How to improve your 750 credit score? It is a question many people ask themselves when trying to get their financial life in order. The good news is, you can do it! Here are five easy ways to help you improve your credit score and achieve an excellent credit score:

- Building credit by paying off all your bills on time every month, showing lenders that you can pay them back and that you are responsible with money.

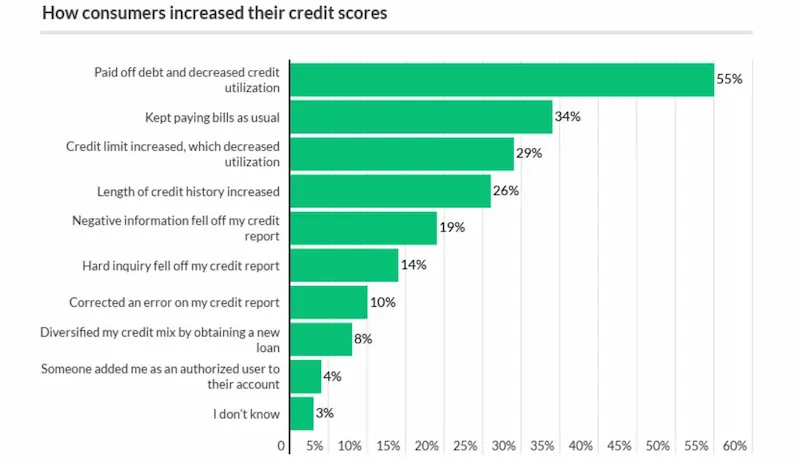

- If you have any debt, pay it down quickly to lower your credit utilization ratio.

- Only apply for new credit cards or loans once you have paid off at least one existing card or loan, preventing your credit score from being negatively impacted.

- Keep track of your payments to know exactly how much you owe each creditor. This will also help you maintain a good credit profile.

- Periodically request a credit limit increase on your existing credit cards, which can help your credit score improve by lowering your credit utilization ratio.

Why Is a Very Good Credit Score Pretty Great?

A Very Good credit score means you have a history of making timely payments on all your debts, which includes mortgages, car loans, and student loans. If you have a Very Good credit score, then you should be able to borrow money for any purpose, such as buying a home, getting a loan for a business, or taking out a personal loan

How to Get a 750 Credit Score?

It would help to start by checking your credit reports from the three major credit reporting agencies (Equifax, Experian, and TransUnion). These reports contain detailed information about your payment history and other essential details about your credit history. Once you have reviewed these reports, you can take steps to improve your current credit score.

Clear your balances

Paying off your outstanding accounts can help improve your credit utilization ratio, significantly determining your credit score. Aim to keep your credit utilization below 30% to maintain a healthy credit profile.

Monitor your credit score

Regularly monitor your average credit scores to track your progress and ensure that any improvements are accurately reflected. This will also help you stay informed about changes impacting your credit score.

Understand credit score requirements

Familiarize yourself with the credit score requirements for various types of loans and financial products. This knowledge will enable you to set realistic targets for improving your credit score and help you make informed decisions when applying for credit.

Minimize credit inquiries

Multiple credit inquiries within a short period can hurt your credit score. Whenever possible, avoid applying for multiple lines of credit simultaneously or within a short timeframe to protect your credit profile.

The first step is to pay off any outstanding balances on your credit card companies, auto loans, and other loans. Paying off old debts will lower your overall amount owed, increasing your available credit.

Establish a sound plan for future purchases

The next thing you need to do is to establish a solid payment plan for future purchases. Ensure you set up automatic payments for your monthly bills. Also, try not to carry too much credit card debt. You could default on some of your obligations if you don’t have enough cash flow to cover your expenses.

Once you have established a solid repayment plan, you should build a healthy credit history. Try to avoid using your credit cards unless necessary. Instead, use cash whenever possible. When you use cash instead of plastic, you will build a better credit record.

Regularly check your report and consider credit repair services

It’s essential to monitor your credit report to identify any discrepancies or negative items that might impact your credit score. In case of any inaccuracies or errors, you can consider using credit repair services to help improve your credit situation. By addressing these issues and working towards a credit increase, you’ll be on your way to establishing a healthier financial future.

