We’ve all experienced the feeling of being in desperate need of cash. Even those with a steady salary might be in a situation where they need immediate funds for unexpected expenses. GreenDayOnline’s straightforward and rapid approval process makes payday loans in Louisiana easy to get.

What Is an Online Payday Loan Near Me For Bad Credit With No Credit Check?

An online payday loan near me for bad credit with no credit check is a loan that lenders offer to borrowers for a short period (until your next paycheck). The amount of money you may get varies by state and ranges from $100 to $1,000. Every state has its own set of rules for payday loans. In Louisiana, the maximum payday loan amount is $350.

Why Get an LA Small Payday Advance With Guaranteed Approval & Same day Deposit?

There are many reasons you might need extra cash from an LA small payday advance with guaranteed approval and same-day deposit. GreenDayOnline can help you if you find yourself in any of these situations.

1. Your Bank Denied You a Loan With Easy Approval.

There is no way to safeguard oneself from financial ruin. Obtaining a bank loan or modifying your home loan is difficult when looking for easy approval. Sometimes it can take up to a year or more to convince a lender. Getting a short-term loan to cover your rent or mortgage payments is significantly simpler. Small financial advances are used by 70% of Americans for daily purposes or to cover consumer bills. Many debtors are perpetually short on cash and must borrow money to fulfill their debts.

2. It Is Difficult to Pay Your Rent.

This is likely why you need a loan. Some people and families may have trouble making rent payments during times of economic downturn or high unemployment. Help is offered in the form of rental assistance programs and philanthropic donations. Your landlord may be amenable to working out a payment plan with you. Make sure you have a solid budget in place so that you can pay your rent and other necessary bills on time.

3. You Need to Pay Credit Card Debt Plus Interst rates.

You’re probably aware of how credit card firms collect debts and make payments. They will phone you up to five times a day, send you threatening letters, and harass you until you settle the amount plus interest. GreenDayOnline can assist if you’re tired of debt collectors phoning until you pay the money, calling you five times a day, and sending you threatening letters. You also have the risk of maxing out your credit card. A cash advance can cover the fee.

4. You Prefer Direct Lenders to Borrowing Money From Family and Friends.

Sometimes people can’t get over their financial problems and turn to their families for financial help. Greendayonline in Louisiana (LA) are happy to guide you with your money troubles without asking your relatives by offering payday loans from direct lenders.

5. You Need to Repay Debt From Another Company

Missing paying a debt from any loan company might have serious financial problems. If you don’t make your payments, you might suffer significant fines and lose part of your belongings, depending on your agreements with lenders. This is where the loan interest you will have to pay is a small problem compared to your major debt.

What Are the Eligibility Criteria for a $200 Cash Advance Loan With No Denial in Louisiana?

The following are the eligibility criteria for a cash loan of $200 or any other amount with no denial in Louisiana:

- At least 18 years of age. In the United States, lending money to anybody under 18 is unlawful.

- You must be a Louisiana resident. To qualify for a payday loan in Louisiana, you must prove your legal residence. The success of getting a loan is almost certain after that.

- Bad credit is not an issue, but you need to have a steady source of income and make at least $1000 monthly. We can then be certain that you can repay the loan.

- You will need a phone number and an email address to get instant approval. We will only be in touch with you if you give us this information.

- Finally, if in bankruptcy, you cannot be a debtor.

We only need a few personal details from you, including your social security number, name, address, and the amount you want to borrow. Once we have received your information, we will contact you to confirm the terms and conditions.

What is the lending statute of payday loans in Louisiana

One mustn’t forget that Louisiana, while a hub of cultural and economic opportunity, is a proactive state regarding payday loans’ regulatory environment. Louisiana law dictates a lending statute that clearly outlines the state’s actionable guidelines for payday loans. In accordance with Louisiana Revised Statutes Ann. 9:3578.1 et seq., lenders charge maximum finance fees and costs of up to 16.75% of the face-value amount of the loan or $45, whichever is less. The statute governs the maximum loan amount, which is $350. Such sure insistence on regulations lends to the prestige and respect for the finance sector in Louisiana.

