An online payday loan is a short-term loan, typically borrowed against the borrower’s next paycheck. These loans are designed to provide quick cash for unexpected expenses, such as medical bills or car repairs. Online payday loans usually carry high-interest rates and fees, so borrowers should know them before taking out a loan. Before committing to an online payday loan, borrowers should look at alternatives to loans – such as a personal loan from their bank.

GreenDayOnline is an online lending platform that helps people find fast and secure online loans, such as day payday and quick loans. It provides:

- Access to various payday loan providers.

- Fees.

- Repayment terms. Allowing users to compare rates.

With GreenDayOnline, individuals needing a payday loan can quickly access the best terms tailored to their needs. The service also includes scheduling payments and tracking progress with the loan process. Additionally, the online platform is designed to simplify and streamline the entire process for borrowers, making it easy to request a loan and receive funds quickly.

What Does an Online Payday Loan Near Me Mean?

An Online Payday Loan Near Me is a short-term loan where a person borrows money from an authorized lender in your area near you for a set period. The amount borrowed varies depending on the borrower’s employment status, income level, credit history, and length of service at the current employer. A payday loan means taking out a short-term loan from $100-$1,000 until your next paycheck arrives.

What Is a No-Credit-Check Payday Loan For Bad Credit?

Payday loans with no credit check for bad credit are short-term loans repaid when the next paycheck arrives. The lender will only grant you funds if you look at your credit history. If borrowers choose a no-credit-check lender, they must know how much a lender charges for borrowing money and how much borrowers can borrow. Typically, borrowers only borrow up to a certain amount depending on their salary, usually from $100 to $1,000. Lenders like these often give larger sums at lower borrowing rates.

How to Get Payday Advance Loans Online?

Getting payday advance loans online typically requires borrowers to fill out the loan request form, provide proof of income, a checking account, identity verification, be 18 years old, and be employed. After these things have been validated, you may be approved for a loan of up to $1,000, with funds in your bank account within the next business day.

How Much Cash Can I Get With a No Denial Payday Loan?

A no denial payday loan offers small amounts of money for short periods. The amount borrowers can get for a payday loan is up to $1,000. Lenders charge late fees and additional costs if they do not repay the loan as scheduled. The amount varies depending on the state and how long you want to borrow. If you need quick cash, GreenDayOnline recommends using our instant approval option. GreenDayOnline offers Online installment loans, personal loans for those who prefer longer terms, and Credit Check Loans.

Who Qualifies For No Credit Check Payday Loans?

Listed below are the criteria for no credit check payday loan qualifications:

1. Meet Minimum Age Requirements

To be approved for a payday loan, borrowers must meet the minimum age requirements set out by their state. In most states, a person has to be at least 18 years old to apply for a payday loan.

2. Have Steady Employment

Steady employment is one of the main factors lenders consider when deciding whether or not to approve your payday loan application process. Lenders will likely require proof, such as recent pay stubs or other forms of income verification, to ensure that borrowers can afford the repayment loan terms of their loan agreement.

3. Be an American Citizen or Legal Resident

To apply for a payday loan, borrowers must be American citizens or legal residents living in certain countries and territories listed by the federal government. They will also need to provide documents such as passports, driver’s licenses, or other valid forms of identification as proof of eligibility status before being approved for the loan.

4. Provide Valid Contact Information

During the loan application process, lenders will perform a soft credit check to review your credit history and determine your ability to repay the loan. Providing valid contact information, such as a phone number and email address, is vital for the lender to communicate with you about your loan application and any required documentation.

All information must be provided accurately and truthfully when submitting your application so that the lender can contact a borrower if they have any questions about their application or need more information before deciding whether or not they will approve your request. A borrower must ensure that all contact information, including email address and mailing address, is provided accurately on their application form in case lenders need to communicate with them further while applying for a payday loan.

In addition to providing contact information, a borrower must have an active bank account for direct deposit. This will allow smooth transactions between the lender and borrower once the loan contract is approved. It’s also critical to indicate a valid source of income when applying for a payday loan, as lenders often consider this when assessing your ability to repay the loan.

