Unsecured loans:

These are unsecured loans that do not require collateral as security. You can use them for any purpose, but they are typically used for short-term needs such as emergencies, car repairs, and other unexpected expenses. Unsecured loans may also be called Short-term Loans or “no-document” loans. Loan funds are usually provided by personal loan lenders.

Secured loans:

A secured loan requires some form of collateral to secure the loan, including real estate, vehicles, jewelry, or even life insurance policies. Secured loans are usually used for longer-term purposes like buying a house or paying off debt. A debt consolidation loan is a common type of secured loan offered by financial institutions.

Joint personal loans:

Joint personal loans involve:

Two or more borrowers.

Usually close relatives or friends.

Applying for a loan together.

Joint personal loans may be used for various purposes and can be secured or unsecured. This arrangement usually provides a longer repayment period and may result in more favorable interest rates. However, both applicants are equally responsible for the loan repayment as if they had taken the loan individually. Some applicants might consider using Credit cards or a secured credit card as an alternative to a joint personal loan.

Joint personal loans are often used when one person has a large debt and wants to help pay it off or if someone has poor credit scores and needs the support of a co-borrower. A joint personal loan allows two individuals to borrow money together as a credit personal option. The borrower must be at least 18, and both parties must sign the agreement.

Cash advances:

This type of loan is similar to payday loans because it immediately gives borrowers access to cash. However, cash advances cannot be paid back over time, unlike payday loans. Cash advances are typically only offered by banks and credit unions, not by an online lenders.

Payday loans:

Payday lenders offer small-dollar loans designed to provide temporary financial assistance until the next paycheck arrives. They usually have high loan rates, making them less attractive to borrowers. These loans are typically costly, and many borrowers need help repaying them.

Bad credit home equity lines of credit (HELOC):

A bad credit lender might offer an alternative in the form of a home equity line of credit (HELOC) for those with poor credit scores. This option allows homeowners to borrow against the equity in their homes, often without a soft credit check.

A HELOC is an adjustable-rate mortgage that allows homeowners to take out a line of credit against their property. It works similarly to a traditional fixed-rate mortgage, except that the interest rate adjusts every month based on changes in market conditions.

HELOCs are great for homeowners who want to use their homes as collateral for a larger loan, such as an equity loan. The bank will seize the property if the homeowner defaults on the loan.

Home equity lines of credit (or second mortgages) are considered safe investments. Most lenders will only allow borrowers to withdraw up to 80% of the value of their homes. However, there might be minimum credit score requirements, and lenders may also consider an applicant’s income ratio and request proof of income to determine eligibility.

Banks and credit unions offer these loans regulated by the Federal Deposit Insurance Corporation (FDIC). Funds are typically available within a few business days after approval.

Student loans:

If you’re going to school full-time, student loans can make sense. You’ll pay less interest if you take out a federal Stafford loan, and private student loans are eligible for government grants. Some lenders also offer specialized loans for people with a lower annual income, which can be helpful for students who might not have a high income but need help managing their credit card debt during their studies.

However, your monthly payments might get too high if you take out multiple loans. Student loans have higher rates than most other loans, so you should shop around before signing anything.

If you don’t qualify for student loans, consider applying for scholarships. Many schools offer merit-based awards that cover tuition costs.

How can you get a bad credit loan?

Determine how much you need:

The first step is figuring out how much money you need. To do this, you’ll need to determine how much you spend each month and what kind of lifestyle you want to live.

You may not know exactly how much money you need, but there are several ways to estimate it. For example, you can calculate your budget using the “rule of 30.”

To determine your need, multiply your total monthly income by 30%, giving you a rough idea of how much you need to save each month.

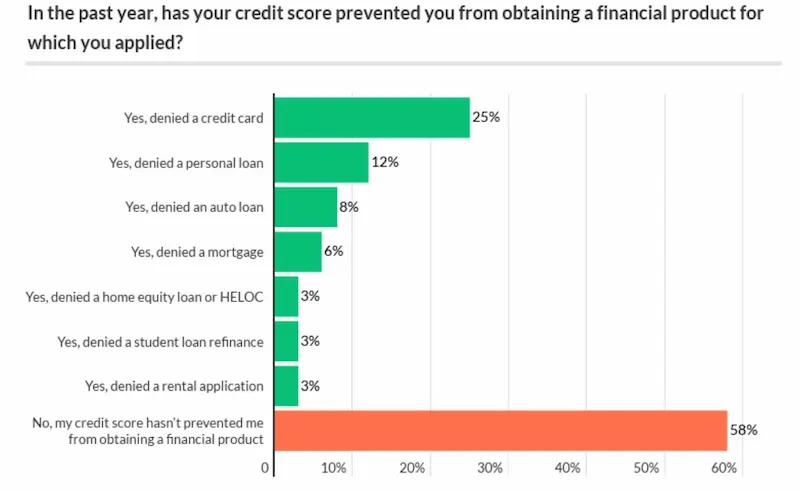

Calculate your credit score:

People with a poor credit history may need help to secure traditional loans. However, Auto loans and Online Loans can cater to borrowers with less-than-perfect credit. By knowing your credit score, you can better evaluate your options and determine which lenders are more likely to approve your application.

