A payday loan is a small short-term loan. It is not considered a long-term debt. The borrower’s next paycheck usually pays off a payday loan. Payday loans are legal in Ohio. However, there are some requirements that lenders have to follow when issuing these loans. GreendayOnline works with payday loan direct lenders offering payday and flexible loans in Ohio.

A payday loan is a perfect option for borrowers to get cash quickly. Additionally, clients with a bad credit scores can still find Online lenders willing to provide loans, making it easier to submit a loan request. Instead of a payday advance, borrowers may also consider payday loan alternatives to address their financial needs. Credit unions are another source of obtaining salary loans. The company has branches in many states, including South Carolina, Oklahoma, and New Mexico. It means borrowers can now access credit and repay it in loan payments installments over a certain period.

More info on OH online payday loans near me for bad credit with no credit check

A payday loan near me for bad credit with no credit check is a short-term, small loan repaid on the borrower’s next payday. Payday loans in OH are commonly known as cash advance loans. They help borrowers access quick cash to cover unexpected expenses or emergencies. Payday loans are for small amounts, usually $1000 or less. They are easy to get and quick to get cash when needed. However, payday loans come with high fees and interest rates, making them very expensive. Borrowers considering payday loans must understand how they work and the risks involved. Borrowers must complete the payday loan application online if borrowers feel payday loans are a good option.

The borrower must not need to worry. It is easy to complete the online form. The loan application process takes as little as five minutes. Applicants get instant approval as they use online payday lenders. They are free to call the lender and speak to their representative if they have any questions or provide their email address for further communication.

Do I Need A Good Credit Score To Obtain a $200 Payday Loan With Guaranteed Approval & Same Day Deposit?

Ohio managers of online payday loan companies do not consider the borrower’s credit score when approving a $200 payday loan with guaranteed approval and same-day deposit. GreenDayOnline’s lenders offer bad credit loans, conventional loans with longer payment terms, larger amounts, and competitive interests (Annual Percentage Rate). They also provide online installment loans, which can benefit different loan types.

A credit builder loan is a type of installment loan that aids in developing credit. Our extensive network of lenders facilitates this process.

What Are The Legal Requirements For Small Cash Advance Loans With No Denial?

Listed below are the main legal requirements for small cash advance loans with no denial..

- A reliable and verifiable source of income

- Social security number

- An active bank account

In case of any financial emergency, our team at GreenDayOnline can assist you with a quick loan decision to help you meet your urgent needs.

GreenDayOnline’s lenders offer payday loans in other states where the loans are legal. Borrowers need a job or other source of regular income to get a payday cash advance in Huber Heights, Ohio. They must have an active checking account and a valid ID. The quick approval process typically takes less than 30 minutes. Furthermore, the payday loans roll over for another 31 days if borrowers cannot repay their loan proceeds on time. However, customers are only allowed to do it once. They have to pay the full amount plus the finance charge after that. The approval process for a payday alternative is more flexible, allowing borrowers to repay their loan proceeds over a longer period. More rules on the Ohio House bill payday loan reform are implemented to save borrowers millions of dollars.

Comparing a flexible loan to a payday loan with instant approval in Ohio

The difference between a flexible loan and a payday loan with instant approval is that the financial institution requires repayment as soon as the borrower’s next paycheck arrives during the application process for a payday loan. A payday loan is short-term and handy when a borrower has an emergency. Examples of uses include urgent home renovations, medical bills, or car repair expenses. The fact that borrowers need to repay the loan on their next loan makes them convenient. Thus, payday loans are only helpful when borrowers are sure to pay the whole loan on their next payday. But what if their salary is delayed?

Let’s take this example:

A borrower’s salary is delayed, and they have not paid rent. All they need to do is complete the application process for a flexible loan. Once approved, they pay the money either on a monthly or bi-weekly basis. Borrowers get payday loans up to $1000. They easily use it to pay rent, as the most common or average rent payment is $800.

In the online lending market, borrowers can opt for an emergency loan with alternative repayment terms that suit their financial situation. These emergency loans can be handy when their paycheck is late and they require funds to cover essential expenses like rent or utilities. These loans can be accessed by filling out a loan application form and may accept various payment methods such as debit cards. Some lenders even offer a cash loan option that can be helpful in times of urgent need.