5. Have an Active Bank Account

Most lenders require applicants to have an active checking account before being approved for their type of loan, so make sure this requirement is met before submitting an application form online or in person at their store location(s). An active bank account is needed so lenders can deposit funds into the account upon approval and automatically deduct bank loan payments from it on due dates each month, which should help make the payment process easier on both ends (applicant & lender).

Can I Get $1,000 Dollar Loans if I Have a Poor Credit Score?

Yes, borrowers can still apply for $1,000 dollar loans despite having a poor credit rating. If a borrower does get approved for a loan, remember that it’s important to repay it on time so that your credit history doesn’t suffer from late payments. Usually, banks require borrowers to prove they have savings, income, and collateral. Some lenders may charge higher rates when people borrow money.

How Do Payday Loans With Guaranteed Approval Work?

A payday loan with guaranteed approval is a short-term loan that usually lasts one month and is repaid when the borrower’s next paycheck arrives. The average person takes out $100-$1,000 monthly from these loans. Payday loans are generally used when someone has a financial emergency, such as car repair or medical bills, or to cover emergency expenses. Most lenders offer easy applications, fast approval, and flexible repayment options. Some people also use them to supplement their income or to handle emergency expenses.

Can I Apply for $100 Dollar Payday Loans Online?

Yes, applying for $100 dollar payday loans online is usually a fast and convenient option, especially when facing emergency expenses.

Yes, borrowers can apply online for payday loans. There are numerous loan websites where borrowers can apply for a payday loan. Some provide quick approval rates, lower rates, and simple application procedures like in GreenDayOnline. Applying for a loan from an unknown source should be avoided, especially if they appear to be giving low-interest rates. Also, once you’ve confirmed the lender, keep your name, address, contact number, and email address. Finally, check with state regulations regarding any organization that offers loans.

Why Is GreenDayOnline the Best Small Payday Loans Lending Platform?

Listed below are the reasons why GreenDayOnline is the best online payday loans lending platform:

- Instant decision. As soon as we receive your small payday loans request, it will take seconds to get the application decision. GreenDayOnline approves loans faster as compared to in-store payday loans. With hour payday loans, you can get the funds you need quickly.

- Safe to apply. If you have never applied for online payday loans, you may wonder whether the application process is safe. At GreenDayOnline, your application is secure and confidential. We offer credit check instant approval to make the process quick and worry-free.

- We specialize in providing same-day loans to cater to your urgent financial needs. Everything, starting from the funding application, is safe and secure. All the personal and financial details shared with us are confidential.

- Accessibility. Customers who apply for payday loans with us have 24/7 access to their loan accounts.

- Better rates. GreenDayOnline is a group of lenders that offers payday loans at better rates. We don’t have hidden charges.

At GreenDayOnline, we are dedicated to providing convenient financial solutions to individuals in need. Our online payday loan service offers a quick and hassle-free way to access funds, with no credit checks required. We understand that unexpected expenses can arise anytime, and we strive to make the borrowing process as straightforward as possible. To better serve our customers, we have expanded our operations across various states in the United States. Below is a comprehensive list of American states where our company actively provides payday loans near you, ensuring that you can access the financial support you need, regardless of location. Please refer to the table below for further details.

| AL – Alabama | AK – Alaska | AZ – Arizona |

| AR – Arkansas | CA – California | CO – Colorado |

| CT – Connecticut | DE – Delaware | DC – District Of Columbia |

| FL – Florida | GA – Georgia | HI – Hawaii |

| ID – Idaho | IL – Illinois | IN – Indiana |

| IA – Iowa | KS – Kansas | KY – Kentucky |

| LA – Louisiana | ME – Maine | MD – Maryland |

| MA – Massachusetts | MI – Michigan | MN – Minnesota |

| MS – Mississippi | MO – Missouri | MT – Montana |

| NE – Nebraska | NV – Nevada | NH – New Hampshire |

| NJ – New Jersey | NM – New Mexico | NY – New York |

| NC – North Carolina | ND – North Dakota | OH – Ohio |

| OK – Oklahoma | OR – Oregon | PA – Pennsylvania |

| RI – Rhode Island | SC – South Carolina | SD – South Dakota |

| TN – Tennessee | TX – Texas | UT – Utah |

| VT – Vermont | VA – Virginia | WA – Washington |

| WV – West Virginia | WI – Wisconsin | WY – Wyoming |

What Is a Direct Lender For Bad Credit Payday Loans?

