Poor credit might make it difficult to get loans, credit cards, or other forms of financial help. Low credit scores might also affect the amount and interest rate of the loan you are accepted for, increasing the cost of the loan. There are several methods for improving your credit score. You may even discover how to instantly raise your credit score by 100 points.

1. Repay Your Delinquent Credit Card Balance

Paying off past-due payments of more than 30 days is one of the most effective strategies to boost your credit score by up to 100 points credit score overnight.

A missed payment should not make any difference. Your score may drop if a balance hasn’t been paid in full for more than a month. Your credit score will be affected if the payment is not paid to credit card companies for a more extended period. To stop the bleeding and improve your credit score, pay off any outstanding credit card or loan balances.

Late or missed payments are not acceptable to a credit card issuer or lender. They want to be sure that they can repay their loan. Late or missing payments don’t give them that assurance. They may also be concerned that you will prioritize other accounts over your loan.

To reduce the number of delinquent accounts, pay off smaller balances first. These delinquencies should be paid as soon as possible, and your credit score will reflect your hard work.

2. Credit balances should not exceed 30%

Credit use has a big influence on your credit score. Your credit usage percentage should be no more than 30%. If you have a $1,000 monthly credit limit, you should not exceed 300.

Consider opening another credit card account if you use more than 30% of your credit each month. You can split your credit across multiple accounts to keep your credit utilization below 30%, provided you pay all balances.

To increase your credit limit, you can also increase it. Your credit utilization will increase by 50% if you spend 0 per month on your credit card and your credit limit to $1,000. Your credit utilization will increase to 30% if you increase your credit limit from $500 to $1,500 and still spend $500.

Ask your credit card provider or another lender for a credit limit raise. You are not required to ask for a credit limit increase. If you have a poor payment history and spending habits, you might be denied. Your provider should consider increasing your credit limit if you are a responsible borrower.

3. You can pay your bills on time

Although it may seem straightforward, if you do not pay your bills on time, you will have difficulty raising your credit score by 100 points overnight. This is the primary worry of lenders.

It is essential to organize and set up automatic payments to pay your bills on schedule. Most bills are predictable. By setting up automatic payments for your credit cards, utility bills, and car payments, you will be able to pay at least the minimum amount.

4. Report Errors

Both lenders and credit bureaus make mistakes when it is about your accounts. Each month, lenders report successful and unsuccessful payments to Equifax, Experian, and TransUnion. There will be errors every once as many lenders process and report information on thousands upon thousands of accounts each month.

Credit bureaus might also report incorrect or inexact information.

No matter who is responsible, correcting credit errors is an excellent way to improve your score quickly. You can request an annual credit report from any of the credit bureaus.

Each credit bureau will provide one credit report per year. Take a look at your credit reports by credit reporting agencies and make a note of any errors.

Call your lender to correct any lender errors. You can show the lender the error and ask them to correct it. Call the credit bureau to correct the account and dispute the report.

Although it can take some time to go through credit reports, it is worth the effort. It is easy to fix errors and improve your score.

5. Create a Credit Monitoring account

A paid or free credit monitoring service is one of the best ways you can keep your credit score in check. Numerous financial institutions offer free credit monitoring services.

You can use services that offer real-time alerts as well as free credit score monitoring. These monitoring accounts allow you to immediately open an online dispute if you notice inaccuracies in your credit report.

You can also monitor your financial accounts to detect fraud quickly and minimize risk. You should notify your monitoring system whenever your account balances change. Your credit utilization ratio should also be monitored.

6. Report Rent and Utility Payments

Did you know that lenders don’t have to report your payments on credit bureaus? Landlords and utility companies, like lenders, are not required to report successful payments.

Lenders almost always report your payments. However, landlords and utility companies are not required to do so. Your credit score can be built by paying utilities and renting.

Call your landlord or utility company to request that they start reporting your payments. Keep making payments, and your credit score will increase.

While this will not immediately enhance your credit score, it will assist you in building your credit history and avoiding more debt. Bear in mind that late payments, like successful rent or utility payments, may be bad for your credit score.

7. Get a Secured Credit card

A secured credit card is a good option if you have trouble getting a car loan or opening a traditional card. Secured debt in finance is debt that is secured by collateral. Secured credit card holders are at risk if they default. Mortgages and vehicle loans are the most frequent secured loans.

However, secured credit cards exist as well. Although these cards function exactly like traditional credit cards, users must deposit collateral or make a security deposit to obtain the card. The credit card company can take your deposit or collateral if you fail to pay your card payments.

8. Register to become an Authorized User

One of the best ways to improve your credit score is to become an authorized user of another’s credit card. If you have a history of employment and good relationships with owners or managers, you may be able to become an authorized user of your employer’s credit card.

Many times, young people become authorized users of their parents’ accounts. This happens when young adults start to go to college or branch out on their own.

You should ensure that you are an authorized user of another account. Poor money habits can hurt your score, but you can also benefit from good money habits.

9. Do not close old credit accounts

Although you don’t want to have debt accounts hanging over your head, you mustn’t close any credit card or loan accounts before applying for another loan. This will only harm your credit score. Don’t close your accounts if you don’t plan to open any new credit lines.

10. Take a Credit Building loan

Credit building loans are a great way to improve your credit score. You can get small personal loans up to $500 with no credit check.

All payments will be reported to credit bureaus to improve your credit score. You can repay the loan in four installments for a single month with our installment loans.

These loans are often part of the predatory online payday loan industry. You will need to repay your loan by your next payday.