What Is the Application Process at GreenDayOnline’s Payday Loans With Instant Approval?

First, fill out the online form to apply for a payday loan with instant approval. Includes personal details such as name, address, contact information, and financial information. Second, wait for approval. GreenDayOnline reviews the information and decides whether the lending partner approves the loan. The third step involves the lender giving the borrower a loan agreement. The agreement outlines the loan terms, including the repayment schedule. Finally, the borrower makes monthly or weekly loan payments per the loan agreement.

What Are the Things to Consider Before Applying for a $300 Payday Loan From Direct Lenders Only?

Listed below are some things to consider before applying for a $300 payday loan from direct lenders only:

1. How Much Money Do You Need From The Online Loans?

Online payday loans are short-term cash advances offered online or at local stores. You borrow funds based on how long you plan to use them. Payday loans are not designed to provide long-term financial solutions. Consider looking into alternative options if you have credit problems.

2. What Type of Good Payday Loans Online Do You Qualify For?

You should only apply for a good payday loan online if you meet the requirements set out by the lender. Most lenders require applicants to have a steady job and good credit history. In addition, they often ask about any outstanding debts.

3. Is the small loan’s Interest Rate High?

The interest rates charged by payday lenders on small loans vary widely. Many charge annual percentage rates (APRs) between 400% and 1,000%. These rates are higher than those associated with traditional bank loans. However, some companies offer lower APRs. Before taking out a payday loan, ensure you understand what you’re getting yourself into.

4. What’s Your Credit Score?

Your credit score is a number that represents your payment history and whether you pay back debts on time. Payday lenders use your credit score to determine if you qualify for a loan. Your credit score may affect the interest rate you’re charged.

5. Do You Have Any Outstanding Debt From Other Top Lenders?

If you owe money to anyone else or any other lender, think twice about getting a payday loan. Lenders look at your total amount of debt, including payday loans, when determining your eligibility for a loan.

6. Can You Afford to Pay Back the Loan?

You could face additional fees and penalties if you don’t repay the loan promptly. Lenders may even report your failure to repay the loan to consumer reporting agencies.

7. Have You Considered Other Options?

There are many alternatives to payday loans. These include savings accounts, credit cards, and pawn shops. Consider these options before taking out a payday loan.

Below are some statistics for payday loans in Louisiana:

| Statistic | Value |

|---|---|

| Average interest rate | 600% |

| Average term | 14 days |

| Average loan amount | $400 |

| Default rate | 1 in 3 |

| Has some of the highest interest rates on payday loans in the country | Yes |

| Can be a risky financial product | Yes |

| Borrowers should carefully consider all of their options before taking out a payday loan | Yes |

What Are the Five Alternatives to Louisiana’s 1 Hour Payday Loans?

The following are the five alternatives to Louisiana’s 1 Hour Payday Loans.

1. Title Loans:

A title loan is when you borrow against your car title. This means you can borrow up to 80% of the value of your vehicle. Title loans are popular because they allow borrowers to obtain cash quickly. Borrowers do not have to wait for their next paycheck. Instead, they receive money immediately upon signing the contract. However, this type of loan comes with high rates of interest.

2. Installment Loans:

An installment loan is a long-term loan where you make payments over several months. Installment loans are ideal for those who want to build equity in their home. These loans are secured by real estate.

3. Check Cashing Services:

Check cashing services are another small-dollar loan to help you access to cash quickly. Check cashing services allow customers to write checks against their checking accounts. Customers may borrow between $100-$1,000. The service charges a fee ranging from 2%-5%. Some companies offer free check cashing services. Others require customers to pay an additional cost.

4. Small Business Loans:

These types of loans are designed specifically for businesses. Small business owners often need help finding financing. A small business loan can help them grow. Typically, these loans carry lower interest rates than other forms of debt.

