There are numerous possibilities for small company funding to help meet the needs of your particular circumstance, whether you’re just starting your business or expanding an existing one.

This tutorial will describe startup requirements, discuss funding possibilities, and walk through what to consider when choosing a funding option to assist you in understanding how to fund a small business with different startup funding opportunities.

Startup Requirements

It would be best if you were prepared when looking for source of funding for a new company. Before anything else, establish what is on your “need” list and what can wait. Ask yourself this: What minimum do you need to launch your business?

However, you can’t cut corners on necessities. This will, of course, be a big investment. Developing a solid business plan can help ensure that you’ve considered all aspects before seeking funds.

Therefore, if you put something on the “it can wait” list when planning your new business venture, check with other areas that can be impacted if that area isn’t funded.

Here are some typical business expenses and some queries to consider before attempting to get money for your business model.

Promotions and a website

It would be best to let people know you are there, which is impossible without effective advertising and a website. You may spend money on social media ads, billboard rentals, local magazine ads, or website optimization to get the most significant search engine rankings. To achieve your financial goal, consider utilizing business credit cards to manage your advertising expenses more efficiently.

All of this costs money.

Stock levels and anticipated orders

Do you have enough raw materials to keep your firm running? If you don’t, should you be investing more? One option is to apply for loans to businesses to assist in financing the purchase of raw materials and catering to anticipated orders, allowing for easier access to capital.

Equipment

How much personal protective equipment (PPE) do you need to purchase to safeguard the health of your employees or clients? Do you require any machinery, phones, laptops, or other devices? Can you buy used equipment? Is renting or leasing equipment a possibility? Determine the most appropriate type of financing to help you get the equipment you need without compromising your budget.

Utilities and rent

Ensure you can pay your lease and electricity charges if you transfer your company to a physical location. Ensure you completely grasp a commercial lease’s terms before signing a contract.

Taxes, licenses, and permits

Remember that your business must comply with local laws and requirements, such as taxes, licenses, and permits. Make sure to handle them responsibly to avoid legal issues in the future.

You want to avoid legal trouble since running a business is expensive. How much money will you pay for taxes, licenses, and permits?

Financing options for small businesses

Do Your Homework

Prepare a business plan that details costs, anticipated sales, and profits before approaching outside sources for company finance. If you require help with this procedure, think about locating a business mentor through SCORE or BusinessAdvising.org of the nonprofit organization.

Though optimism is fantastic, thoughtless optimism has no place in a company plan. Be zealous for your company while being brutally honest regarding your monetary situation. Consider exploring traditional business loans and funding options for startup businesses.

Traditional banks can be a good place to start when looking for financing, but you should also research alternative lenders that may be more open to your business idea. Ensure you clearly understand the amount of startup funds you will need to succeed.

It would help if you did not request more than you require and be ready to explain your plans for using the money and the thinking behind them. When you are ready to convey your vision and clearly understand your pitch, choose any funding methods below.

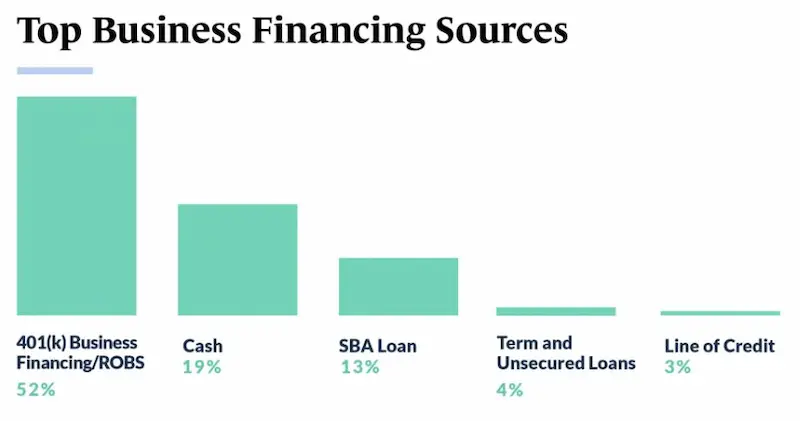

Here are some statistics on financing options for small businesses:

| Financing option | Percentage of small businesses that use it |

|---|---|

| Bank loans | 60% |

| SBA loans | 25% |

| Credit cards | 15% |

| Peer-to-peer lending | 5% |

| Crowdfunding | 1% |

Apply for small business loans.

If you don’t have enough money to start your firm yet and want to maintain complete control, consider taking out a small business loan. You should have a company plan, expense sheet, and financial projections for the following five years to improve your chances of getting a loan. These tools will help you determine how much you should request and show the bank that granting you a loan is wise.

Make loan requests to banks and credit unions once your materials are ready. You’ll want to compare offers to receive the best available conditions for your loan. Personal loans and lines of credit can also be an option if you aren’t eligible for small business loans through traditional lenders. Don’t forget to evaluate the monthly payment terms before deciding.

Crowdfunding

Many people, called crowd funders, contribute money to a business through a crowdfunding platform. Since they don’t obtain a stake in the company and don’t anticipate a financial return on their investment, crowd funders aren’t technically investors. Instead, crowd funders anticipate receiving a “present” from your business in exchange for their donation.