The loan term depends on when borrowers get paid. At the time of paying the first installment loan (long-term loan), borrowers have the option to repay the whole amount at once. They pay this money at once if their budget allows it. These are long-term loans designed to help them cover major expenses, with a loan amount range that can be tailored to their needs.

There are no prepayment penalties charged for these payday loans online. Borrowers can choose to make monthly installments or pay the whole amount on the first installment, and the cost of borrowing will be lower. This flexibility provides financial security to the borrowers.

When will I get the 1 hour payday installment loans after approval?

Borrowers get their cash within one business day after obtaining approval from 1-hour payday installment loans. The company deposits the funds in their bank accounts 24 hours after approval. However, borrowers must confirm with the lender to ensure when the cash will be in their accounts. Permanent resident borrowers may have additional confirmation processes.

What are the benefits of GreenDayOnline’s $300 payday loans for low credit?

Listed below are the benefits of a $300 payday loan with low credit from GreenDayOnline for both permanent resident and non-resident borrowers:

- Flexible loan amount range to meet your needs

- Option to make monthly installments or pay the entire amount on the first installment

- No prepayment penalties for early repayment

- Quick cash deposit within one business day after approval

- Increased financial security due to the flexibility in repayment options

- No credit check: It’s easy for GreenDayOnline’s direct lenders to approve a borrower’s online loans without a credit check application process if they have bad credit. Its lenders do not need any credit report and provide borrowers with a cash advance even if they have never had a loan. Both short and long-term loans do not require soft credit checks. These direct payday lender services are ideal for those with a less-than-perfect credit history.

- Easy approval: Its lenders ensure that their clients for quick payday loans get their emergency cash as soon as possible. The company emails borrowers a confirmation once they receive their emergency cash short-term loan application. It takes only a few minutes to apply online.

- Fast funding: The company works fast and usually funds the loan within 24 hours of receiving applications. Borrowers use the funds immediately, making these loans perfect for when you need emergency cash.

- Competitive interest rates: The payday loan industry is known for its high-interest rates. The competitive rate policy makes it easy for borrowers to repay their loans on time. The market for salary loans needs a lender who understands borrowers’ problems. The longer borrowers repay their loans, the lower their monthly time payments are. GreenDayOnline offers a range of loans with various interest rates to cater to different borrowers’ needs. Feel free to contact the company from time to time for further help.

- Flexible repayment options: Borrowers choose different repayment plans according to their needs. Its direct lenders have term loans designed to address short-term and long-term needs. Ensure to select an option that helps to make timely payments on time. They can opt for the standard procedure if borrowers want to avoid paying extra fees. It allows them to repay their loan in one month. However, they can select the extended plan if they prefer to extend their repayment period.

At GreenDayOnline, we understand the importance of quick and reliable financial assistance when unexpected expenses arise. That’s why we are proud to offer our services across the great state of Ohio. With a strong presence in key cities throughout the region, we are dedicated to helping individuals bridge financial gaps and regain control over their finances. Our payday loan services provide a convenient solution, and our commitment to exceptional customer service sets us apart. Explore the table below to discover the major cities in Ohio where we are actively serving our valued customers.

| Columbus | Cleveland | Cincinnati |

| Toledo | Akron | Dayton |

| Parma | Canton | Lorain |

| Hamilton | Youngstown | Springfield |

| Kettering | Elyria | Newark |

How do I obtain a direct lender payday loan with lower rates in Huber Heights, Ohio?

The step-by-step process of obtaining a day payday loan from instant payday loan companies in Huber Heights, Ohio, is listed below. Direct lender payday loan companies offer a quick loan approval process through various payday loan platforms. By using these platforms, potential borrowers can easily access lenders’ marketplaces.

- Choose from a wide range of instant payday loan companies based in Huber Heights, Ohio.

- Visit the company’s website or online platform, and sign up as a potential borrower.

- Fill out the required information, and submit your application for a day payday loan.

- With their quick loan approval process, you’ll be notified quickly whether you’ve been approved.

- The funds will be deposited into your bank account or made available in person if approved.

- Repay your day payday loan on your next paycheck, plus any applicable fees or interest.

Remember to review the terms and conditions in the lender’s marketplaces before you proceed with any of the payday loan platforms.

