If you live in Washington, you may have heard of personal installment loans. These loans are repaid in installments over some time, typically two years or longer. Installment loans can be used for various purposes, such as consolidating debt, making home improvements, or paying emergency expenses.

Unlike payday loans, which must be repaid in full by your next payday, personal installment loans allow you to make payments over time. You’ll know exactly how much you must pay each month and when you will repay the loan. Your credit score plays a significant role in determining your eligibility and the loan agreement terms.

How Much Can I Get for an Installment Loan?

The amount you can borrow with an installment loan will depend on a few factors, including your income and credit history. Most lenders will allow you to borrow up to $5000 for an installment loan. Various loan products cater to different financial needs and credit profiles.

What Are the Interest Rates?

To apply for a personal installment loan, you’ll need to fill out an online application form provided by the lender. After reviewing your application, the lender will inform you of the loan’s interest rates and other terms. Interest rates can vary depending on your credit score, loan amount, and the lender you choose. It’s essential to compare different loan products and lenders to find the best fit for your financial situation.

Interest rates for installment loans vary depending on the lender and the loan size. However, they are typically much lower than the interest rates for payday loans. Contact us today at Greendayonline to determine how much interest you will pay on your loan and discuss your financial situation.

How Do I Apply?

Applying for an installment loan is easy. You can apply online or in person at a lending office. If you apply online, you’ll need to complete an online application and provide some basic information about yourself and your finances. If you apply in person, you may need additional documentation, such as proof of income or a bank statement. This way, we can evaluate and provide you with the best loan offers.

Once approved for the loan, you’ll typically have to sign a contract and agree to repay the loan in monthly installments over time. Be sure to read the agreement carefully before you sign it to understand all the terms and conditions of the loan.

What Happens if I Can’t Repay My Loan?

If you can’t repay your installment loan, you can extend the repayment period or renegotiate the loan type. However, doing so will likely result in additional fees and interest charges. You may also be subject to collections activity if you default on the loan.

Suppose you’re considering taking out an installment loan. Research and shop around for the best deal. Consider personal loans or a debt consolidation loan if you need to borrow money but want to keep your monthly income in check. And remember, always make sure you can afford the monthly payments before signing on the dotted line, especially if you need a better credit history.

What Is the Difference Between Payday Loans and Installment Loans?

Payday and installment loans are short-term loans designed to help you cover unexpected expenses or make ends meet when your income is low. However, there are some critical differences between the two.

Installment loans are repaid over time in fixed payments, while payday loans must be repaid in full by your next payday. If you’re worried about your bad credit score, title loans may be an alternative.

Installment loans typically have lower interest rates than payday loans, and you can often negotiate the terms of your installment loan if you run into financial difficulties. In addition, some lenders offer reasonable interest rates based on individual circumstances.

You may be subject to high fees and interest charges with a payday loan if you can’t repay the loan on time. However, installment loans often require a minimum credit score or a soft credit check to assess your creditworthiness.

When choosing between a payday loan and an installment loan, consider the interest rate, repayment terms, and fees associated with each type of loan. You should also make sure you can afford the monthly payments before applying.

Can I Get an Installment Loan With No Credit Check?

Yes, we provide online installment loans with no credit checks. This means that your credit history will not be a factor in whether or not you are approved for a loan.

No credit check installment loans can be a good option if you have bad credit or no credit history. However, remember that these loans often come with higher interest rates and fees than traditional loans from personal loan lenders. Shop around and compare offers before taking out a no-credit-check installment loan, especially if you have poor credit scores or uncertain employment status.

Who Offers Washington Installment Loans?

You can get installment loans in Washington through a variety of lenders. These include:

Online lenders: Many online lenders offer installment loans in Washington. These lenders typically have a streamlined application process and can offer competitive interest rates and terms.

Banks typically offer installment loans with low-interest rates and flexible repayment terms. However, the application process can be lengthy, and you may need good credit to qualify for an auto loan or other types of loans.

Credit unions: Credit unions are a good option if you’re looking for a low-interest loan. However, you may need to be a member of the credit union to qualify for a loan.

Payday loan stores: Payday loan stores typically offer high-interest loans with short repayment terms. These loans should be used as a last resort, as they can often trap borrowers in a cycle of debt.

Before choosing a lender, compare offers to find the best interest rate and terms. You should also make sure the lender is licensed to lend in Washington. Additionally, consider checking your credit reports from the major credit bureaus so you can address any errors before submitting your loan request.

Greendayonline is a licensed lender that offers installment loans in Washington with competitive rates and terms. They consider your source of income and allow for flexible time payments.

