Online Title Loans No Store Visit | No Proof Of Income

Online title loans are a type of loan offered to individuals with access to the internet. A borrower gives up their right to the vehicle title for the loan in exchange for quick financing. These loans do not require a credit check and are approved within minutes. Online title loan companies typically charge high fees and interest rates but provide much-needed funds in an otherwise difficult situation.

GreenDayOnline allows a struggling borrower to apply and obtain a title loan online with their secure and modern website. The process begins with the prospective borrower filling out an online form that captures the necessary information to assess their ability to repay the loan and stipulate the repayment terms.

GreenDayOnline connects borrowers with several potential lenders who offer them a title loan based on various factors entered into the application once it is completed and submitted. Qualified applicants then review and compare financing options from multiple lenders easily from the comfort of their homes or office.

If you’re a resident of New Mexico and in need of fast cash, online title loans could be a viable solution for you. With online title loans in New Mexico no store visit required, you can conveniently apply for a loan from the comfort of your own home. By using the equity in your vehicle as collateral, you may be able to qualify for a loan amount based on the value of your car, without having to undergo a credit check.

SUMMARY

- Online title loans are a type of loan where the borrower gives up their vehicle title as collateral in exchange for quick financing, typically done online.

- They do not require a credit check and are approved within minutes, but they come with high fees and interest rates.

- Online title loans include fixed rate, balloon payment, single pay, rolling over, installment, and refinancing car titles.

- To get an online title loan, borrowers must provide proof of identity and vehicle title and agree to a loan contract.

- The loan is repaid within a set period, usually up to 30 days, and failure to make timely payments may result in vehicle repossession.

- GreenDayOnline is an online title loan company that connects borrowers with potential lenders after they fill out an application form.

What Is an Online Title Loan? How Does It Work?

Online title loans are a type of loan secured by a car’s title. The borrower must offer the ownership paperwork of their car as collateral until the loan is paid back in full. These loans provide fast access to cash, usually within 24 hours, and often have lower borrowing amounts than traditional loans, making them accessible to those with bad credit.

An online title loan works similarly to a traditional title loan. The process involves the following steps:

- Apply. Borrowers are able to apply for an online title loan by completing an application on the lender’s website.

- Review by a lender. The lender reviews the borrower’s application and assesses the value of the collateral (the vehicle).

- The signing of the contract. The borrower is asked to sign a contract agreeing to the loan terms if approved.

- Transfer of vehicle title. The borrower transfers ownership of the vehicle title to the lender as collateral for the loan.

- Repayment. The borrower must repay the loan amount plus interest and other fees within a set period, usually up to 30 days.

- Repossession. The lender repossesses the vehicle to recoup losses if the borrower fails to make timely payments.

- Obtaining the Title. The vehicle title is returned to the borrower with no lien once the loan is paid in full, plus any interest or fees that have been added.

The main difference between an online and traditional title loan is that the application and loan process is completed online, which makes the process quicker and more convenient for borrowers as it eliminates the need for in-store visits.

What Are the Different Types of Online Title Loans?

Listed below are the different types of online title loans.

- Fixed Rate Title Loans. Fixed-rate title loans are online that allow borrowers to borrow a set amount and have the entire balance repaid within a specific timeframe. These loans come with fixed monthly payments and interest rates that remain constant throughout the loan term. A fixed-rate title loan is often preferred by those who want to know their monthly payments because of their predictable payment plan.

- Balloon Payment Title Loans. A balloon payment title loan is an online title loan where all the payments made during the duration of the loan contribute only partially towards paying off the total loan principal. A large “balloon” payment is due to cover any remaining costs or fees associated with the borrower’s overall loan balance when the final payment is made at the end of the agreed-upon time frame.

- Single Pay Title Loan. A single-pay title loan is an online loan that is paid back in one lump sum installment rather than multiple installments over time, like other title loans. With single-pay title loans, borrowers must make sure they pay off the full balance due at once, or they are subject to late fee charges or incur additional interest on their account if they fail to do so.

- Rolling Over Title Loans. Online rollover title loans involve rolling over existing debt and interest into a new online title loan with improved terms, which is commonly used for short-term borrowing and offer a repayment extension without incurring additional fees or penalties as long as the current outstanding balance is paid in full each month or meets certain criteria.

