Like most people, you probably have some debt you’d like to pay off. But with so many bills and so little money, it can be hard to know where to start. That’s why it’s essential to understand how to sort your debts in priority.

The first step is to list all your debts, including the amount owed, the interest rate, and the minimum monthly payment. This will help you to see exactly where you stand.

Next, you’ll want to prioritize your debts. The general rule is to start with the debt with the highest interest rate. This is because the longer you carry debt, the more you’ll pay interest.

However, there are other factors to consider as well. For example, if you have a debt with a low balance, you may want to pay it off first to get rid of it quickly. And if you have a debt close to the statute of limitations, you may want to pay it off before it disappears.

Once you’ve sorted your debts into priorities, you can start working on a plan to pay them off. This may involve sacrifices, but it will be worth it in the end.

What are the primary measures to help you deal with debt?

Talk to your creditors:

If you’re having trouble paying back your debts, it might be time to talk to your creditors. You can do this by calling or writing them.

You don’t need an appointment; ask for a short conversation about what you owe and when you plan to repay it. It’s also good to bring along documents showing your payments and balances.

Your creditor may agree to lower your interest rate or extend your repayment period. If they don’t agree to anything, you may want to consider filing bankruptcy.

Getting independent advice:

It’s always best to seek professional advice from someone who knows you and your situation. A financial advisor or lawyer could give you tips on tackling your debt problems. They can also advise whether you qualify for certain loans or credit cards.

Your bank or credit union is an excellent place to find these professionals. They often offer free consultations and services.

Working out a personal budget:

It’s easy to spend too much money without realizing it. To avoid overspending, you’ll need to set up a budget.

This means tracking every penny you earn and spending every dollar you receive. Once you’ve done this, you should be able to figure out how much you need to save each month.

This way, you’ll know how much money you have left after meeting your needs. You can decide which expenses you can afford to cut back on.

Putting your debts in order of priority:

Now that you’ve got a better understanding of your finances, it’s time to put your debts in order of their importance.

You’ll want to ensure you have a clear picture of your total debt load. Then, you’ll want to work out your priorities.

For example, if you have multiple credit card bills, you’ll want to focus on getting those paid off first. After that, you can move on to your mortgage and car loan.

Next, you’ll want to write down all of your debts. Ensure you include unpaid bills, such as utilities and insurance premiums.

After that, you’ll want to prioritize your debts based on their size. The smaller the amount, the higher the priority.

For example, if you have $1,000 in credit card debt, you’ll want to pay that off before tackling your student loan.

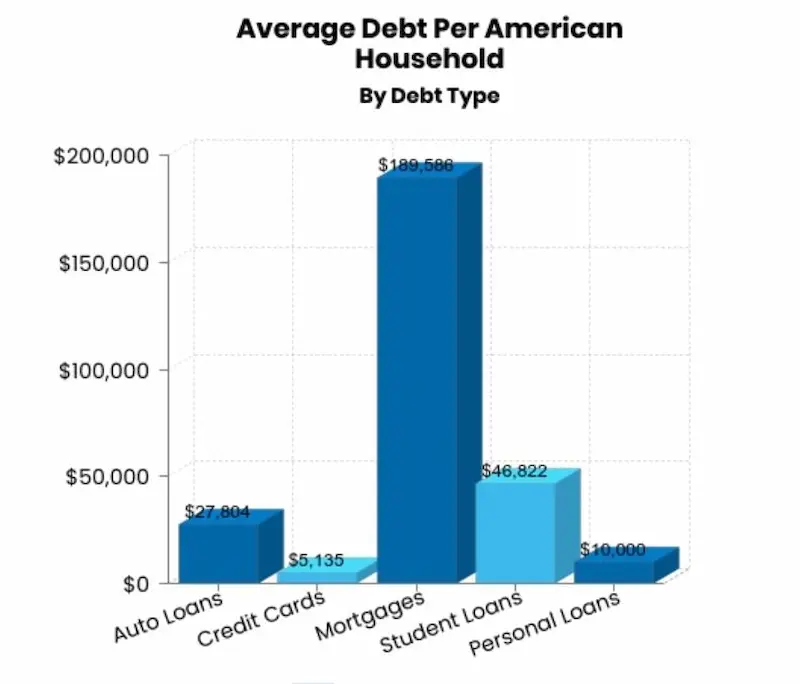

Once you’ve worked out your priorities, you’ll want to create a plan to eliminate your debts. This may mean making some cuts to your lifestyle. Below are statistics on priority debts:

| Type of debt | Average amount owed |

|---|---|

| Mortgage or rent arrears | $7,000 |

| Child maintenance | $3,000 |

| Council tax | $2,000 |

| Utility bills | $1,000 |

| Fines and legal costs | $500 |

Make a list of everything you owe:

To help you keep track of your debts, you’ll want to make a list of everything you own.

Start with your home and add other items like furniture, appliances, cars, etc. Next, go through your monthly bills and record the amounts owed. Then, take a look at your credit report. Look for any errors or mistakes preventing you from getting approved for new credit.

If you’re having trouble paying your bills, contact your creditors immediately. Explain why you haven’t been able to meet your obligations and ask them to consider lowering your payment.

You might also want to talk to your local consumer protection agency. These organizations are there to protect consumers from unfair business practices.

They can provide information on how to file complaints against businesses that aren’t following fair lending laws.

Why it’s essential to pay off debts in the right order?

Debt can be a difficult thing to manage. There are many different types of debt, and each has its rules and regulations. It can be challenging to keep track of all of the different debts that you have and to make sure that you are making the payments on time. Paying off debts correctly to get rid of them as quickly as possible is essential.

The first step in paying off debt is determining your type of debt. There are two main types of debt: secured and unsecured. Secured debt is debt that is backed by collateral, such as a car loan or a mortgage. Unsecured debt is debt that is not backed by collateral, such as credit card debt or medical bills.

Once you know what type of debt you have, you can start to figure out the best way to pay it off. You should pay off secured debt first because if you default on this type of debt, the lender can take your collateral. You should pay off unsecured debt next because this type of debt has no collateral and is more challenging to get rid of.

What are priority debts?

Priority debts are debts that you must pay before any other debts. These debts include things like child support, alimony, and taxes. Priority debts are often given priority status because they are considered essential to someone’s well-being or because they are required by law.

Why should you pay off priority debts first?

There are a few reasons why you should pay off priority debts first. The first reason is that these debts have a higher interest rate. This means that the longer you wait to pay them off, the more money you will end up paying in interest.

The second reason is that these debts may have late fees or other penalties. These fees can add up quickly and make paying off your debt even more difficult. The third reason is that priority debts may be secured by collateral. This means that if you default on the debt, the lender may be able to take possession of the collateral. This can put you in a difficult financial situation.

Frequently Asked Questions

What factors determine the priority of different types of debts?

Key factors are secured vs unsecured status, interest rates, penalties for nonpayment, and impact on credit score and essential services.

How can I prioritize my debts to minimize financial stress?

Focus on secured debts first, then high interest credit cards, personal loans, and lower interest student and auto loans to minimize penalties.

Are there legal consequences for not paying higher-priority debts first?

Yes, lenders can take legal action like wage garnishment for defaulting on secured debts or high interest loans.

What strategies can I use to manage and pay off high-priority debts more effectively?

Strategies include budgeting, debt consolidation loans, balance transfers, debt management plans, credit counseling, and negotiating with lenders.

Can you provide examples of debts categorized by priority to help me understand better?

High priority – mortgage, auto, taxes, child support. Medium priority – credit cards, personal loans. Low priority – student loans, medical debt.