When it comes to convenient and reliable installment loan services in Washington, our company has established a strong presence in key cities across the state. We understand the importance of accessible financial solutions that cater to the diverse needs of individuals and businesses alike. In order to provide our valued customers with the utmost convenience, we have strategically expanded our operations to the most important cities in Washington. Below, you will find a comprehensive table highlighting the major cities where our company is actively serving the community, ensuring that residents in these areas have easy access to the financial support they require.

| Seattle | Spokane | Tacoma |

| Vancouver | Bellevue | Kent |

| Everett | Spokane Valley | Renton |

| Yakima | Federal Way | Bellingham |

| Kirkland | Kennewick | Auburn |

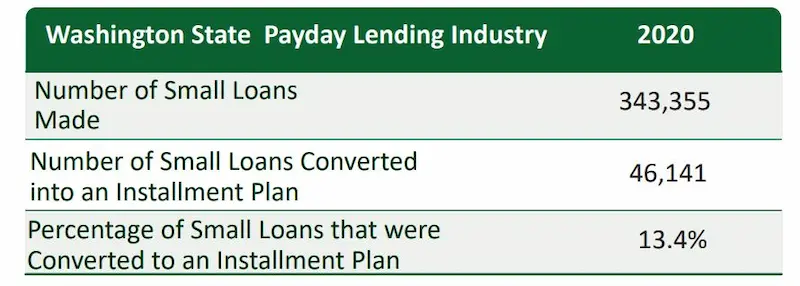

In addition to installment loans, many lenders in Washington also offer payday loans. These short-term, small-dollar loans can provide funds in between paychecks when unexpected expenses arise. If you are considering a payday loan, be sure to understand the terms and fees involved. You can learn more about payday loans available in Washington in our comprehensive guide on Payday Loans Washington. With information on both installment and payday options, you can make the most informed borrowing decision for your needs.

Are Installment Loans Legal in Washington?

Yes, installment loans are legal in Washington. The state has laws limiting the interest rates and fees lenders can charge. These laws help to protect borrowers from being charged excessive fees and interest.

What Are the Advantages of Installment Loans?

Installment loans have a few advantages over other types of loans. These include:

- You can typically get a lower interest rate on an installment loan than a payday loan.

- The repayment terms for an installment loan are usually longer than those for a payday loan, giving you more time to repay the loan.

- You can often negotiate the terms of your installment loan if you run into financial difficulties. This is only sometimes possible with a payday loan.

- Installment loans typically have lower fees than payday loans and often don’t include prepayment fees.

- You can often get an installment loan with no credit check. This can be helpful if you have bad credit or no credit history.

It’s worth noting that installment loans can take a few business days for approval and often require direct deposits into your bank account. Some lenders may also consider your income ratio when approving your application. There are also installment loans for people with different financial situations and credit scores.

Who Are Direct Lenders?

A direct lender is a financial institution that lends money directly to borrowers. Direct lenders can be banks, credit unions, or online lenders, and they may have specific minimum income requirements for borrowers. They typically have lower interest rates and fees and accept debit cards or valid checking accounts for loan repayments than traditional online loans direct lenders. Online lenders are often the best option for installment loans.

What Is APR?

APR stands for annual percentage rate. The interest rate you will pay on your loan is a percentage of the total loan amount. The APR can also include fees and other costs, such as origination fees, late payment fees, or prepayment penalties.

When shopping for an installment loan, compare APRs to find the best deal and review your payment history to determine your eligibility.

What Are the Laws and Regulations Concerning Installment Loans in Washington?

The laws and regulations concerning installment loans in Washington protect borrowers from being charged excessive interest rates and fees. These laws also require lenders to be licensed to lend in the state.

Below are some statistics on Washington Installment Loans:

| Statistic | Value |

|---|---|

| Number of installment loans in Washington (2022) | 1.1 million |

| Average loan amount | $3,500 |

| Interest rate | 28% |

| Term | 36 months |

| Default rate | 12% |

Some of the laws and regulations concerning installment loans in Washington include the following:

- The State of Washington must license lenders.

- The borrower and lender must agree upon loan terms.

- The maximum interest rate a lender can charge is 12%.

- The minimum loan term is 60 days.

- Lenders cannot require borrowers to post collateral for an installment loan.

Conclusion

Washington maintains some of the most stringent installment lending protections on the West Coast designed to prevent predatory lending but access challenges remain. Under state law, interest rates are capped at 25% APR and origination charges limited to 5% or $25 maximum for loans under $700. Such tight limits differ markedly from the high-cost regimes in neighboring Idaho and Oregon. But consumer advocates caution Washington’s regulations have also reduced the supply of installment loans for many lower-income borrowers who still need responsible options. They argue the state should promote affordable credit access channels despite restrictions – unlike more loosely regulated states where predatory lending remains rampant nationwide.

Frequently Asked Questions

What are the key eligibility criteria and documentation requirements for obtaining an installment loan with instant approval in Washington?

You’ll need ID, proof of income over $800/month, a bank account, and to be a Washington resident. Poor credit is generally allowed thanks to alternative lending models.

How does the interest rate and repayment structure for these loans compare to traditional loans available in the state?

APRs range from 13-35%, lower than traditional loans. Repayment terms up to 5 years are offered with fixed monthly principal and interest payments.

What are the advantages of choosing installment loans for bad credit with instant approval in Washington over other borrowing options?

Benefits include predictable payment schedules, ability to improve credit with responsible use, quick online approvals, set loan terms, and better rates than alternatives.

Are there any potential drawbacks or risks associated with these loans that borrowers should be aware of before applying?

Risks include high costs if not repaid quickly, potential credit damage with late payments, and approval doesn’t guarantee affordable payments.