- Installment Title Loans. Installment title loans offer borrowers flexibility in how they choose to manage their finances since there are multiple options for repayment when it comes time for them to pay off their debts from year-to-year depending on things like income levels and available resources given time(s). These online loans break up the total owed sum into smaller increments that require periodic payments until all funds have been fully recovered by whatever bank/institution granted them originally, plus added interest determined beforehand by both parties contracted together for transaction purposes before it began.

- Refinancing Car Titles. Refinancing car titles allow people access cash from the equity built up in cars that are owned outright or almost entirely paid off by purchasers who don’t qualify for traditional financing solutions based solely upon their ability (or inability) pass credit checks conducted through lending companies & organizations approving financial requests these days – even if the actual condition/status merits something better than what that score indicates otherwise beyond outbound metrics associated themselves herewith judged constantly today.

What Are the Requirements Needed for Title Loans?

Listed below are the needed requirements for title loans.

- Proof of Identity. Lenders require a valid form of identification, such as a driver’s license, state-issued ID card, or passport, to prove identity when taking out a title loan.

- Vehicle Title. Borrowers must be able to provide proof that they own the vehicle used for their title loan. That means providing a title document showing the car is free from any liens or holds from other companies or lenders.

- Proof of Income. Title loans typically require some proof of income as well, such as a recent pay stub, bank statements showing consistent deposits, or some other document indicating regular employment and wages being received on a steady basis.

- Insurance Coverage. A title lender often wants to see that borrower’s car is insured with an active policy covering the term of the loan and any period during which it remains unpaid after the original due date passes, which allows them to protect their investments by knowing they’ll be taken care of if something happens to their car while they don’t have coverage in place for it.

- Photos & Odometer Reading. Since lenders use cars via auto titles as collateral for their cash loans, they usually need photos or video evidence showing their overall condition along with current odometer readings. Hence, they have records on file to compare against issues that arise later on with non-payment terms and repossession proceedings needing to take place.

- Vehicle Value Appraisal. Most reputable title loan lenders perform an appraisal on any vehicle being used as collateral before the money is given out against its equity value, so they know more accurately how much risk they assume ahead of time if high balances outstanding remain overdue after initial loan payments become past due down the road while collections efforts begin thereafter.

- Documentation Signing. As with any loan contract terms between two parties, documents indicating all conditions previously agreed upon concerning repayment durations, interest rates, and total amounts owed must be signed before specifying everything expected from both sides.

Can a Bad Credit Borrower Be Eligible for Title Loans?

Yes, a bad credit borrower is eligible for title loans. Title loans are secured loans, meaning that the loan is approved by using an asset as collateral, typically a vehicle such as a car or a boat. The borrowers still are eligible for a title loan if they have bad credit but own a vehicle free and clear of any liens. However, interest rates on title loans are higher than those offered to borrowers with good credit scores due to the risk associated with lending money to people with bad credit scores.

What Are the Advantages of Title Loans?

Listed below are the advantages of title loans.

- Quick Access to Funds: Title loans are easier and faster to obtain than most other types, which makes them great for anyone needing a quick infusion of cash to deal with emergencies.

- Low Borrowing Costs. Since title loans are secured by the borrower’s vehicle, lenders offer lower rates than unsecured loans. Low borrowing cost is especially beneficial for those who need money but don’t want to pay higher interest rates associated with personal loans or credit cards.

- Flexible Loans with Lower Credit Requirements. Title lenders are usually more lenient with their lending terms due to the collateral involved. Therefore, borrowers with bad or limited credit scores receive a loan if they have a car that serves as collateral since it reduces lenders’ risk of not getting their money back if the borrower defaults on their loan payments.

- Good Deal for Lenders. Title loans provide an excellent opportunity for lenders, as they make sure that even if the borrower fails to repay the loan amount, they still get something — i.e., the vehicle used as collateral — in return for their investment plus a portion of the profit made from interest payments over time of repayment period.

- More Options. Many people are surprised to know that title loans are used for more than just emergency cash needs; rather, some choose them over conventional short-term financing solutions because these loans offer more options when it comes to term lengths and payment frequencies, so lenders are able to tailor a title loan specifically towards meeting their requirements and budget constraints.

- Easier Repayment Terms. Finally, many borrowers find it easier to pay off applicable interest only until they’re ready to pay off their principal balance due through various refinancing arrangements available through certified title loan companies.

What Are the Disadvantages of Title Loans?