A direct lender loan makes consumer loans without using any other financial organization. Direct lenders for bad credit loans do not require borrowers to have excellent credit, but they may request collateral (i.e., real estate). They also have cheaper interest rates than traditional banks, which means you could save money when applying for a loan. However, these loans are typically more difficult to qualify for because the consumer needs more savings.

What Are the Alternatives to Same Day Payday Loans?

Same day payday loan alternatives are personal loans from banks, pawnshop loans, installment loans, title loans, and using your credit card as a line of credit. These alternatives may be less expensive and might not need collateral. One such alternative is a personal installment loan, which offers a more manageable payment plan than a short-term, high-interest loan like a payday loan. The best payday loan option is to avoid borrowing money at all costs. If borrowers do not have any savings or proof of steady income, a short-term loan will only cause them problems. Instead, borrowers must find ways to make extra money or cut costs.

What Is the Main Factor Influencing How Fast One Can Get $100 Dollar Payday Loans?

The main factor influencing how fast $100 dollar payday loans can be deposited is the borrower’s FICO score – specifically, the loan payment history from other lenders. A borrower’s present employment status is also considered when determining whether they qualify for a certain loan package. Lenders often want at least six months of consistent income.

What Are the Benefits of Getting a No Credit Check Payday Loan Online?

No credit check payday loans are usually obtained for emergency loan expenses. Take a look at the following advantages of getting a payday loan online and the benefits of payday loans:

- Short-term cash advances: With no transport, driving around to many lenders can be difficult. On top of that, many may reject your application and waste your time.

- Cash advance loans: An online application process is always around because the lender can be anywhere in the United States. You must walk to your phone, PC, or tablet and apply.

- Using online is more convenient and accessible in times of emergency.

What Are the Eligibility Requirements for Getting a Payday Loan?

Listed below are the eligibility requirements to qualify for an online payday loan and enjoy the benefits of payday loans:

- Valid identification. Valid identification consists of a valid driver’s license or state-issued ID. Most lenders need a recently issued ID with proof of address and a clear photograph. Bring or upload a birth certificate, Social Security card, and proof of citizenship.

- Social Security Number. The borrower must provide a personal nine-digit Social Security Number. Lenders get good credit history, credit report, and background information using the borrower’s Social Security Number.

- Proof of steady income and employment verification. Borrowers must provide information about monthly payments, monthly minimum payments, and employers to verify employment and source of income.

- Financial accounts and assets. Loan applicants must submit bank account details from an active bank account. In some cases, they may also need to provide information on alternative sources of income. A checking or online banking account helps borrowers achieve routing and account numbers.

What Is the Repayment Period For $500 dollar loans?

$500 dollar loans have a repayment period of up to one month. The repayment terms of a payday loan differ based on the lender. Borrowers must typically repay all loans within two weeks of their first paycheck. Some lenders, however, allow customers to repay loans after 30 days. Choosing a reputable lender for a payday loan is essential, as terms and conditions may vary.

Can I Qualify for a High-Risk Payday Loan With a Bad Credit Score?

Yes, borrowers with poor credit history can qualify for a high-risk payday loan, provided they meet all the lender’s requirements. Payday loans are considered small-dollar loans and can be an alternative to a traditional loan for those with bad credit. Provide proof of income and employment to get approved.

What is the cost of instant approval / loans with bad credit?

The cost of instant approval / loans with bad credit varies significantly, depending on many factors, including the lender and the borrower’s credit score. The rates on such loans don’t always go through the roof, even if your credit score is not as rosy. Bad credit payday loans have higher rates to compensate for the risk the lender is taking. GreendayOnline works with countless lenders to help you secure a loan at competitive rates, despite a less-than-perfect credit score.

What Is the Maximum Amount For A Payday Loan With Guaranteed Approval?

The maximum payday loan amount is usually from $100 to $1,000. The payday loan amount depends on numerous factors, such as where you live, how old you are, and whether you have any outstanding debts. Comparing traditional loans and small-dollar loans, payday loans with guaranteed approval are relatively smaller in size.