- Fill out an application with the chosen provider. It is usually done online, over the phone, or in person. The application asks for personal information, such as contact details. These include the name, address, income, and bank account details.

- Provide proof of income. It includes pay stubs, bank statements, or other documents showing a regular income source.

- Agree to the loan terms, being aware of your credit limit. It includes the loan amount, the interest rate, and the repayment schedule. Consider if there’s an alternative loan option available to avoid falling into a debt trap.

- Receive the loan funds. Once the application is approved and the loan terms are agreed upon, the lender deposits the loan funds into the bank account, always keeping your credit limit in mind.

- Repay the loan. The loan must be repaid on the next payday or within a certain period, depending on the loan terms. Be aware that the interest rates on payday loans are generally very high and lead to a debt trap if not paid on time.

Obtaining a regular payday loan involves:

- Filling out an application with the chosen provider.

- Providing proof of income.

- Agreeing to the loan terms.

- Receiving the loan funds.

- Repaying the loan.

The interest rates on payday loans are generally very high, leading to a debt cycle if not paid on time. Check the local laws and regulations before proceeding with the loan. Consider alternatives such as borrowing from family or friends, credit union loans, or other options for borrowers like credit check loans, as they have lower interest rates and better terms. Always opt for reputable lenders and take time to understand and evaluate your finance before deciding on payday loans.

In Ohio, obtaining a tribal loan short-term loan is fairly simple. Several Ohio payday loan providers nationwide, including short-term lenders, cater to Bad credit borrowers. Finding one should be easy. The first step is to fill out an application with the chosen provider. The application asks for basic information. These include name, address, and Social Security number. It also asks for employment information and financial assistance regarding how much money is needed. Loans for people with differing credit backgrounds can be found through an Online marketplace. Once the online application is complete, the provider reviews it and determines if to approve it. If approved, the loan is deposited into the borrower’s account within a few days. The borrower must repay the loan, plus interest and fees, within a set period.

Where can I get a $100-$500 payday loan in Ohio?

A few places borrowers get a $100-$500 payday loan are in Huber Heights, Ohio. One option is to go to a store that offers short-term loans or apply for a payday loan online. Payday loan lenders are all over Ohio. Some popular places to find loans include Broadview Heights, Cleveland Heights, Garfield Heights, Maple Heights, and Grandview Heights.

Borrowers must bring some documents if they go to a store offering payday loans. These include identification, weekly or monthly minimum income proof, and a blank check. The store gives legal residents loans and holds their checks until their next payday. Customers need to bring the money to the store on their next payday. The money repays the loan, or the store cashes the borrowers’ checks.

Borrowers about scams should be careful while searching for payday loan options. Choosing a reliable marketplace of lenders is essential to avoid potential fraud.

Borrowers who apply online need to provide the same information as those applying for a loan in a store. They must provide the lender’s bank checking account information to deposit the loan. They also use it to withdraw the repayment on their next payday.

Do GreenDayOnline’s direct lenders only provide bad credit payday loans?

Yes, GreenDayOnline’s direct lenders only provide bad credit payday loans. The company operates under the Ohio House bill laws. Here’s how it works: if borrowers have a bad credit record, they apply for a loan through GreenDayOnline. But borrowers are subject to higher interest rates on payday loans than those with good credit. Lenders see them as a greater risk and charge more interest to offset it. Customers who are unable to access any loan should seek credit counseling.

Payday loans are for a smaller amount of money. They have a shorter-term repayment period than someone with good credit. But if borrowers need cash fast and better credit, GreenDayOnline still helps them get the money they need. The company offers a variety of small-dollar loans like payday and title loans for various loan purposes. It’s important to note that there is a minimum credit score requirement for these loans, which varies depending on the lender and type of loan.

What are the five alternatives to Ohio payday loans approved immediately?

Listed below are the five alternatives to Ohio payday loans approved immediately, including details about types of emergency loans and reliable payday loan providers:

- Personal loans: These can be used for various purposes and have longer repayment terms, making them a better option for those struggling with emergency loan impact.

- Credit cards: Access to money is immediate, but the interest rates can be high if the balance isn’t paid off each month.

- Credit union loans are more affordable alternatives, with lower interest rates and terms tailored to individual needs.