The product is easy to use and allows you to defer payments for 29 days with no penalty. You can access the money you need with payment flexibility without being stuck in a cycle or getting into debt.

In our commitment to providing comprehensive financial solutions, we proudly share the list of American states where our company is actively operating to help individuals raise their credit scores. Our dedicated team has been working tirelessly nationwide, empowering individuals to improve their financial well-being. Please find below the table detailing the states where our services are available.

| Alabama | Alaska | Arizona | Arkansas |

| California | Colorado | Connecticut | Delaware |

| District Of Columbia | Florida | Georgia | Hawaii |

| Idaho | Illinois | Indiana | Iowa |

| Kansas | Kentucky | Louisiana | Maine |

| Maryland | Massachusetts | Michigan | Minnesota |

| Mississippi | Missouri | Montana | Nebraska |

| Nevada | New Hampshire | New Jersey | New Mexico |

| New York | North Carolina | North Dakota | Ohio |

| Oklahoma | Oregon | Pennsylvania | Rhode Island |

| South Carolina | South Dakota | Tennessee | Texas |

| Utah | Vermont | Virginia | Washington |

| West Virginia | Wisconsin | Wyoming |

How is your credit score calculated?

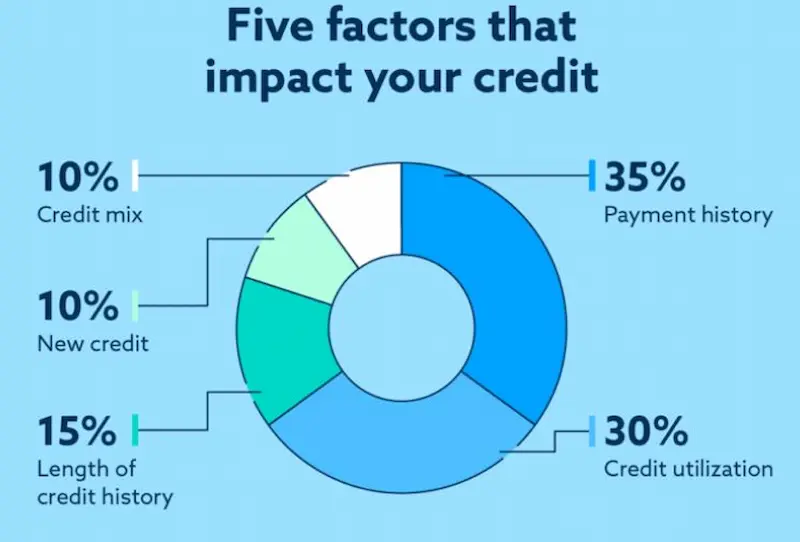

It is important to understand what makes up your credit score and how credit works. This knowledge will allow you to make sound credit decisions and keep your credit standing intact. Let’s get on with it.

- 35 % Payment History:

The biggest influence on your credit score is your monthly payment history. Your payment history simply records your past payments on any loan account or credit line over the past 7-10 years.

- Credit Utilization (30%):

The amount of credit you utilize each month is referred to as your credit use. Your credit usage should be at least 30% of your monthly credit limit, according to credit bureaus and lenders.

- Length and Credit History (15%):

The better your credit history, the longer you have it. Your credit history will look better if you have made regular payments for ten years. A credit history that is seven years old or more is good for your credit score.

- Credit Mix (10%):

Your credit mixture is comprised of all your debts. Lenders are looking for a varied credit profile. An auto loan lender may see that you have never taken out a loan and only had credit cards. This can indicate inexperience.

- New Credit (10%)

Your credit score should have fewer accounts recently opened. Every time you apply for new credit, you will receive a credit inquiry. When you are applying for new lines or loans, a hard inquiry can be common. This can affect your credit score by anywhere from 5-10 points. Therefore, you should have no more than five inquiries within six months.

Here are some statistics on showing how your credit score is calculated:

| Factor | Percentage |

|---|---|

| Payment history | 30% |

| Amount owed | 30% |

| Length of credit history | 15% |

| New credit | 15% |

How often does your credit score update?

When credit bureaus receive reports from lenders, they will update your credit score. Lenders usually submit monthly reports, so your credit report should be updated every 30-45 days. You may receive updates more frequently from some lenders than others, or they may report on a different schedule.

Your credit report is a key indicator of your credit score. Therefore, your score could change as your report changes. Not every update will have an impact on credit scores.

Good credit scores are essential for securing low-interest rates and future credit opportunities. You can improve your credit score by paying attention to your credit reports and practicing healthy money habits.

Frequently Asked Questions

How can I improve my credit score over time?

Pay all bills on time, keep credit card balances low, avoid applying for unnecessary new credit, monitor your reports for errors, and pay down debts to improve your credit score.

What are the best strategies for raising my credit score?

Reducing debt, increasing credit age, only applying for needed new accounts, and establishing a record of responsible use of revolving credit help raise scores most effectively long-term.

How long does it typically take to see an improvement in my credit score?

You can see a credit score increase in as little as a month, but significant improvement takes 6 months to a year of consistent positive financial behaviors like paying on time.

What factors have the most significant impact on my credit score?

Payment history and outstanding debt amounts relative to total available credit limits are the most influential factors, comprising over 60% of typical credit scoring models.

Are there any legitimate credit repair services that can help me improve my credit score?

Nonprofit credit counseling provides education. But businesses make no promises, as no company can remove accurate negative data. Only time and good financial habits will truly improve credit.