The online application process makes it easier for borrowers to explore different lending options. When seeking a loan with bad credit, consider the loan terms, including interest rates and loan payments, to ensure they are manageable within your budget.

Remember, lenders are willing to work with borrowers with credit scores that may need to meet the requirements for traditional loans. You can secure the necessary funds as long as you demonstrate your ability to repay the loan.

Once you’ve determined how much you need, you’ll need to check your excellent credit score. There are three major credit bureaus — Equifax, Experian, and TransUnion. Each has a scoring system determining whether you qualify for a loan.

Your credit score is calculated from information found on your credit report. The better your credit score, the lower your interest rate.

Get prequalified:

Next, you’ll need to find a lender to lend you the money you need. Lenders typically require applicants to complete a prequalification form, which includes basic financial information such as salary and debt obligations, which helps lenders figure out how much they can afford to lend you.

Making payments on time and having responsible credit usage can significantly impact the outcome of loan applications and the loan type you are eligible for. Lenders also look at your credit history when determining how much they can lend you during the loan process. They may ask about any late time payments or foreclosures in your past.

They may also request copies of your credit reports. These reports contain information about your payment history, outstanding debts, and recent inquiries made to creditors.

Compare rates and loan terms:

After you’ve completed the prequalification process, you’ll compare different loan options. Some lenders offer a wide range of traditional loans, and others may provide more specialized options, which provide an option for borrowers with varying needs and approval odds.

When comparing loans, keep these things in mind:

- Interest rate.

- APR (annual percentage rate).

- Length of the repayment term.

- Repayment amount.

- Loan company reputation and customer service.

In addition to these factors, some lenders may include additional fees. Look for personal loan applications that have flexible repayment terms and competitive interest rates. Please always read the fine print before signing an agreement.

Apply online:

Finally, apply for the title loans online. Most lenders now allow borrowers to apply for a loan online. Some lenders even provide instant approval. Follow their instructions carefully if you choose a traditional legitimate lender. Remember to sign all documents, including the application and loan agreement.

How can you choose the best lender?

Customer Experience:

If you’re looking for personal loan companies, consider choosing a lender with a good customer service team. A company with an excellent reputation can answer questions quickly and help you get approved for loan proceeds.

A reputable lender will have clear policies and procedures. They’ll ensure you understand what happened and why if something goes wrong.

You want a lender who understands your needs. Look for companies that offer reasonable terms, flexible repayment plans, and affordable monthly payments to avoid high-interest debt.

Unique features:

Beware of Predatory lenders and focus on choosing a lender with unique features that cater to your specific needs. These may include online account management, mobile app functionality, or other special perks that set them apart.

Do you like getting deals? Do you enjoy saving money? Then consider a cash advance. This type of loan allows you to borrow up to $1,000 without paying back the full amount until you earn enough money to repay it. Alternative loans and loans for borrowers are gaining popularity as more people seek options outside the traditional banking system.

Cash advances are only right for some. But if you’re willing to put in a little extra work, you could save thousands of dollars using this option instead of a payday loan. Potential borrowers should research different lending options and compare them with a traditional bank loan to find the right fit for their needs.

Knowing what you’re looking for is the key to finding the right lender. For example, if you’re looking to consolidate debt, you’ll probably want to stick with a company specializing in that loan. Remember that access to quick cash may be tempting, but making informed decisions is crucial for long-term financial health.

Type of lender:

There are two main types of lenders: direct lenders and indirect lenders. Another option is a lending platform, which connects borrowers with multiple lenders to provide more choices and better rates.

Direct lenders are those that offer loans directly to consumers. Indirect lenders sell loans to other businesses. The right choice for you depends on your circumstances and the funding time you require.

Direct lenders tend to be smaller than indirect lenders. They often specialize in certain types of loans, such as installment loans, and may be more prevalent in areas like West Virginia.

Indirect lenders usually focus on larger loans. They may offer loans through banks, credit unions, mortgage companies, or finance companies. It’s also common for them to act as a credit card issuers.

Loan amounts:

Most lenders require you to fill out a form when applying for a loan. The information you provide helps determine how much you qualify for. They might also check your bank statements and cash flow to ensure regular income. Using a personal loan calculator can help you estimate your potential loan amount.

For example, if you need a small business loan, you might not qualify for a large loan. Instead, you’ll likely receive a smaller loan. Income requirements and a possible loan origination fee should also be considered.