- Family and friends: Borrowing from loved ones can provide quick access to money without high-interest rates.

- Debt management plans: This option involves working with a credit counselor to create a plan to repay existing debts, reducing the need for payday loans.

- Title Loans: A title loan is when one borrows against their car title. It means they are free to borrow up to 80% of the value of their vehicle. Auto title loans are popular because they allow borrowers to obtain cash quickly with a high emergency loan approval rate. People with titles to property can immediately get their next paycheck. Instead, they receive cash immediately upon signing the loan agreement. However, a title loan is a type of loan that comes with high rates of interest and usually involves payments to credit bureaus.

- Check Cashing Services: The check cashing service is another small-dollar loan to help borrowers access cash quickly. Check cashing services allow customers to write checks against their checking accounts. Customers may borrow between $100-$3,000. The service charges a fee ranging from 2%-5%. Some companies offer free check cashing services. Others require customers to pay an additional fee. This service can be considered an option for payday loans.

- Credit Card Cash Advance: It is similar to a payday loan but allows borrowers to borrow more. Credit card cash advances are typically only available to those with poor credit scores. Borrowers receive funds by direct deposit into their bank account if approved. Their payment is due at the end of their billing cycle. This type of loan can sometimes compound credit card debts.

- Small Business Loans: Small business loans are loans designed specifically for businesses. Small business owners often need help finding financing. A small business loan helps them grow. Typically, these loans carry lower interest rates than other forms of debt.

- Installment Loans: An installment loan is a long-term loan in which borrowers pay for several months. These loans are secured by real estate. Installment loans with instant approval are ideal for those who want to build equity in their home.

For Ohio residents looking for flexible borrowing options, installment loans can provide a great alternative to payday loans. Installment loans allow borrowers to take out larger loan amounts and repay over several scheduled payments. This can provide more affordable payment options. If you are interested in learning more, check out our informative guide on Installment Loans Ohio.

How much money do payday lenders provide?

A payday loan is a short-term, high-interest loan, generally for $1000 or less, typically due on the next payday. Many payday lenders require Candidate borrowers to provide access to their checking accounts. They also need to provide a post-dated check for the full loan amount to get the loan. Borrowers typically have to pay fees for the loan, which is as much as $15 for every $100 borrowed. In addition, the loan may have an annual percentage rate (APR) of 400% or more.

The fastest loan options, like payday loans in Ohio, are available to property owners at a standard rate of $15 per $100 borrowed. The maximum loan amount is $500, and the minimum loan term is 14 days. There are no restrictions on the use of payday loan funds. However, the common property cost in Ohio is $120,000. The average price of a common property in Ohio is $130,000.

These convenient loans help cover unexpected medical expenses or manage your monthly expenses until your next paycheck arrives. It is essential to remember that payday loans can be expensive and should only be considered when the quickest emergency loan approval is needed.

Borrowers considering taking out a payday loan must consider other options. Suppose they have an emergency expense and must immediately start their next paycheck. They must consider a cash advance on their credit card or a personal loan from a lender. The painless lending process and using a personal loan calculator can help you make the right decision. Payday online loans should only be used as a last resort.

What are the laws for payday loans in Ohio?

Listed below are the laws for payday loans in Ohio.

- The maximum interest rate for payday loans is 28% per year.

- The total fees charged for a payday loan are limited to $1 for every $5 borrowed, up to $30.

- There is a cooling-off period of 60 days for borrowers who have taken out at least four payday loans in the past 90 days.

- Before issuing a payday loan, lenders must provide the borrower with written notice of the loan terms and the annual percentage rate using a percentage calculator to provide clear financial details.

- Lenders must provide written notice of the right to cancel the loan within three days of receiving the loan and report payments to credit agencies.

- Lenders should also consider offering mortgage loans as an alternative for borrowers with suitable property as collateral.

The maximum amount to borrow in Ohio: Code Ann. 1321.35 et seq, is $500. The loan must be repaid within 31 days, and the maximum finance charge is $15 per $100 borrowed. Borrowers obtaining $300 must pay back $345 – or $115 every two weeks they keep the loan. Per the Ohio House bill, borrowers must only have one outstanding bad credit payday loan at a time. In Ohio, lawmakers recently passed bipartisan payday loan reforms to the state’s payday loan industry, addressing issues like the income gap and debts to business loans. The changes come after years of criticism from consumer advocates. They claim the industry exploits low-income borrowers with high-interest rates and fees, leading to an increasing income gap and a cycle of debts to business loans. By introducing measures like extended repayment terms, these reforms aim to create a fairer system for borrowers. To stay informed about these changes, provide a valid email address to receive notifications and updates.