Listed below are the disadvantages of title loans.

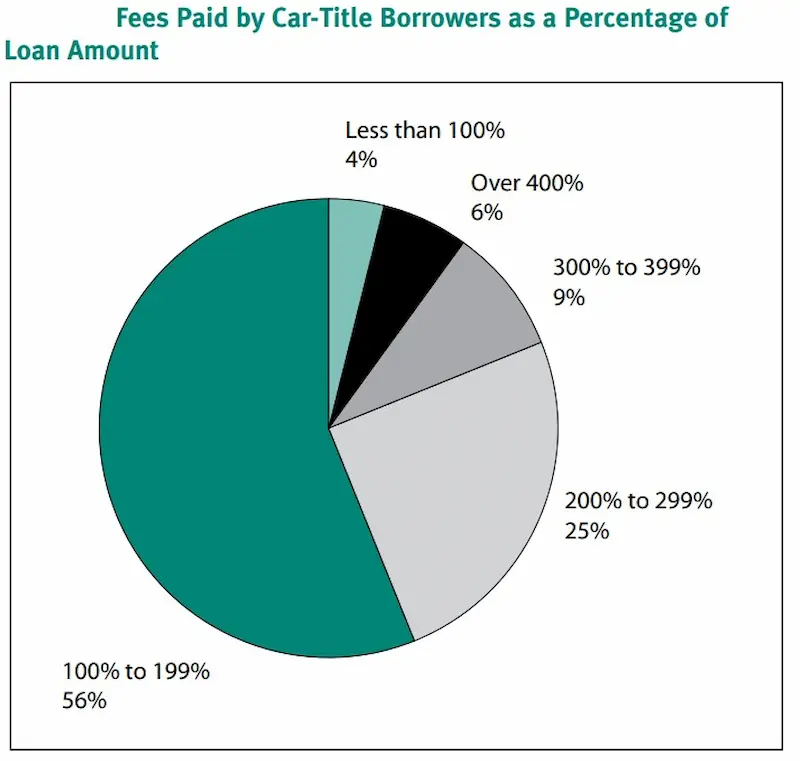

- High-Interest Rates. One of the biggest disadvantages of title loans is the high-interest rates charged on loans. These rates are more than double what a borrower pays on a traditional loan, often reaching triple-digit levels, making it incredibly difficult to pay back promptly and throwing off the borrower’s budgeting plans.

- Required Collateral. Another disadvantage of title loans is that they require collateral to obtain one, which means lenders are able to confiscate the borrower’s vehicle if payments are not made on time or in full when due. A lender takes possession of the car and either sell it to recoup their money or offers another loan with an exorbitant interest rate to keep it from being sold.

- Limited Loan Amounts. There is usually a limit on how much money is able to borrow against a title loan amount taken out against the borrower’s vehicle title based on its value and condition at that particular moment, which means that if the borrower needs more funds, they are not able to get them from a single title loan institution or bank and must find alternative sources for additional funding if required.

- Borrowers Must Payoff the Balance Before Selling the Vehicle. Borrowers with title loans must pay off their balance in full before they sell their vehicle without legal repercussions. Bear historical lien in consideration a borrower decides to part with it without paying back what is owed first if a borrower owns a car but has taken out a title loan; if not done correctly, it spells potential legal problems down the line as unpaid debts continue accruing penalties such as annual maintenance fees or auction costs just by keeping the bill unpaid over extended lengths of time.

- Repossession Risks. Repossession risks increase dramatically for those borrowing against their vehicles under title loan terms or agreements made between borrower and lender prior. Repossession puts ownership for both parties into deeper jeopardy, making things work further out against expectations originally thought of agreed upon by both sides, initially representing free consenting contractual responsibilities.

Can a Borrower Apply for Title Loans Without a Car?

No, a borrower cannot apply for title loans without a car since the process often requires that a vehicle be used as collateral. Lenders only accept cars and trucks as collateral for these loans and usually require borrowers to have clear ownership of the car with no outstanding lien or loan on it in most cases. Depending on the lender, borrowers need proof of income and assistance from a co-borrower if they cannot show proof of full-time employment or a steady income stream.

Is Title Loans Online Easy to Obtain?