Finally, always monitor your credit reports regularly. Check your credit scores periodically to see whether they have improved credit scores. If they last changed a while ago, you should contact credit repair companies or a consumer protection agency like the Federal Trade Commission. They can help you determine whether fraud has been committed against you or introduce you to tools like Credit Builder to improve your credit range.

As a company dedicated to helping individuals enhance their financial well-being, we are proud to share our active presence across various states in the United States. We understand the importance of a strong credit score, and our commitment to serving customers with a credit score of 750 and above has led us to establish operations in multiple regions. Below, you will find a comprehensive table highlighting the American states where our company is actively engaged, providing our expertise and support to individuals on their journey to credit excellence. Explore the table to discover how we can assist you in improving and maintaining your impressive credit score.

| Alabama (AL) | Alaska (AK) | Arizona (AZ) |

| Arkansas (AR) | California (CA) | Colorado (CO) |

| Connecticut (CT) | Delaware (DE) | District Of Columbia (DC) |

| Florida (FL) | Georgia (GA) | Hawaii (HI) |

| Idaho (ID) | Illinois (IL) | Indiana (IN) |

| Iowa (IA) | Kansas (KS) | Kentucky (KY) |

| Louisiana (LA) | Maine (ME) | Maryland (MD) |

| Massachusetts (MA) | Michigan (MI) | Minnesota (MN) |

| Mississippi (MS) | Missouri (MO) | Montana (MT) |

| Nebraska (NE) | Nevada (NV) | New Hampshire (NH) |

| New Jersey (NJ) | New Mexico (NM) | New York (NY) |

| North Carolina (NC) | North Dakota (ND) | Ohio (OH) |

| Oklahoma (OK) | Oregon (OR) | Pennsylvania (PA) |

| Rhode Island (RI) | South Carolina (SC) | South Dakota (SD) |

| Tennessee (TN) | Texas (TX) | Utah (UT) |

| Vermont (VT) | Virginia (VA) | Washington (WA) |

| West Virginia (WV) | Wisconsin (WI) | Wyoming (WY) |

What Does a 750 Credit Score Mean for Your Wallet?

If you want to buy a house, you might qualify for a mortgage with a good credit score. In addition, if you have a Very Good score, you will receive an interest rate lower than most people with fair credit or within the Average credit score brackets.

Your credit score also affects your ability to rent an apartment or condo. A high credit score indicates you are more likely to make your rental payments on time.

In addition, having a Very Good credit score will allow you to apply for certain types of insurance, including homeowners and life insurance.

Your credit score calculations also play a role in obtaining a job. Employers typically require applicants to provide proof of their credit history, which can be determined through different credit scoring models. The higher your credit score, the easier it will be for you to obtain employment. Understanding the various types of credit scores can be helpful in this process.

A Very Good credit score will also help you save money. You will be eligible for many discounts, including savings accounts, free airline tickets, and reduced hotel rates. Factors like credit account age and credit card balances can impact your score positively or negatively. Hence, it’s important to pay attention to these details. Credit card issuers are another aspect to consider, as they can influence credit scores.

How Good Is a 750 Credit Score?

According to FICO, a 750 credit score means excellent credit. This score indicates that you have no late payments, collections, or bankruptcy filings. It also shows that you have paid back every loan you have taken out over the past seven years.

You should know that this type of credit score does not mean you won’t ever experience financial problems. However, it will help you manage those problems when they arise.

What Are the Average Mortgage Rates for a 750 Credit Score?

The average home loan rate for a borrower with a Very Good credit score is currently 4.25 percent.

For borrowers with excellent credit, the average rate is 3.75 percent. For those with poor credit, the average rate rises to 5.5 percent. A bad credit score or limited credit history may cause this.

What Are the Other Factors Behind Your Mortgage Rate?

Several other factors influence your mortgage rate. These include:

- Credit rating agencies, which evaluate and report your creditworthiness

- Your income level

- How much equity do you have in your home

- Whether you own a second property

- The size of your down payment

- The amount of debt you carry

- The length of your mortgage term

- The number of properties you already own

- The type of mortgage product that you choose

What Can I Do With a 750 Credit Score?

