average or additional payday loan. High-interest rates, fees, and renewal fees make payday loans expensive. Borrowers with higher credit scores have lower rates and fees. Timely payments and long credit history improve credit scores. Moreover, knowing applicable payday loan laws is crucial to ensure compliance and avoid unwanted complications.

Frequently Asked Questions

How long does a payday loan typically remain on your credit report?

Payday loans can remain on your credit report for up to 7 years, even after being paid off, though you can request removal once settled.

Does the duration that a payday loan stays on your credit report vary depending on whether it was repaid on time?

No, the length of time a payday loan remains on your credit report does not vary based on whether you repaid it on time or not.

Can I request the removal of a payday loan from my credit report once it’s paid off?

Yes, you can request the payday lender or credit bureaus remove the loan from your credit report after it is fully paid off.

Do payday loans have a different impact on my credit score compared to other types of loans?

Payday loans can negatively impact your credit score more than other loans since they indicate reliance on high-cost debt.

How can I minimize the negative effects of a payday loan on my credit history?

Pay off the loan quickly, maintain on-time payments, and request removal once settled to minimize effects on your credit history.