It would be best to consider what it offers and how to find it, as with other types of insurance. If you’re considering looking for business insurance coverage for your commercial property, such as a commercial property insurance policy, be it that of the EIDL, 7(a), or any other loan that requires that you’ve got an insurance policy for risk that meets the loan requirements. The article below will discuss the Hazard Insurance Program for SBA and the specifics of risk insurance.

What Exactly Can You Call the Definition of An SBA Loan?

Small Business Administration (SBA) loan is a loan for small businesses backed through the SBA and can range from as high as eighty percent. These are the most common types of SBA loans:

- Business loans. EIDL loans. The current SBA Economic Injury Disaster Loans (EIDL) program will end in two days. The program allows loans between $2 and $2 million, at 3.75 percent interest (2.75 percent for not-for-profit organizations), with a loan term that is thirty years.

- SBA 7(a) loan program. This 7(a) program is the most frequently utilized SBA loan type and is available through SBA-approved lending institutions. The maximum sum loan that businesses are eligible to receive is $5,000,000. The SBA can guarantee up to 15% of the credit amount up to $150K. It will also guarantee 75 percent of the loan greater than $150K. This program is essential for various types of business insurance.

- SBA 504 loan. Borrowers can access this loan through SBA Non-Profit Partners. SBA 504 loans are particularly valuable for home-based businesses. CDCs is another term used to describe Certified Development Companies. Forty percent of the total loan funds SBA pays through the CDC. The third-party lenders will finance fifty percent of the amount. In comparison, the remaining 10 percent will be funded by the borrower using funds or the form of business equity. The company must create one job for every $165K borrowed.

- SBA Microloans. Micro-loans (up to $50k) The SBA will make available money to financial intermediaries such as Community Development Financial Institutions (CDFIs) and other non-profit community-based organizations. They then offer microloans to businesses.

If you’re seeking an SBA loan, you must prove that you have insurance against risk.

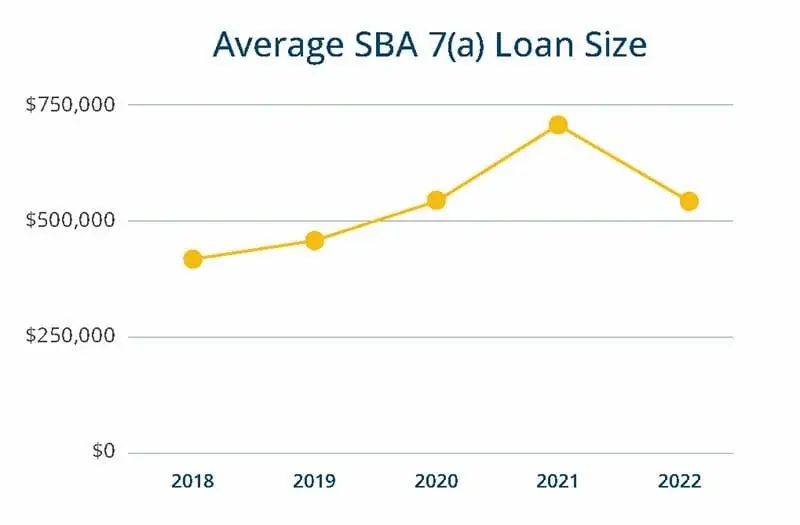

Here are some statistics on SBA loans:

| Statistic | Value |

|---|---|

| Total SBA loans in fiscal year 2022 | $342 billion |

| Average SBA loan size | $674,000 |

| Most common use for SBA loans | Start or expand a business (65%) |

| SBA loan default rate in fiscal year 2022 | 2.7% |

What is Business Hazard Insurance?

Insurance for the business hazard that will cover physical damage to your assets or business in the event of a “hazard.” It’s odd that there isn’t an actual “hazard insurance” at the minimum but not as a term. It describes the kind of insurance the SBA requires that you carry. Here are some typical scenarios of risks that the insurance might cover called hazard

- Theft. Suppose someone steals the business’s assets or other things off your premises. In that case, the business property insurance company can help with the costs of replacing them. Personal property insurance policy.

- Vandalism. Suppose the business property insurance has been damaged or vandalized. In that case, risk insurance will cover the cost of cleaning or replacing the vandalized object.

- Fire insurance covers the costs of repairing or replacing property that has been damaged or destroyed due to a fire. So it would be best to inquire about this hazard insurance policy to protect against possible property damage.

- Flood damage. Purchase flood insurance. Generally speaking, most flood insurance policies will cover water-related damage, for example, ruptured pipes or leaks from the water heater or overflowing washing machines and sink breaking down, and the list goes on. National flood insurance program.

- Storm damage. Damage caused by storms. Based on the specifics of the policy, your insurance may also include damages from natural disasters like floods, storms, earthquakes, and lightning. Each policy is unique. Therefore, ensure you know the adequate coverage and what it does not include. Obtain flood insurance at GreenDayOnline.

Do You Already Have Hazard Insurance?

You may already have insurance when you’re a company owner, but you may need to know your insurance. Two insurance policies that protect you from risks comprise Commercial Property Insurance and the Business Owner’s Policy, which safeguard your physical assets.

Insured Personal Property Insurance. Commercial Property Insurance typically protects the structure and the inside of the building from damage caused by vandalism and accidents. It covers the cost of fixing and replacing forms or their contents in the system up to the insurance coverages limit.