5. Credit Card Cash Advance:

Credit card cash advance is similar to a payday loan but allows you to borrow more. Credit card cash advances are typically only available to those with bad credit scores. You will receive funds by direct deposit into your bank account if approved. Your payment will be due at the end of your billing cycle.

Louisiana residents looking for additional options besides payday loans may want to consider installment loans. Installment loans allow borrowers to repay over several scheduled payments. To learn more about installment loans in Louisiana, check out our article on Installment Loans Louisiana

What Are the Advantages and Disadvantages of $100-$500 Payday Loans?

Listed below are the following advantages and disadvantages of $100-$500 payday loans:

Advantages

- Instant Approval. Once you apply for a payday loan, you should expect approval within minutes. Most lenders offer same-day approvals if you meet their requirements. In addition, you can often get approval even if you have bad credit.

- Easy Application Process. The application process for a payday loan is quick and simple. You do not need collateral or any credit check. Just fill out the loan request form and submit them via the lender’s website. Once approved, you will receive the funds deposited directly into your checking account.

- No Hidden Fees. There are no hidden fees associated with payday loans. Typically, you only pay interest rates between 300 and 400 percent APR. However, you will still have to repay the entire amount plus any fees the lender charges.

- Low-Interest Rates. Most payday loans charge high-interest rates. However, you can find low-interest rate options if you shop around. Lenders will sometimes lower their interest rates if you agree to pay back the loan early.

- Flexible Repayment Options. You can choose how much you would like to borrow. Many lenders allow borrowers to set up automatic payments, which means you will automatically make monthly payments without worrying about missing a payment.

- Short-Term Loans. A payday loan is intended to last just a couple of weeks. After that period, you must repay the full amount plus additional fees. If you cannot afford to repay the loan, you can ask the lender to roll over the balance onto a future date.

Disadvantages

- Predators are suspected. Some say direct online payday loan lenders prey on the financially weak. Payday loan customers may need help, but not lenders. People get aid with rent, insurance, food, and other requirements till payday.

- The cost is high. The biggest negative of fast payday loans is that they might be expensive in terms of charges. For every $100 you borrow from a payday loan service, costs range from $10 to $30. Although this may not seem like much, you might be paying annual percentage rates (APR) of 300, 400, or 400 percent, which is a lot.

- You have access to your bank account. Certain lenders may require your bank account details. When you take out a payday loan, you give business access to your bank account. You may need to do this to secure the loan, but if unsavory characters get a hold of your bank account details, you could later find yourself in trouble.

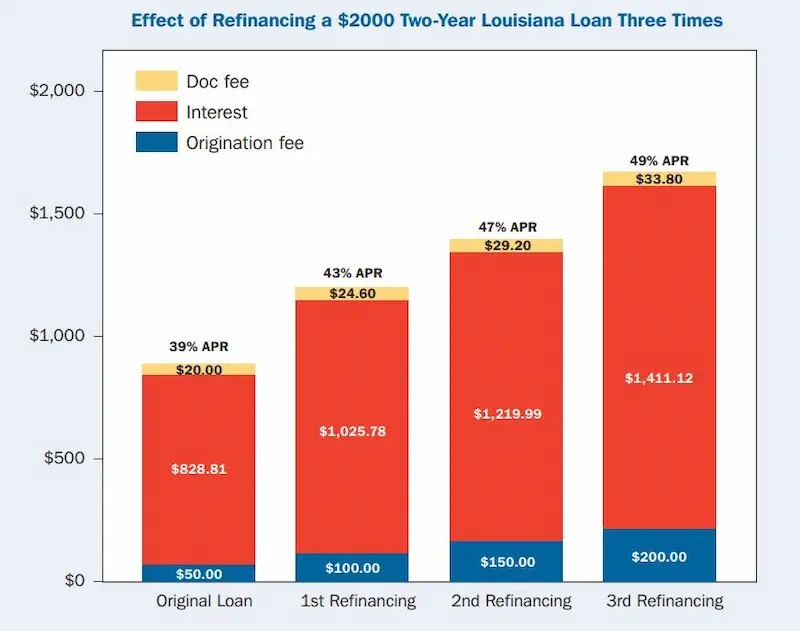

- Debt cycle traps are common. You may use payday loans periodically. If you keep using them, you may go into debt. Living paycheck to paycheck may be stressful. Payday loans will address your financial troubles. Use them if required, but also learn more about your financial condition and make modifications to reduce your debt. Payday loans help in a pinch. You’ll benefit from financial knowledge if you avoid constantly borrowing money.