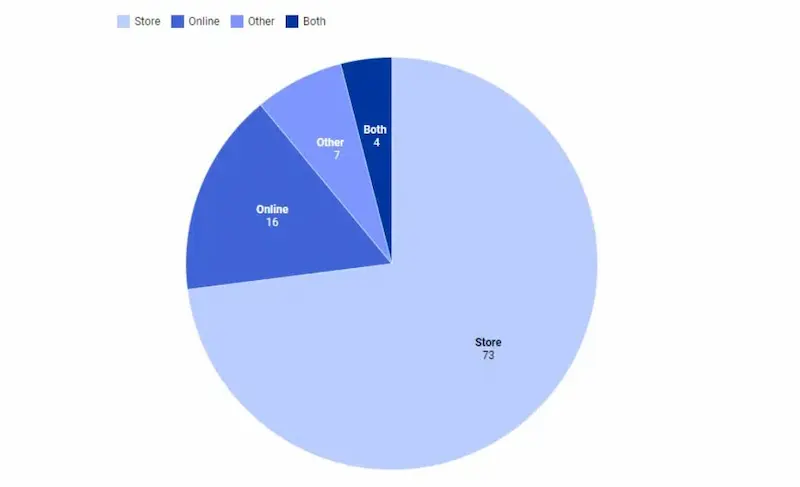

Here are some statistics on Payday Loan Online:

| Statistic | Value |

|---|---|

| Legal Status | Legal in most states |

| Number of Lenders | Over 1,000 |

| Average Interest Rate | 400% APR |

| Average Repayment Term | 14 days |

| Total Amount Taken Out Annually | $10 billion |

| Risks | High interest rates, short repayment terms, risk of default |

| Alternatives | Personal loans, credit cards, government assistance programs |

What Are Payday Loans Direct Lenders?

A payday loan direct lender is a reputable lender that offers small-dollar loans directly to borrowers. Direct lenders issue loans without any intermediaries or brokers, making the process quicker and often more affordable for the borrower. Always ensure you are dealing with a credible direct lender to avoid any potential scams or predatory lending practices.

A payday loan direct lender is a company that lends money directly to those struggling to make ends meet. With payday loans, borrowers can have access to funds and access to cash when needed. On the other hand, payday lenders give short-term financial assistance when customers require emergency funds but cannot obtain a regular loan from a bank.

How Do In-Store Same Day Payday Loans Work?

In-store same day payday loans allow borrowers to get funds in a physical location. The loan is repaid on the borrower’s next paycheck. Steady income documentation is important to qualify for a payday loan. Consumer Borrowing amounts vary by lender and state, providing flexible loan amounts for those in need.

Conclusion

Payday loans offer a convenient way to access funds, cash, and flexible loan amounts for those facing financial challenges. Payday loans are short-term loans that can be accessed by individuals with low credit scores as long as they meet certain criteria, such as age, employment, citizenship, and valid contact information. These loans range from $100 to $1,000 and typically require repayment when the next paycheck arrives.

No-credit-check payday loans are also available, but knowing their fees and borrowing limits is important. To get a payday advance loan, individuals must fill out a loan request form, provide proof of income, and have a checking account. At GreenDayOnline, customer service is available 24/7 for any inquiries, and they offer installment and secured loan options, title loan services, and personal loans for those who prefer longer terms or need help covering Medical Expenses.

Frequently Asked Questions

What are the typical requirements for online payday loans with no credit checks?

Payday lenders offering no credit check loans typically require proof of income, an active checking account, being 18+ years old, and providing personal details. However, alternatives like local charities may better suit those with poor credit.

How can I find reputable online payday loan lenders near me that offer no credit check loans?

Search consumer finance sites for top-rated lenders, check complaints, licensing, and transparency about rates and terms to find a legitimate payday lender online offering no credit check loans.

What are the potential risks associated with online payday loans that don’t require credit checks?

Risks include extremely high interest rates, short repayment periods, renewals leading to debt cycles, and penalties for failing to repay on time. Always read the fine print carefully.

Are there any alternatives to payday loans for people with poor credit scores?

Alternatives like local charity assistance programs, borrowing from family or friends, credit counseling, debt management plans, credit builder loans from credit unions, and advance pay from work may help avoid predatory payday loans.

What should I consider before applying for an online payday loan without a credit check?

Weigh the repayment terms, fees, alternatives available, and whether this loan will solve or worsen your financial woes before applying for a no credit check online payday loan.