Repayment term:

Many people need to realize that there are different payment options available. Some lenders offer fixed-rate loans, while others offer adjustable-rate loans.

Fixed-rate loans are easier to budget because they have a set interest rate throughout the life of the loan. Adjustable-rate loans change based on market conditions.

Adjustable-rate loans can be more expensive over time, especially when they reach triple digits. However, they also give you flexibility since you won’t have to worry about rising interest rates.

Interest rates and Fees:

Interest rates and fees vary depending on the type of loan you apply for, making them a major factor to consider. It is best to always shop around before making significant financial decisions involving larger amounts.

Some lenders, like a bad credit loan company, charge higher interest rates than others, like federal credit unions. It pays to research, so you know what you’re paying.

In today’s financial landscape, access to credit plays a pivotal role in achieving personal and professional goals. At our company, we strive to assist individuals facing financial challenges, including those with poor credit. We understand that each state has its own unique set of regulations and requirements regarding lending practices. As a result, we have expanded our services to multiple states nationwide, diligently working to help individuals in need. To assist you in navigating our coverage, we have compiled a table listing all the American states where our company is actively offering loans and financial solutions for individuals with poor credit. Please refer to the table below for a comprehensive overview of our coverage areas.

| Alabama / AL | Alaska / AK | Arizona / AZ | Arkansas / AR |

| California / CA | Colorado / CO | Connecticut / CT | Delaware / DE |

| District Of Columbia / DC | Florida / FL | Georgia / GA | Hawaii / HI |

| Idaho / ID | Illinois / IL | Indiana / IN | Iowa / IA |

| Kansas / KS | Kentucky / KY | Louisiana / LA | Maine / ME |

| Maryland / MD | Massachusetts / MA | Michigan / MI | Minnesota / MN |

| Mississippi / MS | Missouri / MO | Montana / MT | Nebraska / NE |

| Nevada / NV | New Hampshire / NH | New Jersey / NJ | New Mexico / NM |

| New York / NY | North Carolina / NC | North Dakota / ND | Ohio / OH |

| Oklahoma / OK | Oregon / OR | Pennsylvania / PA | Rhode Island / RI |

| South Carolina / SC | South Dakota / SD | Tennessee / TN | Texas / TX |

| Utah / UT | Vermont / VT | Virginia / VA | Washington / WA |

| West Virginia / WV | Wisconsin / WI | Wyoming / WY |

Here are some statistics about options for people with different financial situations:

| Statistic | Value | Source |

|---|---|---|

| Percentage of Americans with less than $1,000 in savings | 40% | Pew Research Center, 2021 |

| Average credit card debt in the United States | $6,572 | Federal Reserve, 2022 |

| Average payday loan borrower pays over $500 in interest and fees per year | $500 | Consumer Financial Protection Bureau, 2022 |

| Federal poverty rate in the United States | $12,760 for a single person and $25,750 for a family of four | U.S. Census Bureau, 2022 |

| Number of people who receive financial assistance from the government each year | Millions | U.S. Department of Health and Human Services, 2022 |

| Number of nonprofit organizations that offer financial assistance to people in need | Thousands | National Council of Nonprofits, 2022 |

Here are some things to keep in mind when comparing rates, which can be an option for people with different financial situations:

- Interest rates typically range from 0% to 30%, but can have a variable interest rate depending on the lender.

- Most lenders charge an origination fee of 1% to 5%.

- Repayment terms vary. Some lenders allow borrowers to pay off their loans early. Others only let you pay off the principal.

- Lenders may charge additional fees, including late charges, prepayment penalties, and application processing fees.

Frequently Asked Questions

What are the most common types of loans accessible to individuals with poor credit scores?

Payday loans, bad credit personal loans, secured loans requiring collateral, and subprime auto loans are some of the most common options for those with poor credit.

How can someone with a low credit score qualify for a personal loan?

Options include finding a cosigner, offering collateral, providing proof of steady income to show repayment ability, or choosing lenders specializing in bad credit.

What are the pros and cons of payday loans for people with bad credit?

Pros are quick cash and approval despite low scores. Cons are astronomically high fees and rates leading to dangerous cycles of new loans.

Are there any government-backed loan programs specifically designed for individuals with poor credit?

Some government small business loan programs like the SBA Microloan Program consider alternative criteria beyond personal credit scores and history.

What alternative lending options exist for those who need a loan but have a history of bad credit?

Options include online peer-to-peer lending, credit union payday alternative loans, secured credit cards, and participating in credit building programs.

Unemployed individuals with bad credit who need a loan may look into options like specialized personal loans for the unemployed offered by some online lenders, payday alternative loans from credit unions, secured credit cards, home equity loans if sufficient equity is available, hard money asset-based loans, borrowing from family and friends, or crowdfunding loans.