That gift often consists of the item you intend to sell or other unique benefits, including getting to know the company founder or receiving their name on the credits. Because of this, crowdsourcing has become a popular choice for those looking to create artistic works (like documentaries) or tangible goods (like a high-tech cooler).

Crowdfunding is also very popular because it carries little risk for business owners.

Not only do you get to control your business, but you’re usually not obligated to pay back your crowd-funders if your idea doesn’t work. Because every crowdfunding website is unique, read the small print and comprehend your financial and legal duties.

Additionally, attracting potential investors such as venture capital firms, individual investors, private investors, and angel investors can significantly boost the chances of a successful crowdfunding campaign.

Online Lenders

Online lending is another choice that has grown dramatically in recent years. Most financial institutions, including conventional banks, SBA-backed lenders, and CDFIs, provide online lending choices. They come in a few distinct configurations. One is private enterprises that only focus on lending online, like Square and PayPal, or lending as a component of their more significant offerings.

The application procedure and approval times are typically quicker and more convenient in both scenarios. However, knowing that personal credit score and credit ratings could still impact approval is essential. Before taking out any loans, familiarize yourself with the repayment terms. Many non-bank internet lenders impose higher interest rates or significant fines and costs, and different amounts of money might be available compared to traditional bank loans. Remember, maintaining a healthy personal credit score will provide you with better options and favorable terms.

Mission-driven lenders

A mission-driven lender provides an alternative if you cannot get a standard bank loan or one that is SBA-guaranteed. These lenders, which include community development financial institutions (CDFIs) and capital firms, support businesses by offering practical assistance from when the loan application is made until it is repaid. Even though the loan amounts are typically smaller than those from banks, many business owners value the mentoring and business developments that mission-driven lenders offer.

Program for Small Business Innovation Research and Types of Investor

The Small Business Innovation Research Program, which assists companies with R&D projects and is supported by venture funds, is a more profitable federal award program. The program offers a variety of grants, including open, closed, future, and solicitation listing grants, as well as grant money. The types of investor involved in the program vary, but the U.S. Small Business Administration supervises it. Find out which choice is ideal for your business by doing some research.

To ensure the money is used wisely, anticipate a protracted qualification process and a strict measurement plan if chosen.

Start Your Business Using Credit Cards

Numerous examples of startup owners using their available credit to launch brand-new companies. Those stories include some truth, but there is also a significant amount of risk that is simple to ignore. Consider requesting a company card before using your one. You can be eligible for a corporate credit card with at least a modest credit limit in your company’s name, even if your business is young and lacks any records of sales or earnings.

Card issuers must rely on the personal credit of the owners when evaluating applications from startups without a history of financial stability, so if you intend to apply for a business card, be sure to raise your credit score first.

Merchant cash advances

For a relatively short period of time, a merchant cash advance can be a viable financing option for startups. This type of loan allows companies to receive a lump sum of cash in exchange for a percentage of future credit card sales. However, it’s important to note that this method may not offer longer-term funding solutions needed to sustain a growing business. Additionally, the interest rates on merchant cash advances can be significantly higher than other funding sources, such as loans from wealthy individuals or traditional financial institutions.

A business cash advance is a type of funding that allows a business to receive a lump sum of cash upfront in exchange for a portion of future sales. The advance is typically paid back through a percentage of future sales, so it’s important to ensure that you can make the necessary sales to cover the advance and the associated fees. This can be a useful option for businesses with many expenses but may not have the cash flow to cover them all at once.

One of the main benefits of a business cash advance is that it can provide you with the funds you need without requiring collateral. You won’t have to use personal assets to secure the funding. Additionally, business cash advances can be easier to qualify for than traditional loans since they’re based on your future sales rather than your credit history.

However, there are also some downsides to business cash advances. One of the biggest is that they typically come with high fees. This can make them a more expensive option than other forms of funding, so it’s important to compare the costs before you decide if an advance is right for your business.

Ensuring that you pay your bills on time and collecting money from people who owe you can help minimize the need for business cash advances. Facilitating the transfer of money from borrowers to lenders creates a healthier financial ecosystem for everyone involved. Moreover, working with professional investors can provide you with better funding options and financial advice, which might lead to more affordable and sustainable ways to grow your business. Remember, diligently paying your bills on time is crucial to maintaining a good business reputation and long-term financial success.

Frequently Asked Questions

What are the best sources of funding for a small business?

The best funding sources for small businesses are savings, loans from banks or credit unions, crowdfunding, business credit cards, and grants from the government or nonprofits.

How can I secure a small business loan for my startup?

You can secure a small business loan by having a solid business plan, strong personal credit score, collateral, and relationships with lenders built over time.

What are the advantages and disadvantages of seeking venture capital for funding?

Venture capital allows startups to scale quickly but requires giving up equity and some control of the company to investors.

What alternative funding options are available for small businesses aside from traditional loans?

Alternative funding like crowdfunding, business credit cards, grants, and financing from vendors and customers can help small businesses.

How can I create a compelling business plan to attract potential investors?

Focus your business plan on your target market, product details, financial projections, management team, and growth strategy to attract investors.