Title loans online are relatively easy to obtain, depending on the lender that the borrower is working with. Many places require borrowers to submit evidence of a steady income and present proof that they own the title of the car they want to use as collateral. Some lenders check credit scores, so it’s important to understand what is required and reach out for help. Time is often saved as the electronic application process works faster than traditional methods, which makes obtaining a much-needed loan easier for some borrowers when requesting a loan online.

Here are some statistics on online title loans:

| Statistic | Value |

|---|---|

| Number of online title lenders | 1,000+ |

| Average interest rate | 270% APR |

| Average repayment term | 30 days |

| Risks of online title loans | High interest rates, short repayment terms, risk of default |

| Alternatives to online title loans | Personal loans, credit cards, debt consolidation loans |

Is GreenDayOnline a Direct Lender for Title Loans?

No, GreenDayOnline is not a direct lender for title loans. GreenDayOnline is a loan matching service that matches qualified customers with qualified lenders based on the customer’s individual needs. GreenDayOnline does not have any ability to lend people money or hold funds. Customers are able to securely apply through their website and then be sent relevant offers from a network of over 50 lenders in seconds.

At GreenDayOnline, we pride ourselves on providing convenient and hassle-free financial solutions. Our customers value their time and seek efficient alternatives for their borrowing needs. With that in mind, we are excited to present our extensive reach across the United States, offering online title loans without needing a physical store visit. Our commitment to accessibility and convenience has allowed us to establish a strong presence in various states nationwide. Below, you will find a comprehensive table highlighting the American states where our company is active, enabling individuals to access our online title loan services easily. Explore the table below to discover the states where you can take advantage of our streamlined borrowing process without the inconvenience of visiting a physical location.

| Alabama (AL) | Alaska (AK) | Arizona (AZ) | Arkansas (AR) |

| California (CA) | Colorado (CO) | Connecticut (CT) | Delaware (DE) |

| District Of Columbia (DC) | Florida (FL) | Georgia (GA) | Hawaii (HI) |

| Idaho (ID) | Illinois (IL) | Indiana (IN) | Iowa (IA) |

| Kansas (KS) | Kentucky (KY) | Louisiana (LA) | Maine (ME) |

| Maryland (MD) | Massachusetts (MA) | Michigan (MI) | Minnesota (MN) |

| Mississippi (MS) | Missouri (MO) | Montana (MT) | Nebraska (NE) |

| Nevada (NV) | New Hampshire (NH) | New Jersey (NJ) | New Mexico (NM) |

| New York (NY) | North Carolina (NC) | North Dakota (ND) | Ohio (OH) |

| Oklahoma (OK) | Oregon (OR) | Pennsylvania (PA) | Rhode Island (RI) |

| South Carolina (SC) | South Dakota (SD) | Tennessee (TN) | Texas (TX) |

| Utah (UT) | Vermont (VT) | Virginia (VA) | Washington (WA) |

| West Virginia (WV) | Wisconsin (WI) | Wyoming (WY) |

Conclusion

An online title loan is a loan where a borrower gives up their car title as collateral in exchange for quick financing. These loans do not typically require a credit check and are approved within minutes, making them a good option for those with bad credit or needing quick funds.

The process involves applying online, having the lender review the application and assess the value of the collateral, signing a contract, transferring the vehicle title, and repaying the loan amount plus interest and fees within a set period, usually up to 30 days. The lender is able to repossess the vehicle if the borrower fails to make payments. There are different online title loans, such as fixed rates, balloon payments, and single pay. GreenDayOnline is a company that offers online title loans through a secure website that connects borrowers with potential lenders.

Frequently Asked Questions

How do online title loans without a store visit work, and what are the key benefits of this type of loan?

Online title loans provide funds deposited directly without visiting a store, in exchange for temporarily surrendering your car title as collateral. Benefits are convenience and quick funding.

Can I really get a title loan online without providing proof of income, and what are the eligibility requirements for such loans?

Some lenders provide online title loans with no formal income verification, but you still must provide personal details and vehicle information meeting their requirements to qualify.

What are the risks associated with online title loans that don’t require proof of income, and how can I ensure I’m making a responsible financial decision?

Risks include extremely high interest rates and potentially losing your vehicle. Read all terms carefully, shop lenders, and only borrow what you can afford to repay.

What alternatives are available for individuals seeking financial assistance without a store visit and without having to prove their income for a loan?

Alternatives include pawning valuables, borrowing from friends/family or retirement accounts, nonprofit assistance programs, credit card cash advances, and bank or payday loans in some cases.