- You Can’t Establish a Credit History With Them. Payday loans do not aid the process of establishing credit. Other lending choices, like credit cards or personal loans, may assist in building your credit as long as you repay them.

What Are the Benefits GreenDayOnline’s Payday Loans Approved Immediately?

Listed below are the following benefits associated with payday loans approved immediately from GreenDayOnline’s network of lenders:

- Easy to repay: A payday loan is easy to repay. Borrowers need to pay off the amount borrowed when the next salary arrives. There are no penalties for paying early.

- Flexible repayment period: Borrowers usually repay payday loans when they receive their next paycheck, usually after a month. However, they can always repay the loan at any point during the loan’s duration.

- Competitive interest rates: GreenDayOnline offers reasonable interest rates.

- No hidden charges: GreenDayOnline has no application loan fees or other hidden finance charges. In addition, there are no prepayment charges.

- No Service Fee: There is no service fee for requesting a loan at GreenDayOnline.

Is GreenDayOnline a Direct Lender for Payday Loans Per The LA Laws?

No, GreenDayOnline is not a direct lender for payday loans but rather a panel of lenders available to consumers in certain states. Submitting a loan request per the LA laws allows us to connect you to our lending partners and does not guarantee an offer for a loan. GreenDayOnline does not guarantee approval for a shorter-duration loan. In just minutes, you can check your eligibility for an online loan to determine if you are eligible for loan through GreenDayOnline. The borrower’s eligibility will be decided by the lender immediately. You can get your funds within the next business day if approved.

Conclusion

Louisiana enacted meaningful reforms to curb previously unrestricted payday lending but could do more per advocates. Under current law, costs are capped at 600% APR – still high but deterring the most egregious abuses over 1,000% APR seen before. Going forward Louisiana lawmakers could implement lower rate limits without entirely prohibiting access as consumer groups prefer. But the regulations signify progress promoting transparency and establishing fair cost guardrails compared to Texas, Arkansas and Mississippi.

A payday loan is a small dollar loan given to debtors, usually until their next paycheck. In the state of Louisiana, borrowers can borrow up to $350 from a payday lender. Payday loans near me with no credit check are a viable option for people who are having financial difficulties meeting immediate expenses like rent or credit card payments or who have been turned down for a traditional loan like one from a bank. You must be at least 18 years old, a Louisiana resident, employed, and not in bankruptcy to qualify for a payday loan in Louisiana. The application process for a payday loan from GreenDayOnline is easy and only requires filling out an online form with basic personal and financial information. GreenDayOnline will get in touch with the borrower to verify the application’s details.

Frequently Asked Questions

How do online payday loans in Louisiana work without credit checks?

Payday lenders in Louisiana offer loans up to $350 without credit checks. Approval is fast based on income, ID, and bank account info. Loans have high fees and APRs around 400%.

What are the eligibility criteria for obtaining payday loans in Louisiana?

Borrowers need a government-issued ID, Social Security number, evidence of income, and an active checking account. There is no minimum credit score requirement.

Are there any legal regulations and restrictions on payday loans in Louisiana?

Louisiana caps payday loan amount at $350 with a maximum term of 30 days. Rollovers are limited to one time. Extended payment plans are available after difficulties repaying.

What is the typical repayment period for payday loans in Louisiana?

The standard repayment term is 30 days or by the borrower’s next pay date. Borrowers must repay the full loan amount plus fees in a lump sum.

What are the potential risks and alternatives to payday loans in Louisiana?

Risks are high fees, debt cycles. Alternatives are pawn shops, credit union loans, borrowing from family/friends, installment loans, or credit cards.