Having a Very Good credit score opens up a world of opportunities. You can get a better deal on car loans, mortgages, student loans, and credit cards. Joining a credit score club can also provide additional benefits and insights into maintaining or improving scores.

For those with lower credit scores, options such as Secured cards are worth considering to help rebuild and improve their credit rating.

However, remember that having a Very Good credit rating doesn’t guarantee that you will never face financial difficulties again. You still need to pay attention to your finances and avoid unnecessary purchases. It’s also a good idea to periodically obtain credit report copies to track your financial history.

How to Check Your Credit Score for Free?

Many believe they can find credit scores in their credit reports from the three national credit bureaus. Contrary to popular belief, credit scores are only sometimes included in credit reports from the three national credit agencies. You should know a few things about credit ratings before we discuss where you may get them, such as weekly credit reports and understanding the variety of credit scores available to you.

One of the first things to understand is that multiple credit scores are available to you. Your credit risk, or the likelihood that you will pay your obligations on time, is reflected in your credit score. Your credit reports’ material is used in a formula to compute your credit ratings. Maintaining a good relationship with credit issuers and regularly reviewing your credit files to dispute credit report errors if necessary is important.

Equifax, Experian, and TransUnion, the three major national credit bureaus and firms like FICO, use various credit scoring algorithms and may rely on numerous data sources for determining credit scores. Because some lenders may only submit information to one or two of the three nationwide credit bureaus, some lenders’ credit ratings may differ from those offered by the other two bureaus. Additionally, lenders and creditors may consider data other than credit ratings when determining whether to extend credit to you. Factors like credit decrease, interactions with credit repair service companies, and credit counseling might play a role in a lender’s decision.

How, then, do you obtain credit scores? Here are several examples:

- Applying for installment loans from banks or credit unions can help you build or improve your credit and give insight into your credit scores.

- Opening lines of credit with responsible usage and timely payments can impact your credit scores positively, leading to a more accurate representation of your creditworthiness.

- Acquiring a secured credit card allows you to deposit a specific amount of money into an account, which functions as your credit limit. This method can help you establish or rebuild your credit history and scores.

- Use a free credit scoring website or credit score service. Some websites offer users a free credit score. Customers who pay a monthly subscription fee for credit monitoring services may receive credit scores from others.

- Get credit scores directly from one of the three main credit bureaus or another source, like FICO.

- Look at your loan, credit card, or bank statement. Credit ratings are now being offered to customers by many banks, loan firms, and credit card organizations. You could find it by entering into your account online, or it might be on your statement.

Here are some statistics on 750 credit score:

| Statistic | Value |

|---|---|

| Percentage of Americans with 750+ credit score | 25% |

| Likelihood of being denied loans and credit cards | More likely |

| Likelihood of being denied for loans and credit cards | Less likely |

| Likelihood of being able to get a lower down payment on a mortgage | More likely |

| Likelihood of being able to get a higher credit limit on credit cards | More likely |

What Is the Fastest Way to Achieve a Perfect Credit Score?

The fastest way to achieve a high credit score is to pay off all your debts. If you do not pay debt, your credit score will be lower. However, your credit score should increase if you pay off your debts.

Frequently Asked Questions

What are the key strategies to maintain and improve a 750 credit score?

Keep utilization low, make on-time payments, limit hard inquiries, verify all information, and build diverse credit history over time. Monitor often.

What steps can I take to build credit if my score is currently below 750?

Get a secured card, become an authorized user, avoid new hard inquiries, pay all bills on time, lower utilization, and let history age.

How does credit utilization impact my credit score, and how can I manage it effectively?

Keeping utilization under 30%, ideally 10%, will improve scores. Pay down balances frequently, distribute spend across multiple cards, and ask for higher limits.

What are some common mistakes to avoid when trying to improve your credit score?

Avoid suddenly closing old cards, applying for lots of new credit, racking up card balances, and making late payments. Keep utilization low.

What’s the role of on-time payments in building and maintaining a high credit score?

Payment history is the biggest factor in credit scores. Always pay at least the minimum due before the deadline to boost your score over time.