A business Owner’s Policy (BOP) is an insurance policy that combines Commercial Property insurance with General Liability Insurance into one policy. A BOP will protect property from damage like Commercial Property. Still, it can also shield against claims arising from bodily injury or other liabilities.

If you run a business out of your home, you might need more than your homeowner’s insurance to protect the assets of your business. Your SBA lender or loan representative can assist you. It’s wise to consult an independent insurance agent to ensure adequate coverage.

How Much Insurance for Hazards Do You Need?

To determine the appropriate cost of hazard insurance, evaluating your business’s specific risks is essential. An independent insurance agent can help you assess these risks and recommend the right coverage.

The conditions specific to each SBA loan may differ as certain lenders may also have their criteria. It recommends securing 100 percent of the value of the assets owned by your business.

Let’s assume that your business owns the property. The worth of the structure and its contents inside it is 5 million. We can take you to have Commercial Property Insurance maxed out at $4 million. Suppose something happens to the building that damages the entire structure and interior, like a fire. In that case, the damage will be one million dollars.

Talking to an insurance representative will help determine how much insurance you’ll need to safeguard your belongings. It will guarantee that you’ll have the ability to repair all of your possessions if the worst-case scenario should occur. It will be essential to provide proof of hazard insurance to your lender to secure your loan.

Where Can You Get Hazard Insurance and Proof of Hazard Insurance?

Contact an insurance company or agent offering commercial property insurance to obtain hazard insurance. They will likely require specific information about your property, such as its value, age, location, and potential risks. Once you have acquired hazard insurance, request a proof of hazard insurance document from your provider. This document will be crucial to present to your lender when securing your loan.

If you don’t have insurance coverage for your business, there are a variety of alternatives to choose from. Before purchasing an insurance plan, consider the industry sector of your business assets, its financial standing, and the potential risks. It is best to consult with an insurance representative before buying insurance, especially when considering specific coverage like liquor liability insurance.

Suppose you’re planning to purchase business insurance. In that case, we recommend Next Insurance for almost every type of business insurance, including liquor liability insurance.

The following insurance provides low-cost quotes that can tailor your business’s specific requirements, such as liquor liability insurance, starting at just the price for a monthly fee of just $25. Use our partner link to request no-cost quotes.

What Other Types of Insurance Are You Considering?

Hazard insurance protects businesses from harm, but you’ll need other types depending on the kind of company. Here are three different types of insurance suitable for businesses. However, we also provide an extensive guide to business insurance that lists the most well-known 13 types of insurance available to companies.

General Liability Insurance. General liability insurance protects your business and you when a person, whether a client, customer, seller, etc.-sustain the risk of injury or damage to your premises or property or related to your goods or products.

Workers Compensation Insurance. The Workers’ Compensation insurance will cover medical expenses and lost wages for employees injured or sick during work. Nearly every firm with employees will need workers’ Compensation.

Professional Liability Insurance. Professional Liability Insurance (Errors and Omissions Insurance or E&O) protects your company from lawsuits arising from incompetence, poor work, or any financial losses that follow by helping to cover the costs of legal action or lawsuits. If you ever need a replacement card for your insurance, our team can assist you with that as well.

Need Help With Financing for Your Insurance or Business?

Do you require help locating a company insurance company, obtaining a replacement card, or have questions regarding financing for business? Get regular personal support from our experts. We can help with EIDL requests, SBA loans, and other company financing questions.

Apply with GreenDayOnline now to receive personal support for your company, including assistance with your replacement card needs.

Frequently Asked Questions

What is the Hazard Insurance Program for SBA loans, and why is it important for borrowers?

The Hazard Insurance Program for SBA loans requires borrowers to maintain adequate insurance coverage for any hazards that may impact or damage the business collateral used to secure an SBA loan. This protects the lender and borrower by covering rebuild costs and property loss in the event of disasters, accidents, or damage.

How does the Hazard Insurance Program protect lenders and borrowers in the context of SBA loans?

For SBA loans, the Hazard Insurance Program protects lenders by ensuring loan collateral can be replaced if damaged. It protects borrowers by covering any property loss relating to the collateral, preventing further financial loss. This mutually beneficial insurance coverage enables both lenders to safely lend and borrowers to rebuild in case of hazard events.

What are the key features and benefits of the Hazard Insurance Program when obtaining an SBA loan?

Key features include mandatory participation, minimum coverage amounts based on loan size, and coverage for hazards like floods, fire, windstorms, civil unrest, and other disasters or accidents. Benefits include guaranteed asset replacement, additional loan eligibility, risk mitigation, and shared responsibility between lender and borrower for collateral upkeep and safety.

What types of hazards and risks does the Hazard Insurance Program typically cover for SBA loans?

Common covered hazards and risks include fire, lightning, windstorms, hail, explosions, riots, aircraft damage, vehicle damage, smoke, vandalism, fallen objects, volcanic eruptions, snow, ice, collapse, flood, earthquakes, mudslides, and other natural or man-made disasters that may damage or destroy loan collateral assets.

Can you explain the process of obtaining Hazard Insurance for an SBA loan and any requirements or considerations borrowers should be aware of?

Borrowers work with the lender to obtain sufficient hazard insurance based on loan amount prior to closing. Key requirements are covering 80% rebuild cost, naming lender as loss payee, and listing location of collateral. Consider correct property details, exclusions, deductibles, and that the SBA requires hazard insurance be maintained for the full loan term.