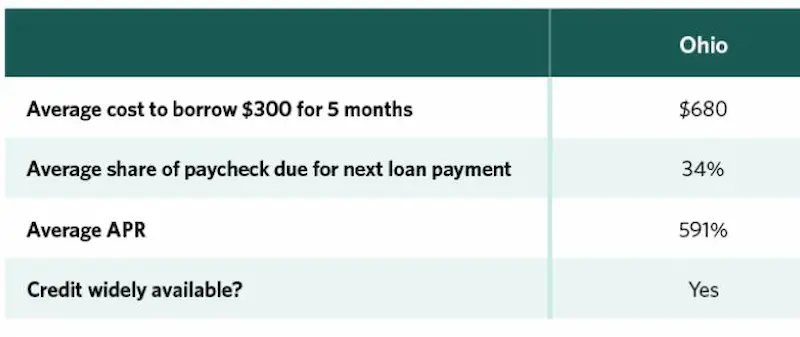

Here are some statistics on Payday Loans Ohio:

| Statistic | Value |

|---|---|

| Average interest rate | 289% APR |

| Average repayment term | 14 days |

| Available lenders | Over 1,000 payday loan storefronts |

| Risks | Payday loans are a type of short-term, high-interest loan that can be difficult to repay. If you are unable to repay the loan in full within two weeks, you may be charged additional fees and interest, which can make it even more difficult to repay the loan. |

| Alternatives | Personal loans, credit cards, debt consolidation loans, government assistance programs |

In Ohio, lawmakers are currently debating Ohio House Bill 123. It will impose new regulations on the payday lending industry and introduce larger network services. The Ohio House bill is set to cap interest rates at 28% and limit the times a loan could be rolled over. Proponents of the bill argue that it is meant to protect consumers from the predatory practices of the payday lending industry while offering Additional Services. Opponents of the Ohio House bill argue that it is supposed to cut off access to credit for many Ohioans who rely on payday loans and informative articles. The bipartisan bad credit payday loan reform bill looks to save Ohio residents millions annually by providing valuable articles and larger network services. The bill is set to protect consumers from predatory lenders and equip them with informative articles.

Conclusion

Ohio prohibited high-cost payday lending to prevent consumer abuse after previously allowing unrestricted costs. Installment loans remain accessible at slightly lower rates from regulated lenders. Outlawing loans over 600% APR closed debt trap loopholes but maintained regulated borrowing channels unlike some bans argued for by advocates. Through ongoing reforms Ohio policymakers work to balance access with affordability. But eliminating unrestricted predatory products protects buyers while retaining lawful options. Neighboring states Michigan, Pennsylvania, Virginia, Kentucky, Indiana regulate payday lending differently.

Frequently Asked Questions

What are online payday loans in Ohio, and how do they work, especially for individuals with bad credit?

Online payday lenders in Ohio offer short-term, small loans at very high interest meant to be repaid upon receiving the borrower’s next paycheck, regardless of credit.

Are there any reputable online payday loan lenders in Ohio that offer same-day cash advances, even if you have a low credit score?

Most legitimate lenders will have eligibility requirements beyond credit score. Ensure lenders are properly licensed in Ohio before applying or providing personal information.

What are the eligibility criteria for obtaining a payday loan in Ohio, and how can I improve my chances of approval with bad credit?

You’ll need government ID, income verification, a bank account. Providing pay stubs, references, or collateral may help those with poor credit get approved.

What are the potential risks and fees associated with online payday loans in Ohio, and how can I make an informed decision when considering such a loan?

Risks include very high interest, short repayment terms, and potential debt cycles. Compare all loan options to make an informed borrowing decision.

Are there any alternatives to online payday loans in Ohio for individuals with bad credit who need quick access to cash?

Alternatives like credit union loans, borrowing from family, credit cards, and seeking assistance from non-profits may be less risky for those with poor credit histories.